Driven by steady growth in the economy, domestic merger and acquisition (M&A) activity in the architecture and engineering industry hit record levels in 2015, according to Morrissey Goodale LLC, a leading business management consulting and training firm to the A/E industry. Growing uncertainty about foreign markets, however, contributed to a drop in the number

of international deals last year.

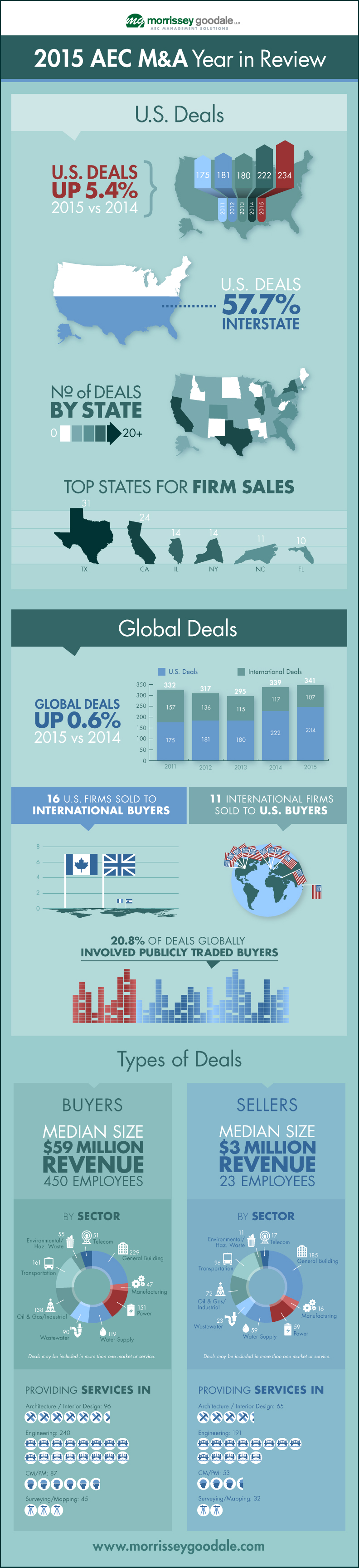

In 2015, Morrissey Goodale tracked a record 234 sales of U.S.-based A/E firms, representing a 5.4% increase over the 222 domestic deals recorded in 2014. Sales of international firms, however, dropped 8.5% from 117 in 2014 to 107 last year. When domestic and international sales are combined, overall global dealmaking in the A/E industry increased by 0.6% in 2015.

Other findings from Morrissey Goodale’s 2015 AEC M&A Year in Review include:

• Texas remained the hottest spot for M&A activity in the United States with 31 firm sales in 2015. California was a close second with 24 firm sales. Other states that saw 10 or more deals last year included Illinois, New York, North Carolina, and Florida.

• More than half (57.7%) of U.S. deals in 2015 involved a buyer and seller from different states, up from 56.2% in 2014.

• More than a fifth (20.8%) of global deals in 2015 involved publicly traded buyers, down from 28.4% in 2014.

• Mega-deals tapered somewhat last year as the median revenue of buyers decreased from $77 million in 2014 to $59 million in 2015, while the median revenue of sellers declined from $4 million to $3 million.

Morrissey Goodale Principal Consultant Neil Churman expects M&A activity in the United States will remain strong in 2016. “Continued confidence among AEC industry leaders will likely drive another busy year for domestic mergers and acquisitions,” he says. “Unease about the price of oil may give some buyers pause in pursuing energy deals, but a new transportation bill and strength in other building and infrastructure markets should lead to continued deal activity among growth-minded firms.”

Morrissey Goodale’s complete 2015 AEC M&A Year in Review and an interactive map of M&A activity in the United States can be found at www.morrisseygoodale.com.

Related Stories

| Mar 14, 2012

Plans for San Francisco's tallest building revamped

The glassy white high-rise would be 60 stories and 1,070 feet tall with an entrance at First and Mission streets.

| Mar 14, 2012

Hyatt joins Thornton Tomasetti as VP in Chicago

A forensic specialist, Hyatt has more than 10 years of experience performing investigations of structural failures throughout the U.S.

| Mar 14, 2012

Tsoi/Kobus and Centerbrook to design Jackson Laboratory facility in Farmington, Conn.

Building will house research into personalized, gene-based cancer screening and treatment.

| Mar 13, 2012

China's high-speed building boom

A 30-story hotel in Changsha went up in two weeks. Some question the safety in that, but the builder defends its methods.

| Mar 13, 2012

Commercial glazer Harmon expanding into Texas

Company expanding into the Texas market with a new office in Dallas and a satellite facility in Austin.

| Mar 13, 2012

Worker office space to drop below 100-sf in five years

The average for all companies for square feet per worker in 2017 will be 151 sf, compared to 176 sf, and 225 sf in 2010.

| Mar 12, 2012

Improving the performance of existing commercial buildings: the chemistry of sustainable construction

Retrofitting our existing commercial buildings is one of the key steps to overcoming the economic and environmental challenges we face.

| Mar 9, 2012

2012 Giants 300 survey due Friday, April 13

See how your firm ranks among the AEC industry leaders.

![2015 was a record year for mergers and acquisitions in the AE industry [infographic] 2015 was a record year for mergers and acquisitions in the AE industry [infographic]](/sites/default/files/Screen%20Shot%202016-01-28%20at%209.38.08%20AM.png)