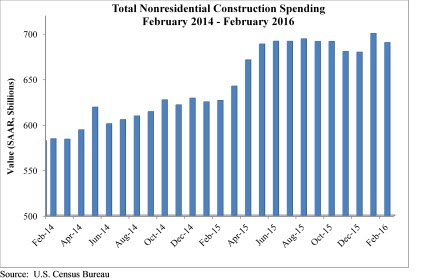

Nonresidential construction spending dipped in February, falling 1.4% on a monthly basis according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC).

Spending in the nonresidential sector totaled $690.3 billion on a seasonally adjusted, annualized basis in February. While this represents a step back from January's figure of $700.3 billion (revised down from $701.9 billion), it is still 1.5% higher than the level of spending registered in December 2015 and 10.1% higher than February 2015.

"February's weather was particularly harsh in certain parts of the country, including in the economic activity-rich Mid-Atlantic region, and that appears to have had an undue effect on construction spending data," ABC Chief Economist Anirban Basu said. "February data are always difficult to interpret, and the latest nonresidential construction spending figures are no different. Seasonal factors have also made state-level data very difficult to interpret.

"Beyond meteorological considerations, there are other reasons not to be alarmed by February's decline in nonresidential construction spending," Basu said. "Today's positive construction employment report indicates continued economic growth. Moreover, much of the decline in volume was attributable to manufacturing, but the ISM manufacturing index recently crossed the threshold 50 level, indicating that domestic manufacturing is now expanding for the first time in seven months."

Eight of the 16 nonresidential subsectors experienced spending decreases in February, though almost half of the total decline in spending is attributable to the 5.9% decline in manufacturing-related spending.

The following 16 nonresidential construction sectors experienced spending increases in February on a monthly basis:

- Spending in the amusement and recreation category climbed 0.4% from January and is up 13.7% from February 2015.

- Lodging-related spending is up 0.4% for the month and is up 30.1% on a year-ago basis.

- Water supply-related spending expanded 1.9% on a monthly basis and 3.2% on a yearly basis.

- Spending in the office category grew 3.8% from January and is up 25.3% on a year-ago basis.

- Transportation-related spending expanded 0.5% month-over-month and 5.8% year-over-year.

- Health care-related spending expanded 2% from January and is up 3.3% from February 2015.

- Public safety-related spending is up 1.8% for the month, but is down 5.3% for the year.

- Commercial-related construction spending inched 0.1% higher for the month and grew 11% for the year.

Spending in eight of the nonresidential construction subsectors fell in February on a monthly basis:

- Educational-related construction spending fell 2.4% from January, but has expanded 8.5% on a yearly basis.

- Communication-related spending fell 15% month-over-month, but expanded 11.8% year-over-year.

- Spending in the highway and street category fell 2% from January, but is 24.5 higher than one year ago.

- Sewage and waste disposal-related spending fell 2.4% for the month, but is up 2.3% for the year.

- Conservation and development-related spending is 4.6% lower on a monthly basis and 16.8% lower on a year-over-year basis.

- Spending in the religious category fell 4% for the month and is up just 0.7% for the year.

- Manufacturing-related spending fell 5.9% on a monthly basis and is up only 0.8% on a yearly basis.

- Spending in the power category fell 0.6% from January, but is 4.8% higher than one year ago.

Related Stories

M/E/P Systems | Oct 30, 2024

After residential success, DOE will test heat pumps for cold climates in commercial sector

All eight manufacturers in the U.S. Department of Energy’s Residential Cold Climate Heat Pump Challenge completed rigorous product field testing to demonstrate energy efficiency and improved performance in cold weather.

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

Resiliency | Oct 29, 2024

Climate change degrades buildings slowly but steadily

While natural disasters such as hurricanes and wildfires can destroy buildings in minutes, other factors exacerbated by climate change degrade buildings more slowly but still cause costly damage.

Hotel Facilities | Oct 29, 2024

Hotel construction pipeline surpasses 6,200 projects at Q3 2024

According to the U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics, the total hotel pipeline stands at 6,211 projects/722,821 rooms, a new all-time high for projects in the U.S.

Office Buildings | Oct 29, 2024

Editorial call for Office Building project case studies

BD+C editors are looking to feature a roundup of office building projects for 2024, including office-to-residential conversions. Deadline for submission: December 6, 2024.

Healthcare Facilities | Oct 28, 2024

New surgical tower is largest addition to UNC Health campus in Chapel Hill

Construction on UNC Health’s North Carolina Surgical Hospital, the largest addition to the Chapel Hill campus since it was built in 1952, was recently completed. The seven-story, 375,000-sf structure houses 26 operating rooms, four of which are hybrid size to accommodate additional equipment and technology for newly developed procedures.

Contractors | Oct 25, 2024

Construction industry CEOs kick off effort to prevent suicide among workers

A new construction industry CEO Advisory Council dedicated to addressing the issue of suicide in the construction industry recently took shape. The council will guide an industry-wide effort to develop solutions targeting the high rate of suicide among construction workers.

Sports and Recreational Facilities | Oct 24, 2024

Stadium renovation plans unveiled for Boston’s National Women’s Soccer League

A city-owned 75-year-old stadium in Boston’s historic Franklin Park will be renovated for a new National Women’s Soccer League team. The park, designed by Fredrick Law Olmsted in the 1880s, is the home of White Stadium, which was built in 1949 and has since fallen into disrepair.

Laboratories | Oct 23, 2024

From sterile to stimulating: The rise of community-centric life sciences campuses

To distinguish their life sciences campuses, developers are partnering with architectural and design firms to reimagine life sciences facilities as vibrant, welcoming destinations. By emphasizing four key elements—wellness, collaboration, biophilic design, and community integration—they are setting their properties apart.

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.