Through the first five months of 2015, nonresidential construction spending is having its second best year since the Census Bureau began tracking the metric in 2002.

According to the July 1 release, nonresidential construction spending increased 1.1% on a month-over-month basis and 8.1% on a year-over-year basis, and totals $669.6 billion on a seasonally adjusted, annualized basis. From January to May, nonresidential spending expanded by 7.1%; the only year in which the segment saw faster growth was 2007. Since then, growth over each year's initial five months has averaged only 1.8%.

Perhaps the most notable aspect of May's release was the extensive upward revisions to three of the previous four months' data. January, February and April saw their nonresidential construction spending estimates revised upward by 2%, 1.4% and 2.4%, respectively. The Census Bureau also increased the estimate for May 2014 by 1.4%.

"Though there continues to be discontent regarding performance of the U.S. economy, the current situation should be viewed positively," said Associated Builders and Contractors Chief Economist Anirban Basu. "The U.S. economy has now entered the mid-cycle portion of its recovery, which often represents a period of sustained progress for the average nonresidential construction firm. As with prior months, the industry progress continues to be led by the private sector. Among private segments, manufacturing-related construction was at the frontline of construction spending growth in May."

"Moderate economic growth will allow interest rates to rise gradually, helping extend this mid-cycle," said Basu. "Although it took several years to get to this point of the recovery, contractors will find themselves steadily becoming busier, with margins gradually expanding. The principle obstacle to progress will be skilled labor shortages, which eventually will translate into faster inflation, rising interest rates and the move into the final stage of the current economic expansion."

Nine of 16 nonresidential construction sectors experienced spending increases in May:

· Manufacturing-related construction spending expanded 6.2% in May and is up by 69.5% for the year.

· Office-related construction spending expanded 1.6% in May and is up 24.6% compared to the same time one year ago.

· Lodging-related construction spending was up 3.2% on a monthly basis and 30.6% on a year-over-year basis.

· Lodging-related construction spending was up 5.5% on a monthly basis and 17.6% on a year-over-year basis.

· Spending in the water supply category expanded 0.9% from April, but is down 6.8% on an annual basis.

· Religious spending gained 1.4% for the month and is up 9.2% from the same time last year.

· Highway and street-related construction spending expanded 2.2% in May and is up 2.1% compared to the same time last year.

· Conservation and development-related construction spending grew 8.6% for the month and is up 27.3% on a yearly basis.

· Amusement and recreation-related construction spending gained 5.8% on a monthly basis and is up 29.8% from the same time last year.

· Communication-related construction spending gained 3.3% for the month and is up 15.7% for the year.

Spending in seven nonresidential construction subsectors fell in May:

· Education-related construction spending fell 0.8% for the month, but is up 1.8% on a year-over-year basis.

· Power-related construction spending remained flat for the month, but is 23.5% lower than the same time one year ago.

· Sewage and waste disposal-related construction spending fell 2.2% for the month, but has grown 13.3% on a 12-month basis.

· Public safety-related construction spending fell 7.9% on a monthly basis and is down 11.8% on a year-over-year basis.

· Commercial construction spending fell 1.7% in March, but is up 11.4% on a year-over-year basis.

· Health care-related construction spending fell 0.6% for the month, but is up 3.1% compared to the same time last year.

· Construction spending in the transportation category fell 0.9% on a monthly basis, but has expanded 5.4% on an annual basis.

Related Stories

Giants 400 | Nov 14, 2022

4 emerging trends from BD+C's 2022 Giants 400 Report

Regenerative design, cognitive health, and jobsite robotics highlight the top trends from the 519 design and construction firms that participated in BD+C's 2022 Giants 400 Report.

Contractors | Nov 14, 2022

U.S. construction firms lean on technology to manage growth and weather the pandemic

In 2021, Gilbane Building Company and Nextera Robotics partnered in a joint venture to develop an artificial intelligence platform utilizing a fleet of autonomous mobile robots. The platform, dubbed Didge, is designed to automate construction management, maximize reliability and safety, and minimize operational costs. This was just one of myriad examples over the past 18 months of contractor giants turning to construction technology (ConTech) to gather jobsite data, manage workers and equipment, and smooth the construction process.

University Buildings | Nov 13, 2022

University of Washington opens mass timber business school building

Founders Hall at the University of Washington Foster School of Business, the first mass timber building at Seattle campus of Univ. of Washington, was recently completed. The 84,800-sf building creates a new hub for community, entrepreneurship, and innovation, according the project’s design architect LMN Architects.

Giants 400 | Nov 9, 2022

Top 50 Data Center Contractors + CM Firms for 2022

Holder, Turner, DPR, and HITT Contracting head the ranking of the nation's largest data center contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 8, 2022

Top 110 Sports Facility Architecture and AE Firms for 2022

Populous, HOK, Gensler, and Perkins and Will top the ranking of the nation's largest sports facility architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 8, 2022

Top 60 Sports Facility Contractors and CM Firms for 2022

AECOM, Mortenson, Clark Group, and Turner Construction top the ranking of the nation's largest sports facility contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Industry Research | Nov 8, 2022

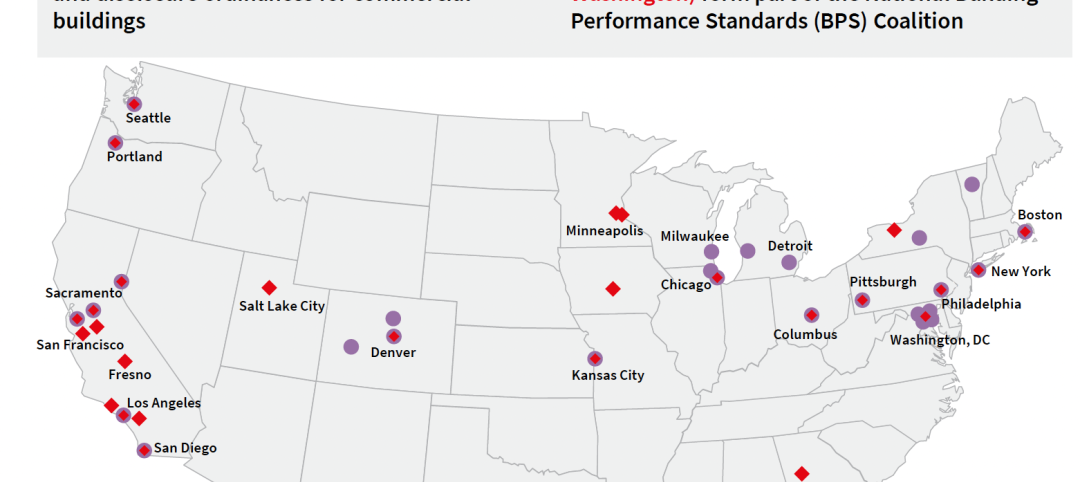

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Hotel Facilities | Nov 8, 2022

6 hotel design trends for 2022-2023

Personalization of the hotel guest experience shapes new construction and renovation, say architects and construction experts in this sector.

Green | Nov 8, 2022

USGBC and IWBI will develop dual certification pathways for LEED and WELL

The U.S. Green Building Council (USGBC) and the International WELL Building Institute (IWBI) will expand their strategic partnership to develop dual certification pathways for LEED and WELL.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).