Driven by steady growth in the economy, domestic merger and acquisition (M&A) activity in the architecture and engineering industry hit record levels in 2015, according to Morrissey Goodale LLC, a leading business management consulting and training firm to the A/E industry. Growing uncertainty about foreign markets, however, contributed to a drop in the number

of international deals last year.

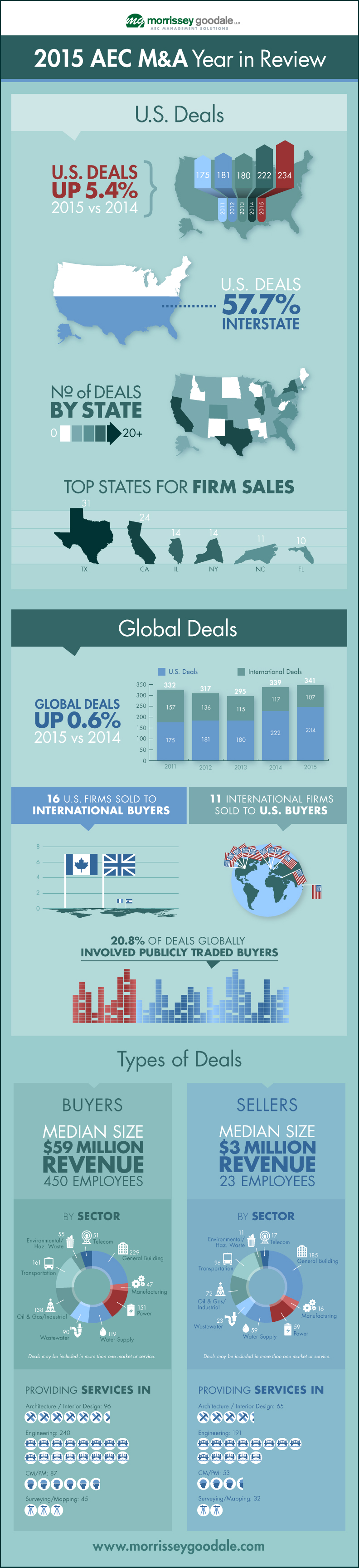

In 2015, Morrissey Goodale tracked a record 234 sales of U.S.-based A/E firms, representing a 5.4% increase over the 222 domestic deals recorded in 2014. Sales of international firms, however, dropped 8.5% from 117 in 2014 to 107 last year. When domestic and international sales are combined, overall global dealmaking in the A/E industry increased by 0.6% in 2015.

Other findings from Morrissey Goodale’s 2015 AEC M&A Year in Review include:

• Texas remained the hottest spot for M&A activity in the United States with 31 firm sales in 2015. California was a close second with 24 firm sales. Other states that saw 10 or more deals last year included Illinois, New York, North Carolina, and Florida.

• More than half (57.7%) of U.S. deals in 2015 involved a buyer and seller from different states, up from 56.2% in 2014.

• More than a fifth (20.8%) of global deals in 2015 involved publicly traded buyers, down from 28.4% in 2014.

• Mega-deals tapered somewhat last year as the median revenue of buyers decreased from $77 million in 2014 to $59 million in 2015, while the median revenue of sellers declined from $4 million to $3 million.

Morrissey Goodale Principal Consultant Neil Churman expects M&A activity in the United States will remain strong in 2016. “Continued confidence among AEC industry leaders will likely drive another busy year for domestic mergers and acquisitions,” he says. “Unease about the price of oil may give some buyers pause in pursuing energy deals, but a new transportation bill and strength in other building and infrastructure markets should lead to continued deal activity among growth-minded firms.”

Morrissey Goodale’s complete 2015 AEC M&A Year in Review and an interactive map of M&A activity in the United States can be found at www.morrisseygoodale.com.

Related Stories

| Aug 8, 2013

Top Science and Technology Sector Architecture Firms [2013 Giants 300 Report]

HDR, Perkins+Will, HOK top Building Design+Construction's 2013 ranking of the largest science and technology sector architecture and architecture/engineering firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Construction Firms [2013 Giants 300 Report]

Skanska, DPR, Suffolk top Building Design+Construction's 2013 ranking of the largest science and technology sector contractors and construction management firms in the U.S.

| Aug 8, 2013

Level of Development: Will a new standard bring clarity to BIM model detail?

The newly released LOD Specification document allows Building Teams to understand exactly what’s in the BIM model they’re being handed.

| Aug 8, 2013

Vertegy spins off to form independent green consultancy

St. Louis-based Vertegy has announced the formation of Vertegy, LLC, transitioning into an independent company separate from the Alberici Enterprise. The new company was officially unveiled Aug. 1, 2013

| Aug 5, 2013

Top Retail Architecture Firms [2013 Giants 300 Report]

Callison, Stantec, Gensler top Building Design+Construction's 2013 ranking of the largest retail architecture and architecture/engineering firms in the United States.

| Aug 5, 2013

Top Retail Engineering Firms [2013 Giants 300 Report]

Jacobs, AECOM, Henderson Engineers top Building Design+Construction's 2013 ranking of the largest retail engineering and engineering/architecture firms in the United States.

| Aug 5, 2013

Retail market shows signs of life [2013 Giants 300 Report]

Retail rentals and occupancy are finally on the rise after a long stretch in the doldrums.

| Aug 5, 2013

Top Retail Construction Firms [2013 Giants 300 Report]

Shawmut, Whiting-Turner, PCL top Building Design+Construction's 2013 ranking of the largest retail contractor and construction management firms in the United States.

| Aug 2, 2013

Michael Baker Corp. agrees to be acquired by Integrated Mission Solutions

Michael Baker Corporation (“Baker”) (NYSE MKT:BKR) announced today that it has entered into a definitive merger agreement to be acquired by Integrated Mission Solutions, LLC (“IMS”), an affiliate of DC Capital Partners, LLC (“DC Capital”).

| Jul 31, 2013

Hotel, retail sectors bright spots of sluggish nonresidential construction market

A disappointing recovery of the U.S. economy is limiting need for new nonresidential building activity, said AIA Chief Economist, Kermit Baker in the AIA's semi-annual Consensus Construction Forecast, released today. As a result, AIA reduced its projections for 2013 spending to 2.3%.

![2015 was a record year for mergers and acquisitions in the AE industry [infographic] 2015 was a record year for mergers and acquisitions in the AE industry [infographic]](/sites/default/files/Screen%20Shot%202016-01-28%20at%209.38.08%20AM.png)