According to Associated Builders and Contractors (ABC), the Construction Backlog Indicator (CBI) for the fourth quarter of 2014 declined 0.1 months, or 1%. Despite the quarter-over-quarter decline, backlog ended the year at 8.7 months, which is still 4.4% higher than one year ago.

"Inconsistent growth in the volume of public work continues to suppress the pace of nonresidential construction; however, private construction momentum continues to build," said ABC Chief Economist Anirban Basu. "With hotel occupancy rising, office vacancy falling and demand for data climbing exponentially, a number of key private segments are positioned for rapid growth in construction spending this year.

"There are a number of factors that are likely to be beneficial to nonresidential contractors in 2015," said Basu. "First, although interest rates were expected to rise after the Federal Reserve ended its third round of quantitative easing, they have actually been trending lower—due to factors such as falling interest rates abroad and a strengthening U.S. dollar—which helps contractors with construction volume and borrowing costs. Second, materials prices have continued to fall—particularly inputs related to the price of oil, iron ore and copper. This also makes it more likely that construction projects will move forward and helps boost profit margins."

Regional Highlights

• Average backlog in the South is back above 9 months for the first time since the first quarter of 2014.

• Though backlog in the West fell sharply during 2014's final quarter, average backlog remains comparable to where it was a year ago.

• Both the Northeast and the Middle States registered levels of average backlog unseen during the history of the CBI survey.

Industry Highlights

• Average backlog in the commercial and institutional category is virtually unchanged over the past year, suggesting the pace of recovery will remain moderate overall.

• Infrastructure-related spending is likely to be brisk going forward primarily due to improved state and local government fiscal conditions.

• Heavy industrial average backlog remains in the vicinity of multi-year highs, but these readings do not fully reflect the impact of a stronger U.S. dollar, which may result in a slowdown in export growth and an associated softening in industrial investment.

Highlights by Company Size

• During the fourth quarter, backlog expanded for mid-sized companies with annual revenue ranging between $30 million-$100 million. These firms enjoyed approximately half a month expansion in their respective average backlogs during the fourth quarter.

• On the other hand, backlog for small firms (annual revenue less than $30 million) and very large firms (annual revenue greater than $100 million) declined 0.2 months and 0.5 months, respectively.

• Large firms appear to have been impacted by a slowdown in large project infrastructure spending in certain parts of the country, while smaller firms have been impacted by greater observed difficulty in obtaining bonding for projects in the context of accelerating small firm failure.

• Average backlog has increased by nearly three months or by more than three months for all firm size categories since the fourth quarter of 2009.

Related Stories

Contractors | Jun 26, 2019

Katerra launches apprenticeship program to help develop the future of construction

The program offers nationally recognized, portable construction trade credentials.

