According to Associated Builders and Contractors (ABC), the Construction Backlog Indicator (CBI) for the fourth quarter of 2014 declined 0.1 months, or 1%. Despite the quarter-over-quarter decline, backlog ended the year at 8.7 months, which is still 4.4% higher than one year ago.

"Inconsistent growth in the volume of public work continues to suppress the pace of nonresidential construction; however, private construction momentum continues to build," said ABC Chief Economist Anirban Basu. "With hotel occupancy rising, office vacancy falling and demand for data climbing exponentially, a number of key private segments are positioned for rapid growth in construction spending this year.

"There are a number of factors that are likely to be beneficial to nonresidential contractors in 2015," said Basu. "First, although interest rates were expected to rise after the Federal Reserve ended its third round of quantitative easing, they have actually been trending lower—due to factors such as falling interest rates abroad and a strengthening U.S. dollar—which helps contractors with construction volume and borrowing costs. Second, materials prices have continued to fall—particularly inputs related to the price of oil, iron ore and copper. This also makes it more likely that construction projects will move forward and helps boost profit margins."

Regional Highlights

• Average backlog in the South is back above 9 months for the first time since the first quarter of 2014.

• Though backlog in the West fell sharply during 2014's final quarter, average backlog remains comparable to where it was a year ago.

• Both the Northeast and the Middle States registered levels of average backlog unseen during the history of the CBI survey.

Industry Highlights

• Average backlog in the commercial and institutional category is virtually unchanged over the past year, suggesting the pace of recovery will remain moderate overall.

• Infrastructure-related spending is likely to be brisk going forward primarily due to improved state and local government fiscal conditions.

• Heavy industrial average backlog remains in the vicinity of multi-year highs, but these readings do not fully reflect the impact of a stronger U.S. dollar, which may result in a slowdown in export growth and an associated softening in industrial investment.

Highlights by Company Size

• During the fourth quarter, backlog expanded for mid-sized companies with annual revenue ranging between $30 million-$100 million. These firms enjoyed approximately half a month expansion in their respective average backlogs during the fourth quarter.

• On the other hand, backlog for small firms (annual revenue less than $30 million) and very large firms (annual revenue greater than $100 million) declined 0.2 months and 0.5 months, respectively.

• Large firms appear to have been impacted by a slowdown in large project infrastructure spending in certain parts of the country, while smaller firms have been impacted by greater observed difficulty in obtaining bonding for projects in the context of accelerating small firm failure.

• Average backlog has increased by nearly three months or by more than three months for all firm size categories since the fourth quarter of 2009.

Related Stories

| May 1, 2013

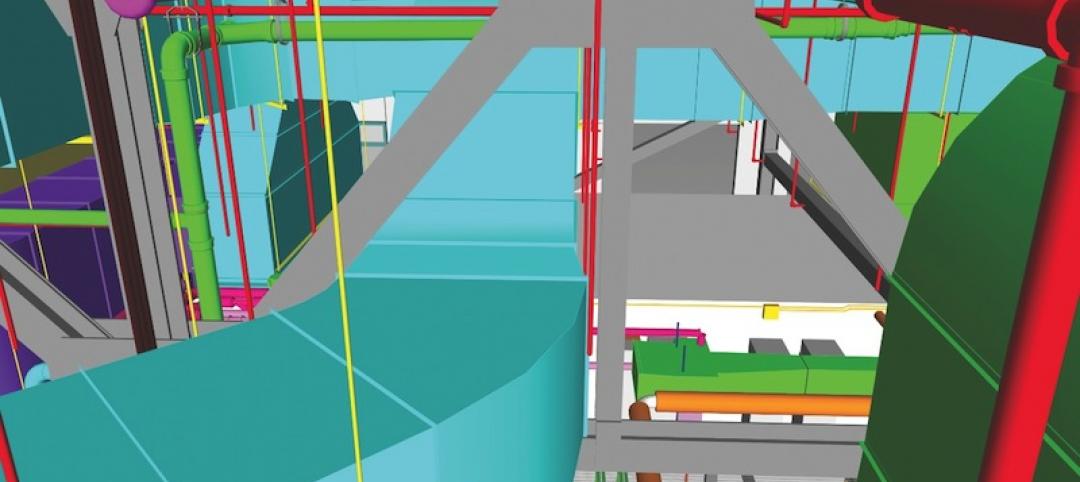

World’s tallest children’s hospital pushes BIM to the extreme

The Building Team for the 23-story Lurie Children’s Hospital in Chicago implements an integrated BIM/VDC workflow to execute a complex vertical program.

| Apr 30, 2013

Healthcare lighting innovation: Overhead fixture uses UV to kill airborne pathogens

Designed specifically for hospitals, nursing homes, child care centers, and other healthcare facilities where infection control is a concern, the Arcalux Health Risk Management System (HRMS) is an energy-efficient lighting fixture that doubles as a germ-killing machine.

| Apr 30, 2013

First look: North America's tallest wooden building

The Wood Innovation Design Center (WIDC), Prince George, British Columbia, will exhibit wood as a sustainable building material widely availablearound the globe, and aims to improve the local lumber economy while standing as a testament to new construction possibilities.

| Apr 26, 2013

Apple scales back Campus 2 plans to reduce price tag

Apple will delay the construction of a secondary research and development building on its "spaceship" campus in an attempt to drive down the cost of developing its new headquarters.

| Apr 26, 2013

Solving the parking dilemma in U.S. cities

ArchDaily's Rory Stott yesterday posted an interesting exploration of progressive parking strategies being employed by cities and designers. The lack of curbside and lot parking exacerbates traffic congestion, discourages visitors, and leads to increased vehicles emissions.

| Apr 26, 2013

Decaying city: Exhibit demonstrates the fragility of the man-made world

Theater set designer Johanna Mårtensson built a model cityscape out of bread only to watch it decay.

| Apr 25, 2013

Colorado State University, DLR Group team to study 12 high-performance schools

DLR Group and the Institute for the Built Environment at Colorado State University have collaborated on a research project to evaluate the effect of green school design on occupants and long-term building performance.

| Apr 24, 2013

More positive momentum for Architecture Billings Index

All regions and building sectors continue to report positive business conditions

| Apr 24, 2013

North Carolina bill would ban green rating systems that put state lumber industry at disadvantage

North Carolina lawmakers have introduced state legislation that would restrict the use of national green building rating programs, including LEED, on public projects.

| Apr 24, 2013

Los Angeles may add cool roofs to its building code

Los Angeles Mayor Antonio Villaraigosa wants cool roofs added to the city’s building code. He is also asking the Department of Water and Power (LADWP) to create incentives that make it financially attractive for homeowners to install cool roofs.