The Window and Door Manufacturers Association (WDMA) and the American Architectural Manufacturers Association (AAMA) have jointly released the updated 2011/2012 Study of the U.S. Market for Windows, Doors and Skylights. This report delivers accurate and timely information on window, door, skylight, and curtain wall market trends and product relationships for both residential and commercial construction. Historic data for 2006 through 2011 and forecast data for 2012 through 2015 are also included in the report. Forecasts are based on projections of construction activity as of March 2012.

According to the study's data, the demand for prime windows continued to remain slow in 2011, following housing activity in general, after falling from peak volumes in 2006. The demand for windows in new housing decreased by 2% in 2011 though remains slightly ahead of 2009 levels. Demand in 2012 is expected to increase further as the housing recovery begins to gain momentum. Meanwhile, remodeling and replacement windows fell by nearly 12% versus 2010. In total, the residential window market decreased by 9%.

Residential skylights experienced an increase of 2% from 2010 to 2011. The increase was driven heavily by the continued strength of remodeling and replacement activity, which now represents more than 80% of the residential skylight market. For 2012, the market is expected to grow 6% overall. Forecasts indicate continued growth through 2015.

Little change in the segmentation for interior door material types is expected over the next 5 years. However, significant volume is expected to return to the entry and interior door market as new construction rebounds. Further, nonresidential construction declined slightly in 2011, tempering growth in the nonresidential entry and interior door categories.

Additional and more detailed information on the residential and commercial fenestration markets is contained in the 2011/2012 WDMA/AAMA U.S. Market Studies, which includes all of the items listed below.

- WDMA/AAMA U.S. Industry Statistical Review and Forecast summarizes residential, non-residential and remodeling trends from government and industry sources.

- WDMA/AAMA U.S. Industry Channel Distribution Report profiles the residential and non-residential market for windows and doors as it flows through the identified distribution channels.

- WDMA/AAMA U.S. Industry Market Size Report quantifies residential and non-residential market volumes, both historic and projected.

- WDMA/AAMA U.S. Industry Regional Statistical Review and Forecasts detail information for 11 individual regions.

The 2011/2012 WDMA/AAMA Study of the U.S. Market for Windows, Doors and Skylights, as well as the other reports listed above, are available for purchase online at the WDMA Bookstore. +

Related Stories

| Nov 2, 2010

Energy Analysis No Longer a Luxury

Back in the halcyon days of 2006, energy analysis of building design and performance was a luxury. Sure, many forward-thinking AEC firms ran their designs through services such as Autodesk’s Green Building Studio and IES’s Virtual Environment, and some facility managers used Honeywell’s Energy Manager and other monitoring software. Today, however, knowing exactly how much energy your building will produce and use is survival of the fittest as energy costs and green design requirements demand precision.

| Nov 2, 2010

Yudelson: ‘If It Doesn’t Perform, It Can’t Be Green’

Jerry Yudelson, prolific author and veteran green building expert, challenges Building Teams to think big when it comes to controlling energy use and reducing carbon emissions in buildings.

| Nov 2, 2010

Historic changes to commercial building energy codes drive energy efficiency, emissions reductions

Revisions to the commercial section of the 2012 International Energy Conservation Code (IECC) represent the largest single-step efficiency increase in the history of the national, model energy. The changes mean that new and renovated buildings constructed in jurisdictions that follow the 2012 IECC will use 30% less energy than those built to current standards.

| Nov 1, 2010

Sustainable, mixed-income housing to revitalize community

The $41 million Arlington Grove mixed-use development in St. Louis is viewed as a major step in revitalizing the community. Developed by McCormack Baron Salazar with KAI Design & Build (architect, MEP, GC), the project will add 112 new and renovated mixed-income rental units (market rate, low-income, and public housing) totaling 162,000 sf, plus 5,000 sf of commercial/retail space.

| Nov 1, 2010

John Pearce: First thing I tell designers: Do your homework!

John Pearce, FAIA, University Architect at Duke University, Durham, N.C., tells BD+C’s Robert Cassidy about the school’s construction plans and sustainability efforts, how to land work at Duke, and why he’s proceeding with caution when it comes to BIM.

| Nov 1, 2010

Vancouver’s former Olympic Village shoots for Gold

The first tenants of the Millennium Water development in Vancouver, B.C., were Olympic athletes competing in the 2010 Winter Games. Now the former Olympic Village, located on a 17-acre brownfield site, is being transformed into a residential neighborhood targeting LEED ND Gold. The buildings are expected to consume 30-70% less energy than comparable structures.

| Oct 27, 2010

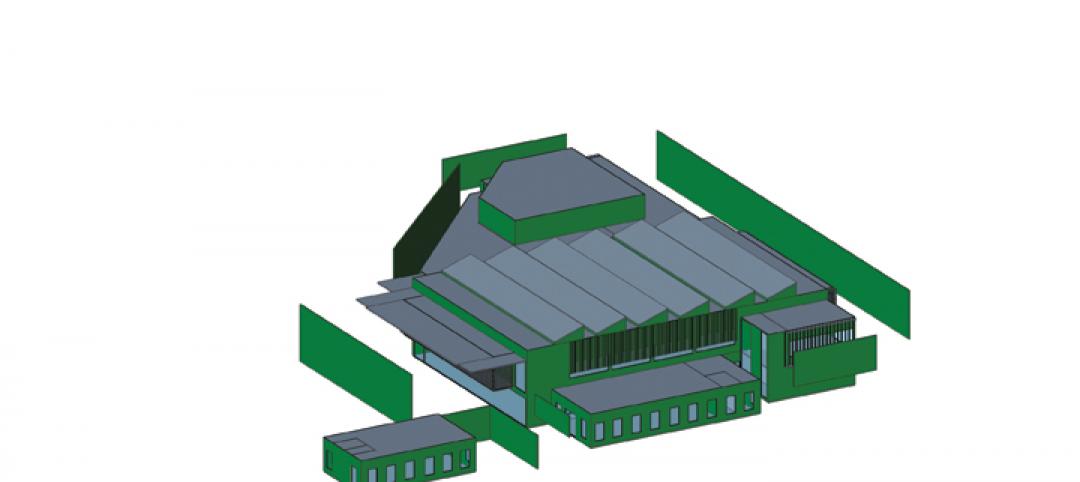

Grid-neutral education complex to serve students, community

MVE Institutional designed the Downtown Educational Complex in Oakland, Calif., to serve as an educational facility, community center, and grid-neutral green building. The 123,000-sf complex, now under construction on a 5.5-acre site in the city’s Lake Merritt neighborhood, will be built in two phases, the first expected to be completed in spring 2012 and the second in fall 2014.

| Oct 21, 2010

GSA confirms new LEED Gold requirement

The General Services Administration has increased its sustainability requirements and now mandates LEED Gold for its projects.

| Oct 18, 2010

World’s first zero-carbon city on track in Abu Dhabi

Masdar City, the world’s only zero-carbon city, is on track to be built in Abu Dhabi, with completion expected as early as 2020. Foster + Partners developed the $22 billion city’s master plan, with Adrian Smith + Gordon Gill Architecture, Aedas, and Lava Architects designing buildings for the project’s first phase, which is on track to be ready for occupancy by 2015.