Driven by steady growth in the economy, domestic merger and acquisition (M&A) activity in the architecture and engineering industry hit record levels in 2015, according to Morrissey Goodale LLC, a leading business management consulting and training firm to the A/E industry. Growing uncertainty about foreign markets, however, contributed to a drop in the number

of international deals last year.

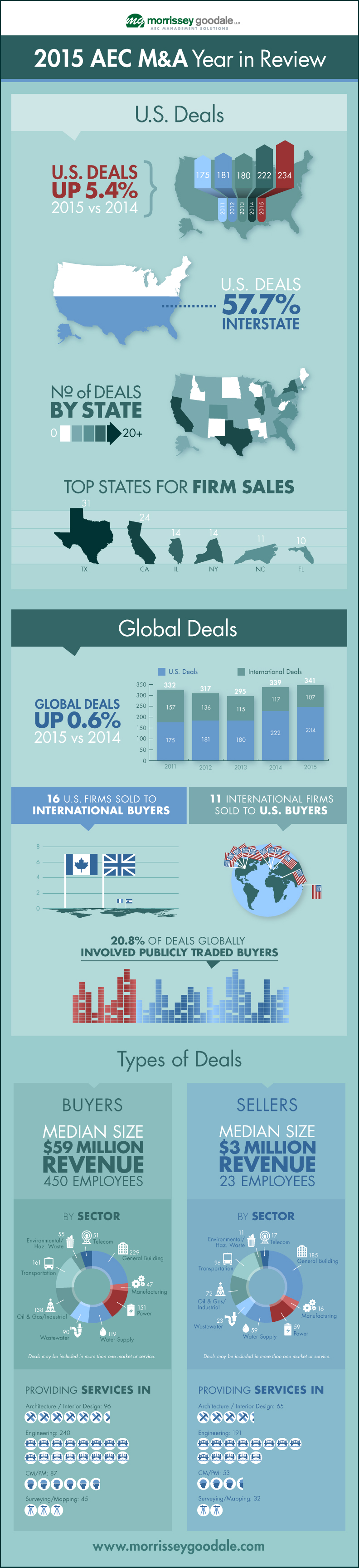

In 2015, Morrissey Goodale tracked a record 234 sales of U.S.-based A/E firms, representing a 5.4% increase over the 222 domestic deals recorded in 2014. Sales of international firms, however, dropped 8.5% from 117 in 2014 to 107 last year. When domestic and international sales are combined, overall global dealmaking in the A/E industry increased by 0.6% in 2015.

Other findings from Morrissey Goodale’s 2015 AEC M&A Year in Review include:

• Texas remained the hottest spot for M&A activity in the United States with 31 firm sales in 2015. California was a close second with 24 firm sales. Other states that saw 10 or more deals last year included Illinois, New York, North Carolina, and Florida.

• More than half (57.7%) of U.S. deals in 2015 involved a buyer and seller from different states, up from 56.2% in 2014.

• More than a fifth (20.8%) of global deals in 2015 involved publicly traded buyers, down from 28.4% in 2014.

• Mega-deals tapered somewhat last year as the median revenue of buyers decreased from $77 million in 2014 to $59 million in 2015, while the median revenue of sellers declined from $4 million to $3 million.

Morrissey Goodale Principal Consultant Neil Churman expects M&A activity in the United States will remain strong in 2016. “Continued confidence among AEC industry leaders will likely drive another busy year for domestic mergers and acquisitions,” he says. “Unease about the price of oil may give some buyers pause in pursuing energy deals, but a new transportation bill and strength in other building and infrastructure markets should lead to continued deal activity among growth-minded firms.”

Morrissey Goodale’s complete 2015 AEC M&A Year in Review and an interactive map of M&A activity in the United States can be found at www.morrisseygoodale.com.

Related Stories

Architects | Oct 20, 2015

Four building material innovations from the Chicago Architecture Biennial

From lightweight wooden pallets to the largest lengths of CLT-slabs that can be shipped across North America

University Buildings | Oct 16, 2015

5 ways architecture defines the university brand

People gravitate to brands for many reasons. Campus architecture and landscape are fundamental influences on the college brand, writes Perkins+Will's David Damon.

Architects | Oct 13, 2015

Architects Foundation expands National Resilience Initiative

The group is launching a search for three more NRI members.

Architects | Oct 13, 2015

Santiago Calatrava wins the European Prize for Architecture

The award honors those who "forward the principles of European humanism."

Office Buildings | Oct 5, 2015

Renderings revealed for Apple's second 'spaceship': a curvy, lush office complex in Sunnyvale

The project has been dubbed as another “spaceship,” referencing the nickname for the loop-shaped Apple Campus under construction in Cupertino.

Airports | Oct 5, 2015

Perkins+Will selected to design Istanbul’s 'Airport City'

The mixed-use development will be adjacent to the Istanbul New Airport, which is currently under construction.

High-rise Construction | Oct 5, 2015

Zaha Hadid designs cylindrical office building with world’s tallest atrium

The 200-meter-high open space will cut the building in two.

Architects | Oct 2, 2015

Herzog & de Meuron unveils design for Vancouver Art Gallery expansion

The blocky, seven-story wood and concrete structure is wider in the middle and uppermost floors.

Airports | Sep 30, 2015

Takeoff! 5 ways high-flyin' airports are designing for rapid growth

Nimble designs, and technology that humanizes the passenger experience, are letting airports concentrate on providing service and generating revenue.

Contractors | Sep 30, 2015

FMI: Construction in place on track for sustained growth through 2016

FMI’s latest report singles out manufacturing, lodging, and office sectors as the drivers of nonresidential building activity and investment.

![2015 was a record year for mergers and acquisitions in the AE industry [infographic] 2015 was a record year for mergers and acquisitions in the AE industry [infographic]](/sites/default/files/Screen%20Shot%202016-01-28%20at%209.38.08%20AM.png)