TOP CONTRACTORS

2012 Total Revenue ($)1 Turner Corporation, The $9,084,870,0002 Fluor $4,268,290,5003 Skanska USA $4,076,092,8144 PCL Construction Enterprises $3,981,419,1645 Whiting-Turner Contracting Co., The $3,699,782,7716 Clark Group $3,563,246,7197 Balfour Beatty $3,453,790,8478 Gilbane $3,083,529,0009 Structure Tone $2,947,433,00010 McCarthy Holdings $2,546,000,000

TOP CONSTRUCTION MANAGEMENT FIRMS

2012 Total Revenue ($)1 URS Corp. $297,282,0762 STV $227,390,0003 JE Dunn Construction $207,304,1544 Barton Malow $182,697,8975 Parsons Brinckerhoff $179,900,0006 S. M. Wilson & Co. $168,859,7407 Turner Corporation, The $157,920,0008 Jones Lang LaSalle $140,020,0009 LPCiminelli $139,198,32910 Structure Tone $132,000,000

Read BD+C's full Giants 300 Report

Related Stories

Giants 400 | Dec 12, 2023

Top 35 Veterans Affairs Facility Architecture Firms for 2023

LEO A DALY, Page Southerland Page, Guidon, and HDR top BD+C's ranking of the nation's largest Veterans Affairs facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 40 Military Facility Architecture Firms for 2023

Michael Baker International, HDR, Whitman, Requardt & Associates, and Stantec top BD+C's ranking of the nation's largest military facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Office Buildings | Dec 12, 2023

Transforming workplaces for employee mental health

Lauren Elliott, Director of Interior Design, Design Collaborative, shares practical tips and strategies for workplace renovation that prioritizes employee mental health.

Giants 400 | Dec 11, 2023

Top 150 Local Government Building Architecture Firms for 2023

Gensler, HOK, Stantec, and Skidmore, Owings & Merrill top BD+C's ranking of the nation's largest local government building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 11, 2023

Top 90 State Government Building Architecture Firms for 2023

Page Southerland Page, Skidmore, Owings & Merrill, Stantec, and NORR top BD+C's ranking of the nation's largest state government building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Codes and Standards | Dec 11, 2023

Washington state tries new approach to phase out fossil fuels in new construction

After pausing a heat pump mandate earlier this year after a federal court overturned Berkeley, Calif.’s ban on gas appliances in new buildings, Washington state enacted a new code provision that seems poised to achieve the same goal.

Green | Dec 11, 2023

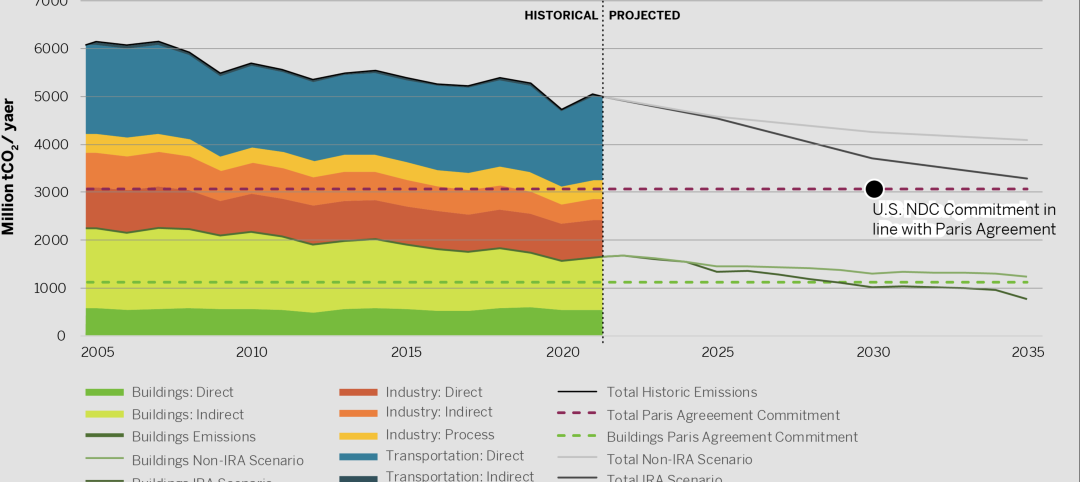

U.S. has tools to meet commercial building sector decarbonization goals early

The U.S. has the tools to reduce commercial building-related emissions to reach target goals in 2029, earlier than what it committed to when it signed the Paris Agreement, according to a report by the U.S. Green Building Council.

MFPRO+ News | Dec 11, 2023

U.S. poorly prepared to house growing number of older adults

The U.S. is ill-prepared to provide adequate housing for the growing ranks of older people, according to a report from Harvard University’s Joint Center for Housing Studies. Over the next decade, the U.S. population older than 75 will increase by 45%, growing from 17 million to nearly 25 million, with many expected to struggle financially.

Office Buildings | Dec 11, 2023

Believe it or not, there could be a shortage of office space in the years ahead

With work-from-home firmly established, many real estate analysts predict a dramatic reduction in office space leasing and plummeting property values. But the high-end of the office segment might actually be headed for a shortage, according to real estate intelligence company CoStar Group.

University Buildings | Dec 8, 2023

Yale University breaks ground on nation's largest Living Building student housing complex

A groundbreaking on Oct. 11 kicked off a project aiming to construct the largest Living Building Challenge-certified residence on a university campus. The Living Village, a 45,000 sf home for Yale University Divinity School graduate students, “will make an ecological statement about the need to build in harmony with the natural world while training students to become ‘apostles of the environment’,” according to Bruner/Cott, which is leading the design team that includes Höweler + Yoon Architecture and Andropogon Associates.