A short-range drone was the hottest retail story of 2013. The morning after CEO Jeff Bezos unveiled Amazon’s “octocopter” on “60 Minutes,” the Internet was abuzz with speculation about whether this Jetsonesque delivery technology would actually fly, further favoring e-commerce over brick-and-mortar stores.

Even using conventional methods, online retailing has enviable momentum. An estimate by comScore, which specializes in digital business analytics, indicated that American consumers ordered $46.5 billion worth of merchandise from desktop devices alone during November-December 2013—up 10% from 2012, and a record for online holiday spending.

Traditional retailers, who have already weathered years of a dismal economy, aren’t backing down. In fact, as the housing market and consumer confidence have revived, retail has emerged as a bright spot in 2014’s commercial construction forecasts.

The American Institute of Architects predicts gains in the 12% range for the sector this year. Real estate services firm Cassidy Turley forecasts that 38,000 new storefronts will be developed in 2014, compared with just over 36,000 in 2013. (About 40% are expected to be restaurants, led by new “fast casual” concepts.)

Despite the complexity of a sector that encompasses everything from banks to burger joints, clear trends are emerging. Here’s what BD+C’s retail giants are telling us about what their clients need, and want, from Building Teams.

1. Technology isn’t the enemy

At True Runner, Pittsburgh, this “Go-Board” highlights real-time information on running groups, race routes, and weather. This digital experience is designed to support the retail environment without dominating it, according to architect Little. Photo: Michael Mauro/Mauro Media

Creative retailers are looking for facilities that can leverage technology instead of trying to beat it. “Stores are fighting high-tech fire with high-tech fire by integrating technology into the shopping experience and helping to get people off the computer and back into the store,” says Kevin Horn, VP of Global Architecture Practice and interior designer for RTKL. “It’s mainly a trend for exclusive stores right now, but it’s going to filter down as developers figure out what works.”

One major department store that asked not to be named plans to experiment with interactive screens in dressing rooms, giving shoppers an easier way to communicate with clerks, discover additional available colors, locate out-of-stock items, and browse coordinating garments, accessories, and shoes. The tech-integrated experience may extend to a mobile point-of-sale system instead of the traditional check-out, says Alex Shapleigh, a Principal at Callison. “Customers and sales reps can interact face-to-face in comfortable and familiar settings.”

AT&T is rolling out a new store design companywide, with transactions untethered from a standard checkout and with compatible products displayed in “experience zones.” The idea is to remove communication barriers between shoppers and employees, according to Paul Roth, AT&T’s President of Retail Sales and Service.

Some retailers are even softening their stance against “showrooming,” whereby consumers visit stores to evaluate items but then buy them from online vendors. For instance, digital jewelry retailer Blue Nile is now operating a staffed counter within the wedding department of a Seattle Nordstrom store. In this pilot program, the jewelry must still be purchased online, but Nordstrom benefits from Blue Nile’s rent and a new source of customers that will be exposed to displays of gowns and related items.

Shapleigh acknowledges that integrating tech isn’t easy. “Challenges include keeping the content fresh and relevant and keeping hardware up and running. To be a success, integrated technologies have to be purposeful and focused on improving the overall experience in a way that more low-tech methods can’t achieve.”

2. Customers crave authenticity

Exemplifying a trend toward authenticity, the Little Red Fox neighborhood market and café in Washington, D.C.’s Chevy Chase neighborhood purveys homemade food, coffee, and local market items. SmithGroupJJR assisted owner-operators Matthew Carr and Anne Alfano in remaking a former commercial bakery, exposing rustic wood, an industrial skylight, original floors, and painted plaster walls. Photo: Luis Velez Alvarez

Today’s consumers, though increasingly comfortable online, still respond to shopping experiences that are somehow perceived as “special.” Local relevance and uniqueness are draws, whether the offering is artisanal cheese or handmade hats. Gensler Principal and Retail Practice Area leader Barry Bourbon reports that the trend is particularly strong among his urban clients.

“Brand consistency is less important than getting the culture and preferences right,” he says. “Consumers increasingly prioritize self-expression and exhibit a variety of lifestyle choices. To attract these customers, retailers may venture into smaller, nontraditional settings to convey uniqueness and connection.”

James Farnell, Creative Director with Little, says, “Retailers are looking to engage the senses, using textured finishes and even aromas to connect with customers. We’re seeing more of a localized product assortment, and also furnishings sourced from within the community.”

