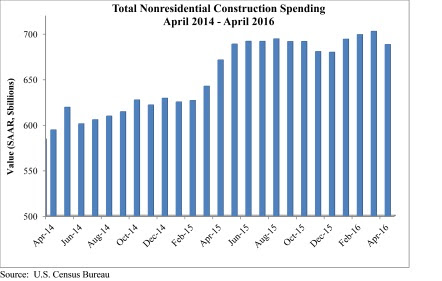

Nonresidential construction spending fell 2.1% in April according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Nonresidential spending totaled $688.2 billion on a seasonally adjusted, annualized rate.

Much like last month, the sting of a disappointing headline number was mitigated by upward revisions to the previous two months of data. March's estimate was revised from $695.7 billion to $702.6 billion, while February's estimate saw a 0.1% increase. March represents the first month in which spending exceeded $700 billion since March 2009.

"Nonresidential construction spending growth continues to struggle to maintain momentum," said ABC Chief Economist Anirban Basu. "The amount of nonresidential construction value put in place has expanded by just 2.5% over the past year, with private spending up 3.4% and public spending up just 1.4%. While many will primarily attribute this to a sluggish U.S. economy, one that has expanded by less than 1.5% during each of the last two completed calendar quarters, there are other factors at work.

"Lower materials prices are embodied in the value of completed work," said Basu. "Though commodity prices have been firming recently, commodity prices had been in decline for more than a year. Moreover, in some communities, nonresidential construction is facing severe constraints given an insufficient number of qualified workers. Both factors would tend to constrain the level of observed growth in nonresidential construction spending.

"There may also be growing skittishness among private developers, who have become increasingly concerned by possible overbuilding in commercial, office and lodging markets," warned Basu. "Both lodging and commercial construction spending dipped in April. This hesitancy is reflected in many ways, including in the Architectural Billings Index, which has struggled to consistently stand meaningfully above its threshold value of 50. Public spending also remains lackluster as many states deal with underfunded pensions and ballooning Medicaid costs."

Only five of 16 nonresidential construction sectors experienced spending increases in April on a monthly basis:

- Religious-related spending expanded 9.6% from March 2016 and 7.3% from April 2015.

- Spending in the public safety category grew 5.2% on a monthly basis but fell 6.2% on a yearly basis.

- Office-related spending expanded 1.6% for the month and 20.3% for the year.

- Amusement and recreation-related spending expanded 0.8% month-over-month and 8.3% year-over-year.

- Spending in the power category rose by 0.3% for the month and 0.6% from April 2015.

Spending in 11 of the nonresidential construction subsectors fell in April on a monthly basis:

- Spending in the communication category fell 7.7% from March 2016 and is down 16.4% from April 2015.

- Highway and street-related spending fell 6.5% on a monthly basis but is up 4% on a yearly basis.

- Commercial-related spending dipped 3.7% for the month but is up 6.8% from April 2015.

- Spending in the health care category fell 3% from March 2016 and is down 0.6% from the same month one year ago.

- Educational-related spending dropped 2.4% month-over-month but is up 5.4% year-over-year.

- Spending in the lodging category fell 2% on a monthly basis but is up 24.6% on a yearly basis.

- Transportation-related spending fell 1.7% since March 2016 and is down 1% from April 2015.

- Sewage and waste disposal-related spending fell 1.4% for the month but is up 1% from April 2015.

- Manufacturing-related spending fell 1.4% month-over-month and 9.8% year-over-year.

- Spending in the conservation and development category dipped 1.2% for the month and 6.5% year-over-year.

- Water supply-related spending fell 0.5% on a monthly basis and 6.5% on a yearly basis.

Related Stories

| Sep 13, 2022

Orange County opens civic center complex—one of California’s largest P3 projects

Orange County’s recently opened County Administration North (CAN) building caps an urban center development that constitutes one of California’s largest ever P3 projects.

Laboratories | Sep 12, 2022

Lab space scarcity propels construction demand in life sciences sector

In its 2021 Life Sciences Real Estate Outlook, JLL predicted that access to talent would be a primary concern for an industry sector that had been growing by leaps and bounds. A year later, talent still guides real estate decisions. But market conditions of a different sort were cooling the biotech field: namely, investors that have soured on startups which underperformed after going public. What this means for new construction and renovation going forward is unpredictable, as the drivers behind life sciences’ surge are still palpable.

| Sep 12, 2022

Staff at New York City architecture firm is first in U.S. to unionize

Staff at New York City architecture firm is first in U.S. to unionize.

| Sep 12, 2022

San Antonio’s new courthouse aims to provide safety and security while also welcoming the public

The San Antonio Federal Courthouse, which opened earlier this year, replaces a courthouse that had been constructed as a pavilion for the 1968 World’s Fair.

Giants 400 | Sep 9, 2022

Top 25 Casino Contractors + CM Firms for 2022

The Yates Companies, W.E. O'Neil Construction, Alberici-Flintco, and PCL Construction Enterprises top the ranking of the nation's largest casino contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Sep 9, 2022

Top 90 Hospitality Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and The Yates Companies top the ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 9, 2022

Top 80 Hotel Sector Contractors + CM Firms for 2022

AECOM, Suffolk Construction, STO Building Group, and Swinerton top the ranking of the nation's largest hotel and resort sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

| Sep 9, 2022

Add sand shortage to supply chain woes

As if it wasn’t enough to have lumber, windows, doors, and metal pipe in short supply, you can add sand, which is theoretically plentiful on Earth, to the list of construction materials that can be hard to come by.

Senior Living Design | Sep 8, 2022

What’s new with AQ: The top trends in active adult living

Today's 55-or-better buyers are ready to design their lives and their homes as they see fit. With so much growth on tap, builders and developers must stay apprised of trends related to home, environment, and culture of 55+ communities.

| Sep 8, 2022

The Twin Cities’ LGBTQ health clinic moves into a new and improved facility

For more than 50 years, Family Tree Clinic has provided reproductive and sexual health services to underserved populations—from part of an old schoolhouse, until recently.