Driven by steady growth in the economy, domestic merger and acquisition (M&A) activity in the architecture and engineering industry hit record levels in 2015, according to Morrissey Goodale LLC, a leading business management consulting and training firm to the A/E industry. Growing uncertainty about foreign markets, however, contributed to a drop in the number

of international deals last year.

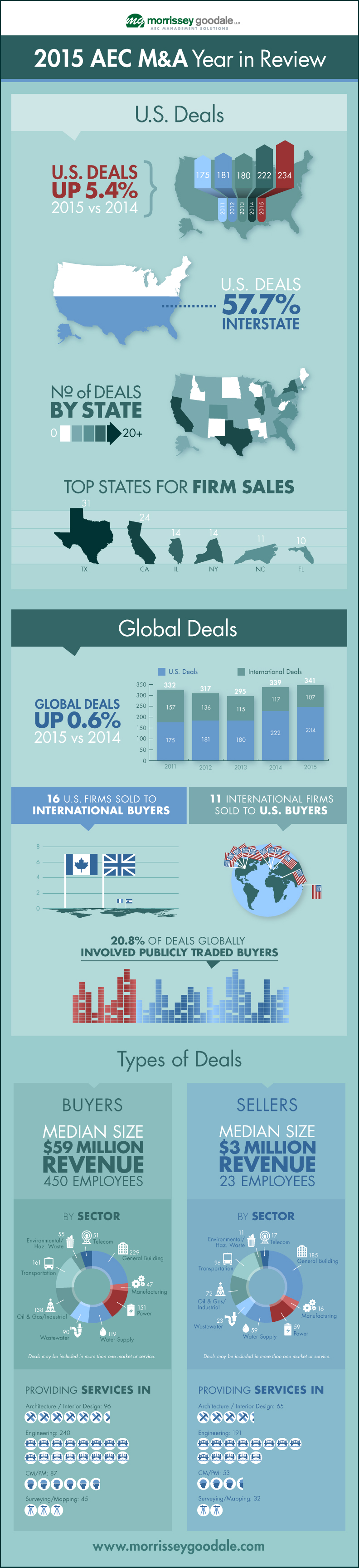

In 2015, Morrissey Goodale tracked a record 234 sales of U.S.-based A/E firms, representing a 5.4% increase over the 222 domestic deals recorded in 2014. Sales of international firms, however, dropped 8.5% from 117 in 2014 to 107 last year. When domestic and international sales are combined, overall global dealmaking in the A/E industry increased by 0.6% in 2015.

Other findings from Morrissey Goodale’s 2015 AEC M&A Year in Review include:

• Texas remained the hottest spot for M&A activity in the United States with 31 firm sales in 2015. California was a close second with 24 firm sales. Other states that saw 10 or more deals last year included Illinois, New York, North Carolina, and Florida.

• More than half (57.7%) of U.S. deals in 2015 involved a buyer and seller from different states, up from 56.2% in 2014.

• More than a fifth (20.8%) of global deals in 2015 involved publicly traded buyers, down from 28.4% in 2014.

• Mega-deals tapered somewhat last year as the median revenue of buyers decreased from $77 million in 2014 to $59 million in 2015, while the median revenue of sellers declined from $4 million to $3 million.

Morrissey Goodale Principal Consultant Neil Churman expects M&A activity in the United States will remain strong in 2016. “Continued confidence among AEC industry leaders will likely drive another busy year for domestic mergers and acquisitions,” he says. “Unease about the price of oil may give some buyers pause in pursuing energy deals, but a new transportation bill and strength in other building and infrastructure markets should lead to continued deal activity among growth-minded firms.”

Morrissey Goodale’s complete 2015 AEC M&A Year in Review and an interactive map of M&A activity in the United States can be found at www.morrisseygoodale.com.

Related Stories

| Feb 17, 2012

MacInnis joins Gilbane board of directors

MacInnis is the chairman and recently retired CEO of Connecticut-based EMCOR Group, Inc.

| Feb 16, 2012

Gain greater agility and profitability with ArchiCAD BIM software

White paper was written with the sole purpose of providing accurate, reliable information about critical issues related to BIM and what ArchiCAD with advanced technology such as the GRAPHISOFT BIM Server provide as an answer to address these issues.

| Feb 16, 2012

TLC Engineering for Architecture opens Chattanooga office

TLC Engineering for Architecture provides mechanical, electrical, structural, plumbing, fire protection, communication, technology, LEED, commissioning and energy auditing services.

| Feb 16, 2012

Summit Design + Build begins build-out for Emmi Solutions in Chicago

The new headquarters will total 20,455 sq. ft. and feature a loft-style space with exposed masonry and mechanical systems, 15 foot clear ceilings, two large rooftop skylights and private offices with full glass partition walls.

| Feb 16, 2012

Highland named president of McCarthy Building Companies’ California region

Highland moved into this new role in January 2012 following a six-month transition period with Carter Chappell, the company’s former president, California region.

| Feb 16, 2012

Big-box retailers not just for DIYers

Nearly half of all contractor purchases made from stores like Home Depot and Lowe's.

| Feb 16, 2012

4.8-megawatt solar power system completed at Jersey Gardens Mall

Solar array among the largest rooftop systems in North America.

| Feb 15, 2012

Fourth-generation Ryan to lead Ryan Companies AE team

Ryan leads a team of eight architects, four civil engineers, two landscape architects and two virtual building specialists in their efforts to realize their customer’s vision and needs through Ryan’s integrated project delivery system.

| Feb 15, 2012

NAHB sees gradual improvement in multifamily sales for boomers

However, since the conditions of the current overall housing market are limiting their ability to sell their existing homes, this market is not recovering as quickly as might have been expected.

| Feb 15, 2012

Skanska secures $87M contract for subway project

The construction value of the project is $261.9 M. Skanska will include its full share, $87 M, in the bookings for Skanska USA Civil for the first quarter 2012.

![2015 was a record year for mergers and acquisitions in the AE industry [infographic] 2015 was a record year for mergers and acquisitions in the AE industry [infographic]](/sites/default/files/Screen%20Shot%202016-01-28%20at%209.38.08%20AM.png)