Most older Americans don’t reside in “livable” communities that combine safety, security and affordability with appropriate housing and transportation options, and supportive features and services that enhance personal independence, allow residents to remain in their homes as they age, and foster residents’ engagement in civic, economic, and social life.

In a 33-page paper titled “Which Older Adults Have Access to America’s Most Livable Neighborhoods,” the Joint Center for Housing Studies at Harvard University and AARP’s Public Policy Institute draw upon information from the 2017 American Communities Survey (ACS)—whose estimates categorize 217,739 Census neighborhood block groups—as a guide to analyze AARP’s 2018 Livability Index, an online interactive source that scores neighborhoods across the U.S. to shed light on the current livability of a given location and to highlight opportunities for improvement.

The Index derives from more than 4,500 questionnaire respondents and 80 in-depth interviews, as well as input from 30 experts in various fields.

The paper also used ACS microdata to examine profiles of older adults residing in neighborhoods with different levels of livability to suggest opportunities for addressing inequality in access to livable communities, and to the specific elements certain populations lack even in the most livable places.

The paper’s goal is to evaluate whether access to livable communities is evenly distributed across the older adult population, to assess how older adults access livability features, and to understand the characteristics of higher performing communities.

DISCONNECT BETWEEN WHERE PEOPLE LIVE AND WHAT THEY NEED

Some key findings:

•Nearly 146 million Americans of all ages live in neighborhoods at the bottom two quintiles in terms of livability. And older adults are underrepresented in most livable communities; in the least livable quintile, adults age 55 or older made up near one-third of residents.

•Older adults who move tend to relocate to newer places with similar levels of overall livability as their previous neighborhoods. Only 11% move to more livable locations, and 14% actually move to neighborhoods with lower livability scores.

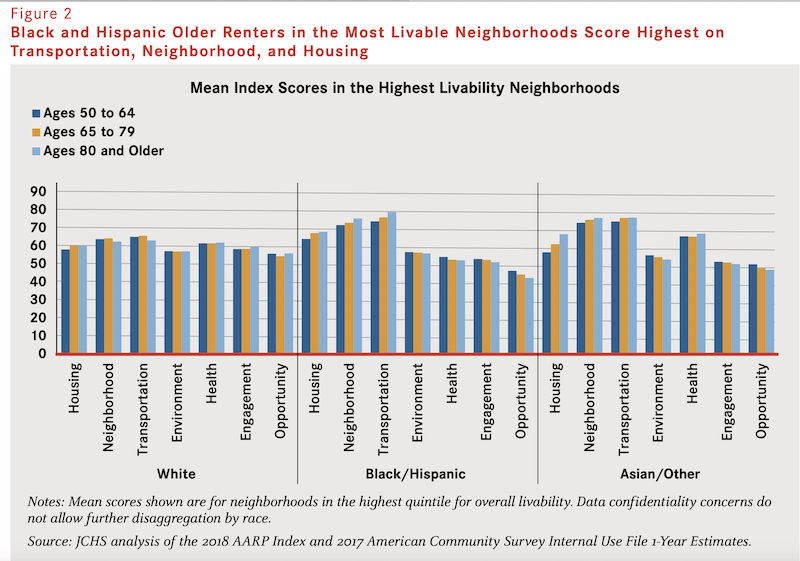

•There is a relationship between different types of livable neighborhoods and income, race/ethnicity characteristics, and homeownership. “At every level of livability, homeownership and income play important roles in accessing features that contribute to high scores in specific livability categories,” the paper’s authors write.

Certain themes also emerged from this research:

•Livability gap. There is a disconnect between what people have and what they need in communities to age in place.