RTKL’s Horn mentions the runaway success of handmade e-commerce site Etsy (likely to hit $1 billion in transactions this year). Brick-and-mortar stores are getting the message. For instance, Crafted at the Port of Los Angeles opened in 2012 as a year-round urban marketplace for independent artists, using a simple month-by-month leasing agreement. But even stores with a more conventional sales model are rejecting generic designs.

“Our clients realize that the shopping experience has to be memorable, personalized, and somehow unique in order to beat the online competition,” says Gastón Olvera, LEED AP, Project Director at MBH Architects.

Grocery stores and restaurants seem particularly enthusiastic about using this strategy to combat category-killer superstores (e.g., Target, Walmart, Meijer). “Our grocery clients want to work with local suppliers and to promote seasonal and local products through design, particularly signage,” says John Scheffel, a Branded Environments Specialist at api(+). “We use graphics to educate shoppers about product origins and seasonal options, such as local and craft beer varieties. Even some discount food retailers are reflecting this trend.”

3. Mediocre malls need makeovers to survive

EE&K, a Perkins Eastman company, recently updated the 1960s-era Walt Whitman Shops in Huntington Station, N.Y. Refreshed interiors were augmented with an outdoor plaza including flower beds and a new statue of Whitman, for a welcoming environment. Photo courtesy Simon Properties.

In a national landscape pocked with failed shopping centers, mall renovation has emerged as an especially promising retail trend. Jones Lang LaSalle’s 2014 U.S. Retail Forecast indicates widely varying success for today’s malls, contrasting competitive centers (occupancies above 80%) with laggards that suffer from low traffic, high vacancy, and blah décor.

“We expect to see robust rent growth in strong malls, where it will become increasingly difficult to find space, and increasing vacancies in dead or near-dead malls,” says primary author Greg Mahoney, President and CEO, JLL Retail Americas. “Aggressively expanding retailers will seek vibrant malls with strong demographics.”

Developers who see opportunity in well-located but underperforming properties have poured cash into major renovations. “Repositioning is in full swing in many of our markets across New York state and Pennsylvania,” says Andy Hart, RLA, ASLA, Director of Retail Site Development with Bergmann Associates. “Specifically, introducing dining options, entertainment, and other customer amenities to the shopping experience gives the shopper more reasons to visit malls and also increases the time spent there.”

Craig Chinn, AIA, formerly an Associate Principal at KTGY and now Principal at his own firm, Architecture Design Collaborative, says, “Mall renovations are focusing on lighter, brighter flooring, LED lighting, and neutral colors that help put the focus on the retail stores.” Chinn, a member of BD+C’s 40 Under 40 Class of 2013, adds that vibrant accent colors are being used to spice up food courts and common areas.

The retail component of Washington, D.C.’s midcentury mixed-use development L’Enfant Plaza recently received a major facelift courtesy of The JBG Companies and architect SmithGroupJJR. The 1.3 million-sf site has been expanded and updated with daylighting, fresh graphics, and a streetlike food court instead of an uninspired ring of vendors circling a seating corral. “Customers have expansive views of the outside and a perfect place to enjoy a respite during the workday,” says Andrew Rollman, AIA, LEED AP, a VP at SmithGroupJJR.

4. Create destinations that invite customers to linger

The Mall at Greece Ridge, Rochester, N.Y., is a recent redevelopment by Wilmorite Management Group, created through selective demolition of a two-story, 165,000-sf store that had formerly been an anchor. The new, single-story Avenue of Shops and Restaurants is conducive to smaller-scale tenants and makes room for outdoor dining and events. Bergmann Associates designed the project. Photo: David Brennan Photography

Common to many mall renovations, as well as some single-site projects, is greater attention to outdoor spaces and entertainment options. Where available, outdoor space is increasingly seen as an asset that can be exploited as a setting for concerts, how-to workshops, and other events that will draw customers and keep them on site longer.

EE&K, a Perkins Eastman company, recently led the renovation of the Walt Whitman Shops, a 1960s mall in Huntington Station, N.Y. In addition to a major expansion and improved interior design, the project included a central neighborhood plaza entrance including flower beds, a courtyard, and a new statue of the namesake poet. “Our design focus was on creating an iconic destination, similar to a small-town Main Street, where people can enjoy offerings and not feel overwhelmed,” says Principal Peter Cavaluzzi, FAIA. “It’s about making a relaxed luxury environment, inspired by the character of bucolic beachfront towns on Long Island.”

