The U.S. Energy Information Administration has posted preliminary results from its periodic Commercial Buildings Energy Consumption survey. Data for the project were collected in 2012 and detailed analyses of energy consumption will be released beginning next spring. The project includes buildings >1,000 sf that devote more than half of their floorspace to activity that is not residential, manufacturing, industrial, or agricultural.

The preliminary results from the Commercial Buildings Energy Consumption Survey (CBECS) show that there were 5.6 million commercial buildings in the United States in 2012, comprising 87.4 billion square feet of floorspace. This represents a 14% increase in the number of buildings and a 22% increase in floorspace since 2003, the last year for which CBECS results are available.

The preliminary data can be found in this summary table of building counts and total square footage by building size category, principal building activity, year of construction category, Census region, and Census division. The first tab provides the estimates; the second tab on the table provides relative standard errors (RSEs) for the estimates.

For comparison, there is a similar summary table from the 2003 CBECS. Other file formats for the same table can be accessed from the 2003 CBECS data page.

The size, use, vintage, and geographic region of a building are among the key determinants that influence its energy use. Subsequent releases will show more detailed characteristics and crosstabulations among key categories. This is the first release of many reports and data releases expected for the 2012 CBECS; these preliminary tables provide a first look at the building stock and the attributes that drive commercial energy use.

Trends – 1979 to 2012: Growth in building size outpaces increases in building stock

Since the first CBECS was conducted in 1979 to the current 2012 CBECS, the number of buildings has increased from 3.8 million to 5.6 million, and the amount of commercial floorspace has increased from 51 billion to 87 billion square feet.

HOW DOES EIA PRODUCE RELIABLE RESULTS FROM A SAMPLE SURVEY?

The CBECS is a national sample survey. See How Were Buildings Selected for the 2012 CBECS? for an overview of the sampling process. After the sample was selected, preparations for the interviewing phase began. In April 2013, about 250 field interviewers were trained to visit buildings across the United States and recruit respondents knowledgeable about energy use in the buildings. After recruiting a respondent at a building, the field interviewer’s job was to conduct an interview on a laptop computer asking questions about the building’s structure, use, energy equipment, and energy use. Between April and November 2013, interviews were conducted in-person or by telephone at over 6,500 buildings nationwide. Because every building had a chance to be selected and that chance is known, a sample weight can be assigned to each case. The resulting dataset is representative of the entire U.S. commercial building population.

Principal building activities: The most prevalent building types account for the majority of the total buildings and floorspace, while the building types with the largest average buildings are less common in the building stock

The commercial building sector is characterized by diversity. The 2012 survey identified more than 100 subcategories of building activity, which are aggregated into the 14 principal building activities shown in the summary table and in the figures below. CBECS includes buildings as small and singular in activity as a freestanding bank or fast food restaurant, to buildings as large and complex as an office building with hundreds of tenants or a major airport terminal. CBECS also includes vacant buildings; some vacant buildings use energy, either for maintenance purposes or because a small amount of space is still used in the building1.

Among the general building activities, lodging, education, and health care are the largest buildings, on average. The health care category's average is greatly affected by the size of inpatient health care buildings (i.e., hospitals), which have an average size of 247,700 square feet per building, compared to outpatient health care buildings, which have an average size of 12,100 square feet.

Figure 4 tracks changes in the building stock over the past 10 years by comparing the number of buildings for each principal building activity from 2003 to 2012. The highest percent of growth was in vacant buildings and other types of buildings, which includes buildings such as airplane hangars, laboratories and data centers. Warehouses, food service buildings, public assembly, and office buildings also increased between 2003 and 2012, while food sales buildings (e.g., grocery and convenience stores) showed a decrease,2 and mercantile (retail and malls) showed a decrease, although it is not statistically significant. Because CBECS is a sample survey, each estimate has sampling error associated with it, which should be considered when comparing estimates. See What is an RSE? and Estimation of Standard Errors for more information.

Size of buildings: Although there are relatively few very large buildings (over 100,000 square feet of floorspace), they account for more than one-third of total commercial building floorspace

Commercial buildings are often depicted showing a skyline of towering buildings. However, the vast majority of commercial buildings are relatively small. Just less than half of buildings are 5,000 square feet in size or smaller, and nearly three-fourths are 10,000 square feet or smaller. The median building size is 5,100 square feet (i.e., half the buildings are larger than this and half are smaller), while the average size is 15,700 square feet. The average is larger than the median because of the influence of a small number of very large buildings; buildings over 100,000 square feet make up only about 2% of the building count but about 35% of the total floorspace.

Year constructed: The commercial building stock is middle-aged, and newer buildings are larger than older ones

Commercial buildings remain in use for many decades. Although about 12% of commercial buildings (comprising 14% of commercial floorspace) were built in the past 10 years, the commercial building stock is still fairly old, with about half of all buildings constructed at least 35 years ago. However, in the existing building stock, there are more buildings built in the 2000s than buildings built prior to 1946.