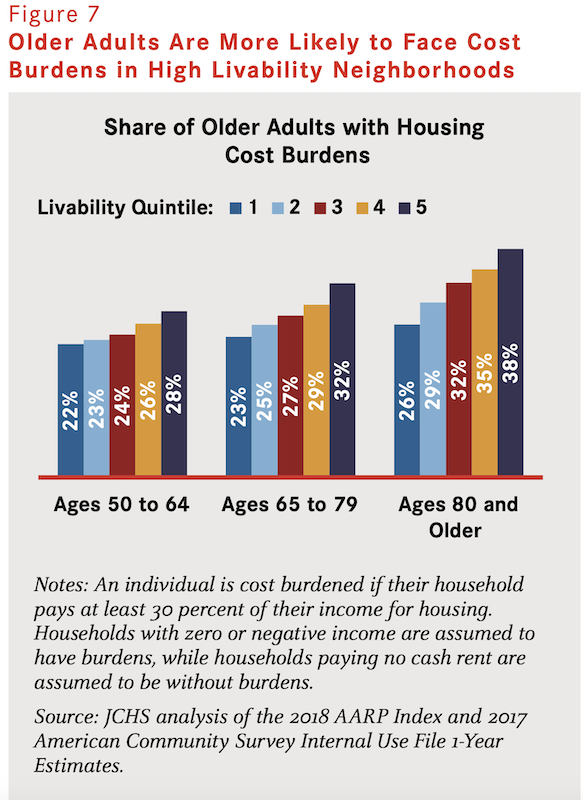

•Housing affordability. Communities that score higher on the Index tend to have higher housing costs. High housing costs can create obstacles to accessing the benefits livable communities can provide.

•Disparities in access to specific livability features. People of color, people with disabilities, and people with lower incomes may not have access to amenities and services that support aging. As the analysis shows, even when living in high scoring communities these groups may not have access to amenities and services related to health, engagement, and opportunity.

•Mobility. People tend to move to places with similar livability levels as their previous neighborhood.

•Neighborhood preferences and location choice. Individual preferences, barriers, and available community amenities may impact people’s decisions on where to live.

POLICY SUGGESTIONS INCLUDE PROMOTING HEALTHIER ENVIRONMENTS

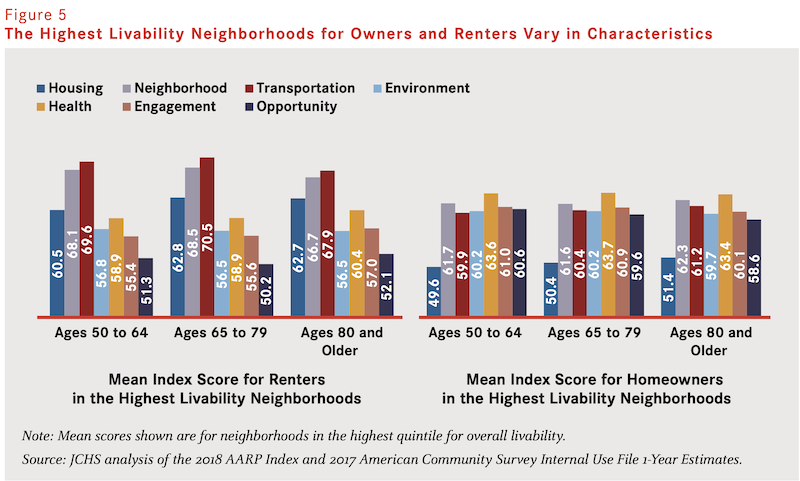

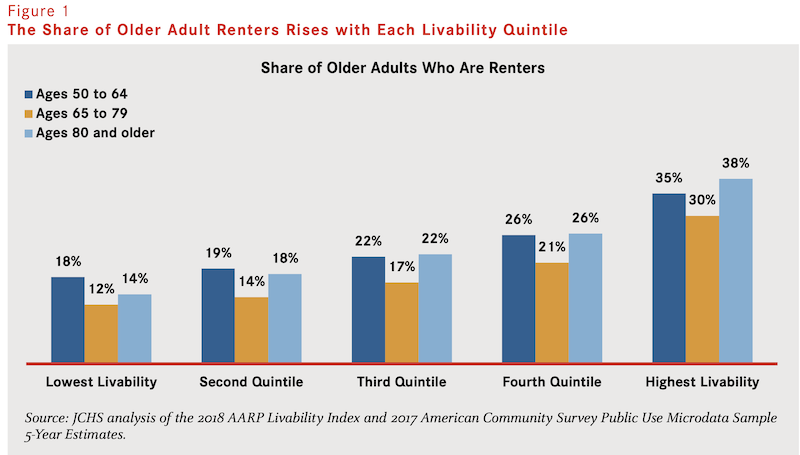

Livable communities tend to have diverse housing types that include more single-person households, where older adults are more likely to reside. This factor might explain why, on average, older renters live in more livable places than do older owners.