Engineer Buro Happold is working on structural systems for the new Pier 17 at South Street Seaport in New York City, a project designed by SHoP Architects in collaboration with James Corner Field Operations, and developed by The Howard Hughes Corporation. Replacing a barnlike mall, the project features open-air retail spaces and exposed-view corridors that pay homage to old-fashioned New York street markets. An expansive green roof will support public events such as concerts. Perimeter “garage door” systems will respond to the weather conditions, making for an adaptable indoor-outdoor space.

5. Green saves money and intrigues consumers

Sustainable construction is gaining appeal among retail consumers, according to Dustin Watson, partner and Director of Sustainability at design firm DDG. Watters Creek at Montgomery Farm in suburban Dallas, a two-phase project, is pursuing LEED-CS certification. Photo courtesy of DDG.

“Retail clients might not be asking for sustainable materials or building practices en masse just yet, but I predict that they will, especially if they want an edge with female customers,” says RTKL’s Horn. Over the next decade, says Horn, women will account for two-thirds of consumer wealth in the U.S. He cites research stating that 37% of women are more likely to pay attention to brands that are committed to environmental causes—an important stat because 85% of brand-driven purchases are made by women.

“LEED will continue to be the standard, but we are going to see more net-zero retailers,” Horn predicts. Kohl’s announced in 2011 that it has already achieved net-zero greenhouse gas emissions, and Walgreen’s recently opened its first net-zero energy store in suburban Chicago.

Dustin Watson, Partner and Director of Sustainability at design firm DDG, says his clients are increasingly enthusiastic about green. “Changes in consumer mindset have helped clear the way for additional corporate funding and resources to be directed to retail sustainability programs,” he says. “Ultimately a more sustainable retail environment will lower operating expenses, decrease risks, provide a focal point for the community, increase consumer loyalty, provide more flexible settings, reduce environmental impacts, and increase the bottom line.”

DDG’s green projects include Watters Creek at Montgomery Farm in suburban Dallas, a two-phase shopping center pursuing LEED-CS certification, and Atlantic Station in Atlanta, a LEED-qualified mixed-use development going up on a brownfield site.

Bergmann’s Hart reports that client Destiny USA, a shopping-and-entertainment center in Syracuse, N.Y., is requiring all new tenants to be LEED-certified. As of June 2013, more than 60 of the mall’s retailers were seeking LEED certification, with Gold level already achieved by multiple stores. The mall bills itself as the world’s largest LEED Gold retail building, at more than 2.4 million sf. Developers have released a case study detailing their cost savings, hoping to “encourage other businesses to follow our example” (http://destinyusa.com/green/does-leed-certification-work).

6. High-end meets low-end

The Fashion Outlets of Chicago, designed by RTKL and KA, combine high-end and mid-price stores in a upscale environment. Jazzy environmental graphics and displays of fine art convey a sense of excitement and uniqueness. Developers: Macerich, AWE Talisman. Photo: David Whitcomb

Luxury and low-priced stores are thriving as midline retailers struggle, reflecting an increasingly uneven distribution of wealth in the economy. Though unemployment and consumer confidence have certainly improved, the discount retail category isn’t losing any relevance. “Since the recession, there has been a renewed interest in value,” says JLL’s 2014 Retail Report. “As a result, outlet centers have performed outstandingly in recent years.”

Agrees Bergmann’s Hart, “The rise in dollar stores and low-end grocery stores is happening. The economy has hurt the middle and working class the most, and that has meant that they are looking to save money.”

MJ Munsell, IIDA, Principal and Retail Design Lead at MulvannyG2 Architecture, affirms that big box and discount stores are still important, but says many clients are rethinking the scale of their properties. “They’re reallocating and reducing square footage because their businesses have changed quite a bit, just in the past two years. They’re considering what’s necessary in urban vs. suburban locations, and the influence of more and more online shopping.”

Says Callison’s Shapleigh, “They’re beginning to develop strategies and concepts to take the ‘big’ out of big box. The next big success story will come from the big-box retailer that figures out how to create a more engaging and inspiring customer experience while still providing a broad and deep product assortment.”

Simultaneously, the luxury category is performing well—not only among traditionally affluent older consumers but also among urban Millennials. Luxury outlet malls reflect an intersection of these trends, offering premium merchandise at a relative bargain. “The quality of outlet retailers has been more sophisticated and upscale,” says the JLL report. “Luxury brands and department stores, which once fought hard against the off-price concept, are dipping their feet into the outlet pool.”

