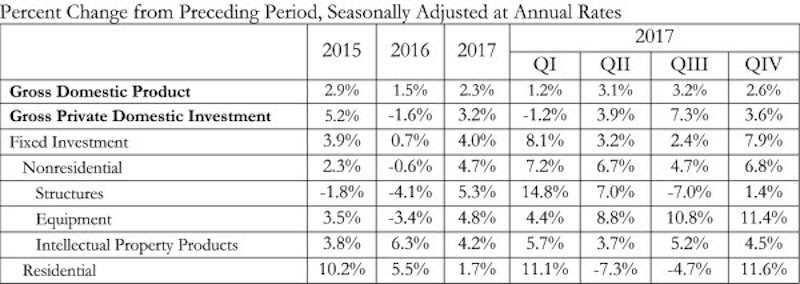

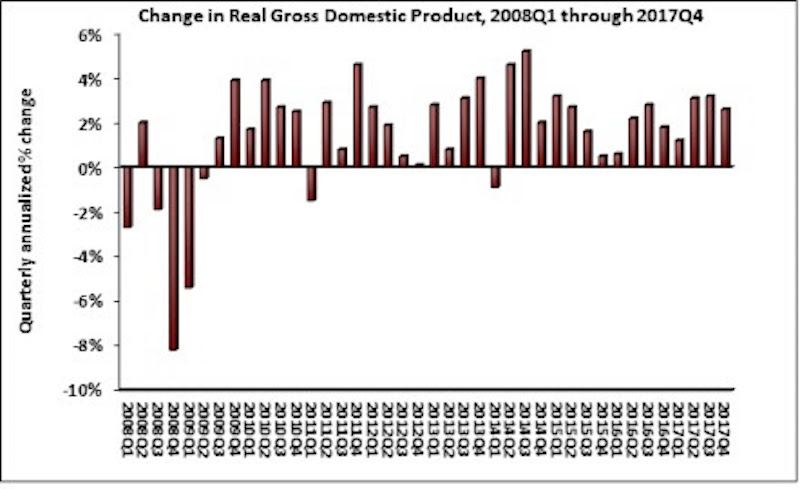

The U.S. economy grew by 2.3% in 2017, while fixed investment increased at a annual rate of 7.9%, according to an Associated Builders and Contractors (ABC) analysis of data released today by the Bureau of Economic Analysis.

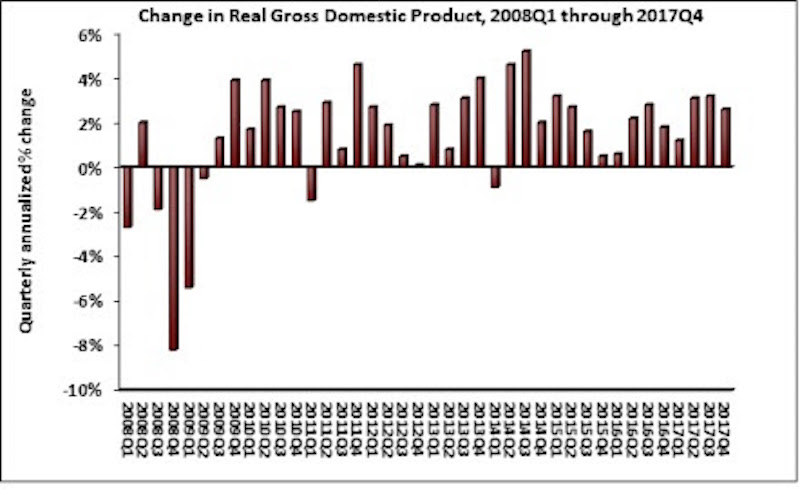

The economy expanded at an annual rate of 2.6% during the fourth quarter of 2017 after expanding at a 3.2% rate during the third quarter. Nonresidential fixed investment performed similarly to overall fixed investment in the fourth quarter by increasing at a 6.8% rate. This represents the third time in the past four quarters that nonresidential fixed investment increased by at least 6.7%.

The year-end figure for GDP growth of 2.3% is up from 1.5% in 2016 but down from the 2.9% figure posted in 2015. Nonresidential fixed investment increased 4.7% in 2017, its best year since increasing 6.9% in 2014. This followed a 0.6% contraction in 2016.

“Many will look at this report and conclude that consumer spending, the largest component of the economy, drove fourth quarter growth by expanding at a 3.8% annual rate,” said ABC Chief Economist Anirban Basu. “Upon further inspection, however, the fourth quarter consumer spending missed its 3% expectation due to imports increasing at twice the rate of exports. This widening trade deficit subtracted 1.13 percentage points from fourth quarter GDP growth.

“The factors that have helped to accelerate economic growth in America remain in place, including a strengthening global economy, abundant consumer and business confidence, elevated liquidity flowing through the veins of the international financial system and deregulation,” said Basu. “Stakeholders should be aware that although many companies have announced big plans for stepped-up investment, staffing and compensation—due at least in part to the recently enacted tax cut—the plans have yet to fully manifest within the data. The implication is that the U.S. economy is set to roar in 2018.

“As always, contractors are warned to remain wary,” said Basu. “The combination of extraordinary confidence and capital can fuel excess financial leverage and spur asset price bubbles. The implication is that as contractors remain busy, there should be an ongoing stockpiling of defensive cash. That recommendation will be difficult for many contractors to implement, however, with labor shortages and materials costs rising more rapidly and slender profit margins in many construction segments.”

Related Stories

Market Data | Aug 18, 2020

6 must reads for the AEC industry today: August 18, 2020

The world's first AI-driven facade system and LA's Greek Theatre restoriation completes.

Market Data | Aug 17, 2020

5 must reads for the AEC industry today: August 17, 2020

5 strategies for creating safer hotel experiences and how to manage multifamily assets when residents no longer leave.

Market Data | Aug 14, 2020

6 must reads for the AEC industry today: August 14, 2020

The largest single sloped solar array in the country and renewing the healing role of public parks.

Market Data | Aug 13, 2020

5 must reads for the AEC industry today: August 13, 2020

Apple Central World opens in Bangkok and 7-Eleven to buy Speedway.

Market Data | Aug 12, 2020

6 must reads for the AEC industry today: August 12, 2020

UC Davis's new dining commons and the pandemic is revolutionizing healthcare benefits.

Market Data | Aug 11, 2020

6 must reads for the AEC industry today: August 11, 2020

Elevators can be a 100% touch-free experience and the construction industry adds 20,000 employees in July.

Market Data | Aug 10, 2020

Dodge Momentum Index increases in July

This month’s increase in the Dodge Momentum Index was the first in all of 2020.

Market Data | Aug 10, 2020

Construction industry adds 20,000 employees in July but nonresidential employment dips

Association warns skid will worsen without new relief.

Market Data | Aug 10, 2020

5 must reads for the AEC industry today: August 10, 2020

Private student housing owners reap the benefits as campus housing de-densifies and race for COVID vaccine boosts real estate in life sciences hubs.

Market Data | Aug 7, 2020

6 must reads for the AEC industry today: August 7, 2020

BD+C's 2020 Color Trends Report and HMC releases COVID-19 Campus Reboot Guide for Prek-12 schools.