Building Tech | Jun 26, 2019

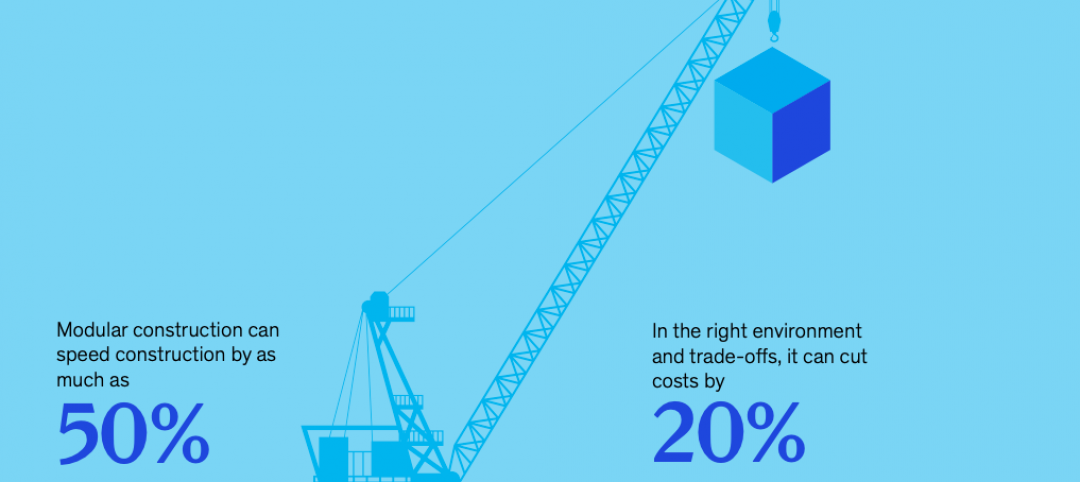

Modular construction can deliver projects 50% faster

Modular construction can deliver projects 20% to 50% faster than traditional methods and drastically reshape how buildings are delivered, according to a new report from McKinsey & Co.

Contractors | Jun 15, 2019

Turner tops off new classroom space at Middle Tennessee State University

The building includes a “command center” for training students to interact with emergency personnel.

Contractors | May 24, 2019

Two versions of a hard hat for the future are ready for production

Clayco worked with a Georgia college to design a hard hat with greater comfort and adaptability.

Contractors | May 20, 2019

SoCal’s oldest GC bounds into second century

C.W. Driver succeeds by sticking to core markets and practices.

Codes and Standards | Apr 25, 2019

Report: Contractors invest $1.6 billion in workforce development annually

ABC members increased training spending 45% from 2013, according to a new report.

Resiliency | Apr 22, 2019

Turner Construction doubles down on jobsite efficiency

The company targets a 50% cut in greenhouse gas emissions and water use from construction activities by 2030.

Building Tech | Apr 19, 2019

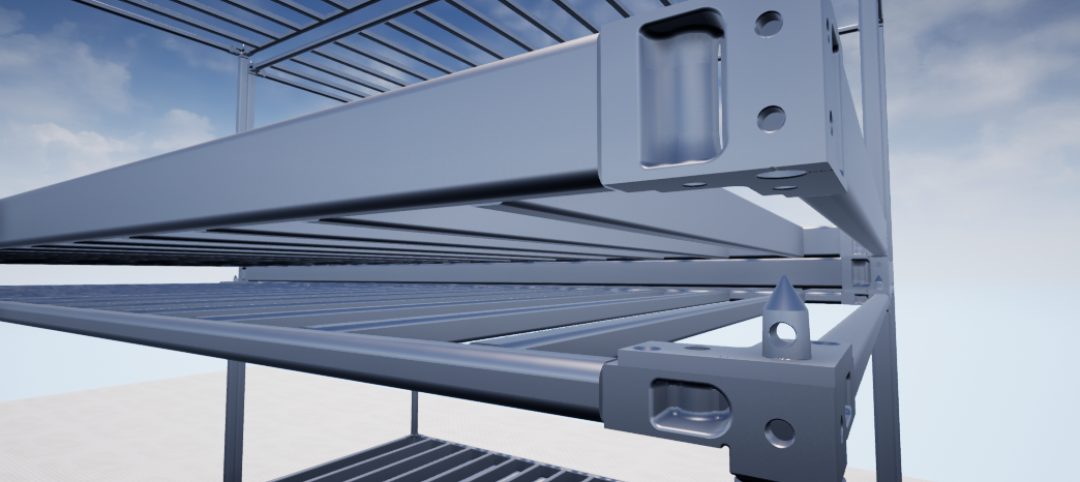

Skender, Z Modular reach agreement to fabricate multifamily housing components

Factory to open soon on the southwest side of Chicago.

Contractors | Apr 15, 2019

Do you have a fear of getting 'Uber'd'? Join the club

Exacerbating the AEC talent shortage is the coming mass exodus of baby boomers as they reach retirement age.

Contractors | Apr 15, 2019

Suffolk launches Smart Lab in Los Angeles

The lab will identify, test, and scale new technologies to help advance the construction industry.