RTKL’s design for the new Fashion Outlets of Chicago, in suburban Rosemont, reflects this paradigm, showcasing less expensive brands (Forever 21, Gap, Jockey) alongside designer names (Gucci, Michael Kors, Prada). Punchy environmental graphics—a trend noted by many of the firms consulted for this story—and fine art help make the space more distinctive. In partnership with The Arts Initiative, a side project of developer AWE Talisman, the mall’s initial installation featured the work of 10 artists selected by the Miami-based gallery Primary Projects. “This adds a level of detail, story, and authenticity to what could have been a fairly soulless shopping center,” says RTKL’s Horn.

7. Fast and flexible wins the retailing race

MBH Architects created this minimalist, 864-sf Camper shoe store in Santa Monica, Calif., adapting a concept by Japanese designer Tokujin Yoshioka, originally built in Paris. Spain-based Camper has a track record of creating compact, one-of-a-kind stores with internationally known designers, as well as temporary “Walk in Progress” installations that allow sales to commence while permanent sites are under construction. Photo: Misha Bruk

Regardless of property type, many retail clients have a common request of their AEC partners: make it flexible and make it fast. The linked objectives reflect clients’ desire to stay nimble in the face of economic, social, and technological change.

MulvannyG2’s Munsell says, “Clients are asking us how store design can support the need for greater flexibility, and how they can have this, as well as attracting a younger customer and integrating technology, as fast as possible. These are by far the most pressing issues retailers are facing, and they are requested with consistency across retail sectors.”

Lee Preston, EVP of Creative Services at WD Partners, says many clients are looking at smaller footprints to minimize capital investment and achieve a “just right” solution. In some cases, pop-up stores are a quick way to create excitement and test concepts and locations without a long-term investment.

Little, for instance, developed an eight-week pop-up shop for Belle & Ty, a boutique created by department store Belk in a vacant Charlotte, N.C., mall space. Key features of the installation, targeted at women aged 18 to 24, included amply sized “VIP” dressing rooms and an Instagram wall for sharing real-time images submitted by shoppers. MBH recently completed a quick store for Camper shoes at Pioneer Place in Portland, Ore., giving the client a market toehold while waiting for more permanent space elsewhere in the mall to be completed.

So-called “fashion trucks”—rolling stores that build on the success of food trucks—may represent the ultimate in flexibility, speed, convenience, and curated selection. Gensler’s Bourbon mentions a mobile store operated by trendy U.K.-based retailer TopShop, which has cruised the streets of the Big Apple. Boutique vehicles have also been spotted in Austin, Boston, Chicago, Dallas, Los Angeles, Minneapolis, Portland, and San Francisco. Some retailers, like Boston’s The Fashion Truck, combine mobile shops with digital storefronts. Stacey Steffe, Co-Founder and President of the American Mobile Retail Association (americanmra.com), estimates that about 400 “parkable stores” (excluding food trucks) are currently operating in the U.S.

Conclusion: 'Shoppers don’t live by speed alone'

It’s hard to be emotional about a drone. Many who operate, and create, brick-and-mortar stores are betting that this principle may be the saving grace in their battle for retail market share. Convenience is important, but shoppers don’t live by speed alone.

“Designers and retailers must explore ways to implement change—to stay fresh in front of the customer and maintain momentum in a rapidly changing world,” concludes Little’s Farnell. “People have a deep need to find meaning and connect emotionally to the world around them. Especially now, how can the shopping experience be enriched with meaning and connect emotionally with customers?”

Retailers’ attempts to answer this weighty question—with an assist from forward-thinking Building Teams—will be coming soon to a mall, storefront, pop-up, or retail truck near you.

Near-term retail trends market and sector analysis

EXPANDING SECTORS

Fitness/health/spa

Drugstores

Thrift stores

Grocery (smaller/niche formats)

Fast-food and “fast casual”

Automotive

Discounters and dollar stores

Off-price apparel

Pet supplies

Sporting goods

Wireless stores

Banks

SHRINKING SECTORS

Bookstores

Video stores

DIY home stores

Mid-priced apparel

Mid-priced grocery stores (especially unionized)

Office supplies

Stationery/gift shops

Shipping/postal stores

Casual dining (older concepts)

STRONGEST POTENTIAL GROWTH MARKETS (based on population change in the next three years)

Atlanta

Charlotte

Dallas

Houston

Las Vegas

Orlando/Palm Beach/Fort Lauderdale

Phoenix

ADDITIONAL FAVORABLE GROWTH MARKETS

Boston

Chicago

Washington, D.C.