Newer buildings tend to be larger than older buildings. The average building size for those constructed before 1960 is 12,000 square feet; buildings constructed between 1960 and 1999 average 16,300 square feet; and buildings constructed in the 2000s average 19,100 square feet. The differences between these average building sizes are statistically significant.

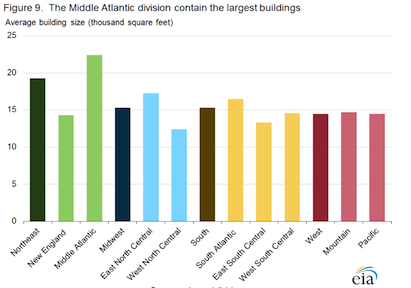

Census region and division (see map): The South has the most commercial buildings, but the Northeast has the largest commercial buildings

The South Census region, the most populous of the four Census regions, has the largest percentage of commercial buildings and commercial floorspace, with about 40% of both total buildings and floorspace. The Midwest and West regions each account for more than one-fifth of commercial buildings and floorspace.

Buildings in the Northeast region are, on average, 4,000 to 5,000 square feet larger than buildings in the other regions. The Northeast region includes the Middle Atlantic division (New York, Pennsylvania, and New Jersey), where buildings average 22,400 square feet.

Footnote

1 CBECS principal building activity is defined as the activity occupying the most floorspace. Respondents are first asked if there is one activity that occupies 75% or more of the floorspace. If not, CBECS collects the top three building activities and their corresponding percents and the principal activity is assigned as the one comprising the most floorspace.

2 Estimates for number of food sales buildings can be somewhat misleading because grocery stores and convenience stores are often part of strip malls and therefore included in the "Enclosed and strip malls" category in CBECS. "Enclosed and strip malls" is a subcategory of "Mercantile" and is shown in the summary table.

Specific questions on this product may be directed to Joelle Michaels.

Related Stories

Student Housing | Dec 7, 2022

Cornell University builds massive student housing complex to accommodate planned enrollment growth

In Ithaca, N.Y., Cornell University has completed its North Campus Residential Expansion (NCRE) project. Designed by ikon.5 architects, the 776,000-sf project provides 1,200 beds for first-year students and 800 beds for sophomore students. The NCRE project aimed to accommodate the university’s planned growth in student enrollment while meeting its green infrastructure standards. Cornell University plans to achieve carbon neutrality by 2035.

Office Buildings | Dec 6, 2022

‘Chicago’s healthiest office tower’ achieves LEED Gold, WELL Platinum, and WiredScore Platinum

Goettsch Partners (GP) recently completed 320 South Canal, billed as “Chicago’s healthiest office tower,” according to the architecture firm. Located across the street from Chicago Union Station and close to major expressways, the 51-story tower totals 1,740,000 sf. It includes a conference center, fitness center, restaurant, to-go market, branch bank, and a cocktail lounge in an adjacent structure, as well as parking for 324 cars/electric vehicles and 114 bicycles.

Multifamily Housing | Dec 6, 2022

Austin's new 80-story multifamily tower will be the tallest building in Texas

Recently announced plans for Wilson Tower, a high-rise multifamily building in downtown Austin, Texas, indicate that it will be the state’s tallest building when completed. The 80-floor structure will rise 1,035 feet in height at 410 East 5th Street, close to the 6th Street Entertainment District, Austin Convention Center, and a new downtown light rail station.

Geothermal Technology | Dec 6, 2022

Google spinoff uses pay-as-you-go business model to spur growth in geothermal systems

Dandelion Energy is turning to a pay-as-you-go plan similar to rooftop solar panel leasing to help property owners afford geothermal heat pump systems.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mixed-Use | Dec 6, 2022

Houston developer plans to convert Kevin Roche-designed ConocoPhillips HQ to mixed-use destination

Houston-based Midway, a real estate investment, development, and management firm, plans to redevelop the former ConocoPhillips corporate headquarters site into a mixed-use destination called Watermark District at Woodcreek.

Office Buildings | Dec 5, 2022

How to foster collaboration and inspiration for a workplace culture that does not exist (yet)

A building might not be able to “hack” innovation, but it can create the right conditions to foster connection and innovation, write GBBN's Chad Burke and Zachary Zettler.

University Buildings | Dec 5, 2022

Florida Polytechnic University unveils its Applied Research Center, furthering its mission to provide STEM education

In Lakeland, Fla., located between Orlando and Tampa, Florida Polytechnic University unveiled its new Applied Research Center (ARC). Designed by HOK and built by Skanska, the 90,000-sf academic building houses research and teaching laboratories, student design spaces, conference rooms, and faculty offices—furthering the school’s science, technology, engineering, and mathematics (STEM) mission.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.

Giants 400 | Dec 1, 2022

Top 50 Parking Structure Architecture + AE Firms for 2022

Choate Parking Consultants, Gensler, Clark Nexsen, and Solomon Cordwell Buenz top the ranking of the nation's largest parking structure architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.