The likelihood of living in livable communities shifts somewhat with the person’s age. Among older adults, those ages 50 to 64 as well as those ages 80 and older have a slightly better chance of living in a high livability neighborhood than do those ages 65 to 79. Among those ages 80 and older, 18 percent reside in the top quintile neighborhoods but only 16 percent of those ages 65 to 79 do. In contrast, those ages 65 to 79 are more likely than other age groups to live in lower-livability neighborhoods.

The paper offers policy recommendations that focus on housing affordability and access, creating save neighborhoods that have ample food and culture available, environments that promote healthy, clean and natural places to live; and communities that supporting resident well-being and social lives, and enable economic and educational pursuits.

“By analyzing the Index in conjunction with Census block group data from the ACS, we have revealed specific areas that warrant focused attention,” the paper states. “Housing stock, tenure, and affordability have particular influences on the access older adults have to the most livable communities.” While this analysis could not reveal if the most vulnerable older people residing in livable communities have equal access to every feature, service, and amenity, “one expects they do not.”

Related Stories

Market Data | Apr 11, 2023

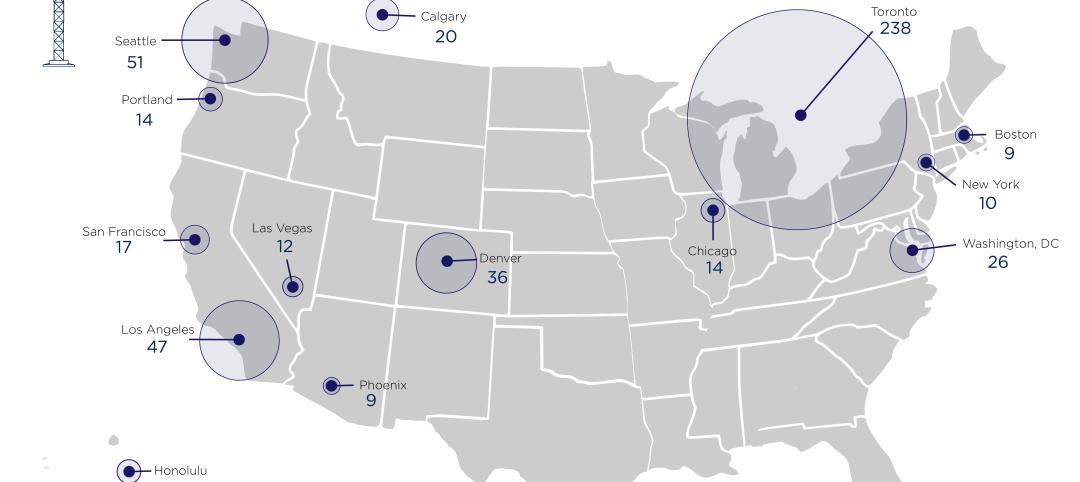

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.

Market Data | Apr 4, 2023

Nonresidential construction spending up 0.4% in February 2023

National nonresidential construction spending increased 0.4% in February, according to an Associated Builders and Contractors analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $982.2 billion for the month, up 16.8% from the previous year.

Multifamily Housing | Mar 24, 2023

Average size of new apartments dropped sharply in 2022

The average size of new apartments in 2022 dropped sharply in 2022, as tracked by RentCafe. Across the U.S., the average new apartment size was 887 sf, down 30 sf from 2021, which was the largest year-over-year decrease.

Multifamily Housing | Mar 14, 2023

Multifamily housing rent rates remain flat in February 2023

Multifamily housing asking rents remained the same for a second straight month in February 2023, at a national average rate of $1,702, according to the new National Multifamily Report from Yardi Matrix. As the economy continues to adjust in the post-pandemic period, year-over-year growth continued its ongoing decline.

Contractors | Mar 14, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of February 2023

Associated Builders and Contractors reported today that its Construction Backlog Indicator increased to 9.2 months in February, according to an ABC member survey conducted Feb. 20 to March 6. The reading is 1.2 months higher than in February 2022.