Los Angeles

Miami

New York

San Diego

San Francisco

Seattle

Tampa

Sources: Cassidy Turley 2014 Retail Forecast (sectors, http://bit.ly/1eGTuFY) and Jones Lang LaSalle Retail Forecast United States 2014 (regions, http://bit.ly/1b0CfLg)

Related Stories

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

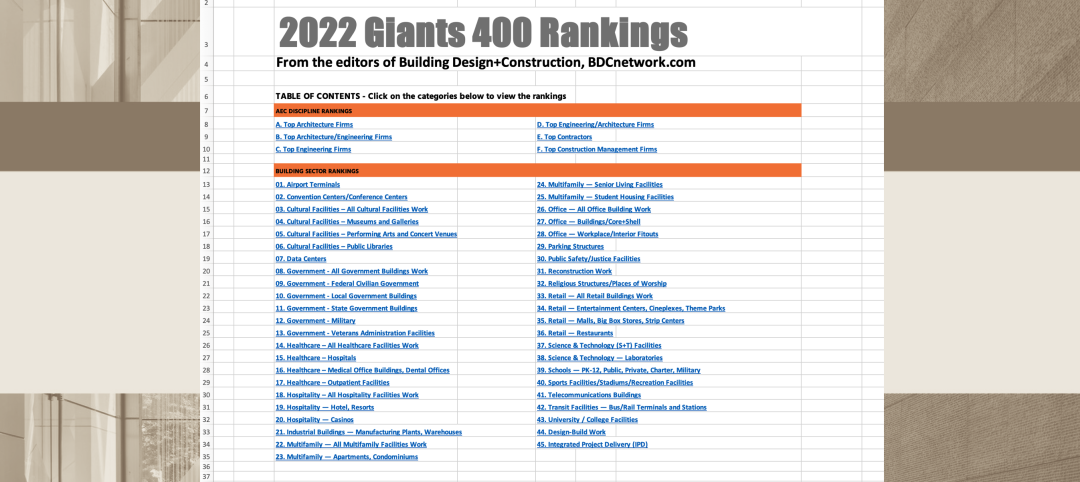

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

University Buildings | Feb 8, 2023

STEM-focused Kettering University opens Stantec-designed Learning Commons

In Flint, Mich., Kettering University opened its new $63 million Learning Commons, designed by Stantec. The new facility will support collaboration, ideation, and digital technology for the STEM-focused higher learning institution.

Sustainability | Feb 8, 2023

A wind energy system—without the blades—can be placed on commercial building rooftops

Aeromine Technologies’ bladeless system captures and amplifies a building’s airflow like airfoils on a race car.

Codes and Standards | Feb 8, 2023

GSA releases draft of federal low embodied carbon material standards

The General Services Administration recently released a document that outlines standards for low embodied carbon materials and products to be used on federal construction projects.

University Buildings | Feb 7, 2023

Kansas City University's Center for Medical Education Innovation can adapt to changes in medical curriculum

The Center for Medical Education Innovation (CMEI) at Kansas City University was designed to adapt to changes in medical curriculum and pedagogy. The project program supported the mission of training leaders in osteopathic medicine with a state-of-the-art facility that leverages active-learning and simulation-based training.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Giants 400 | Feb 6, 2023

2022 Reconstruction Sector Giants: Top architecture, engineering, and construction firms in the U.S. building reconstruction and renovation sector

Gensler, Stantec, IPS, Alfa Tech, STO Building Group, and Turner Construction top BD+C's rankings of the nation's largest reconstruction sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Transit Facility Giants: Top architecture, engineering, and construction firms in the U.S. transit facility sector

Walsh Group, Skanska USA, HDR, Perkins and Will, and AECOM top BD+C's rankings of the nation's largest transit facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.

Giants 400 | Feb 6, 2023

2022 Telecommunications Facility Sector Giants: Top architecture, engineering, and construction firms in the U.S. telecommunications facility sector

AECOM, Alfa Tech, Kraus-Anderson, and Stantec head BD+C's rankings of the nation's largest telecommunications facility sector architecture, engineering, and construction firms, as reported in the 2022 Giants 400 Report.