Industry Research | Mar 9, 2023

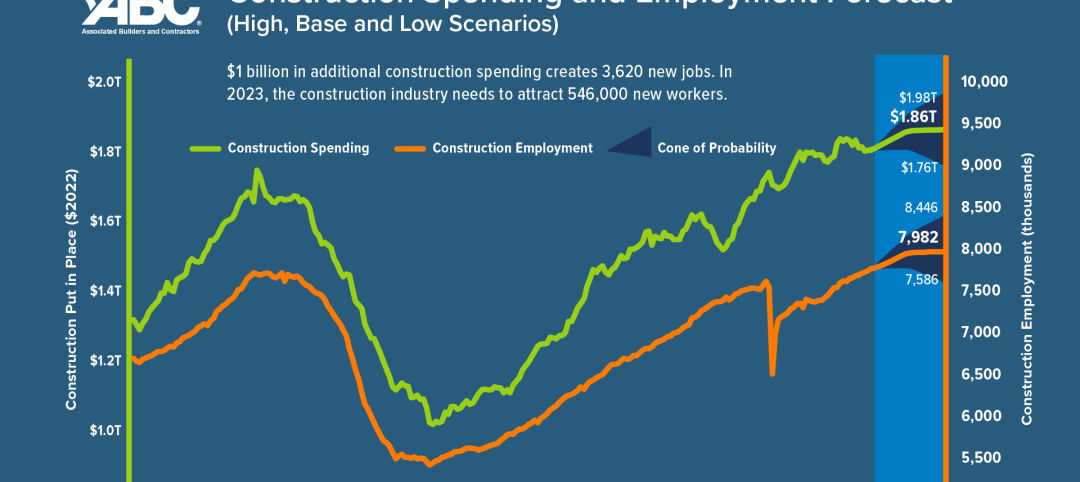

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Market Data | Mar 7, 2023

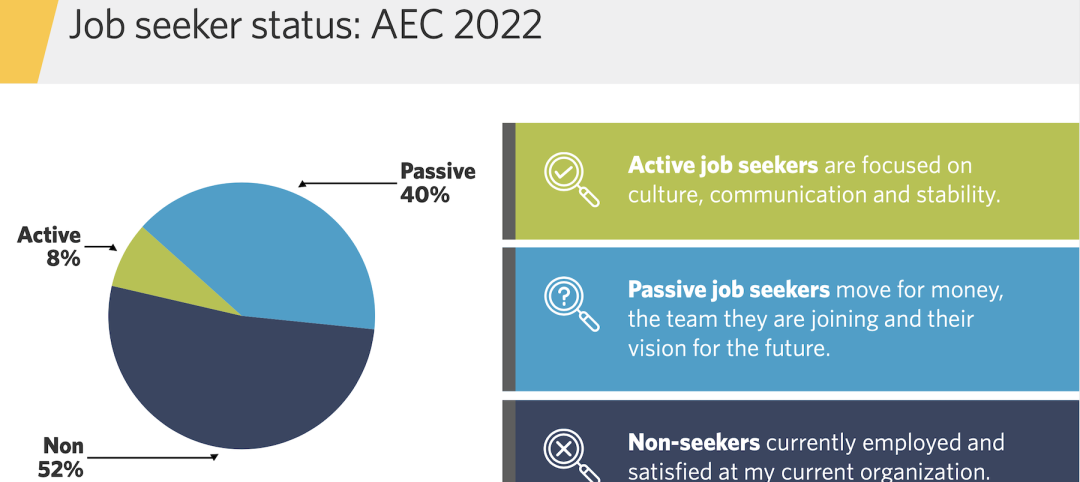

AEC employees are staying with firms that invest in their brand

Hinge Marketing’s latest survey explores workers’ reasons for leaving, and offers strategies to keep them in the fold.

Multifamily Housing | Feb 21, 2023

Multifamily housing investors favoring properties in the Sun Belt

Multifamily housing investors are gravitating toward Sun Belt markets with strong job and population growth, according to new research from Yardi Matrix. Despite a sharp second-half slowdown, last year’s nationwide $187 billion transaction volume was the second-highest annual total ever.