Government work is scattered among dozens of federal civilian agencies, the Pentagon and the military branches, the 50 states, and tens of thousands of municipalities. The only thing these disparate entities have in common is a tight hold on their pocketbooks. With the federal stimulus having faded into the ether, and with state and municipal collections of sales and property taxes down, government construction at all levels will be slow to recover.“We’ll be lucky to see 2007 numbers by 2017,” says Margaret Bowker, Vice President, JE Dunn Construction.

Inside the Beltway, the GSA, the National Institutes of Health, the Naval Facilities Engineering Command, and the U.S. Army Corps of Engineers are still posting RFPs, but there’s a sense that “spending has been put on hold to wait and see the outcome of the election,” says Barry Perkins, LEED AP BD+C, Vice President – Government Construction, James G. Davis Construction Corp.“Certainly the size and type of projects has changed, with more smaller renovations and retrofits than larger new construction,” he says.

SCROLL DOWN FOR GIANTS 300 GOVERNMENT FIRM RANKINGS

“We’re showing up to prebids and competing against firms that never used to pursue city or county work,” says Dennis Thompson, Executive Vice President for Business Development, Manhattan Construction Co. “Competition has increased five- or six-fold, so you see an erosion of fees.”

The result: “You have the same firms chasing a smaller pool of projects,” says Len Vetrone, Webcor Builders’ Senior Vice President for Public and Federal Work.

MAKING THE ADJUSTMENT TO GOVERNMENT WORK

For newbies to federal work, learning how to work with the bureaucracy can be an eye-opener. When the economy went into the tank in 2008, Pepper Construction Group took on its first two GSA projects—the renovation of the Mies van der Rohe-designed John C. Kluczynski Federal Building, in Chicago, and the John Weld Peck Federal Building, in Cincinnati.

“There’s just an enormous amount of paperwork, forms, and protocols that are required on government jobs compared to our private work,” says Senior Vice President Rich Tilghman, PE. “We have high-quality teams with lots of experience renovating large buildings in the private sector, and GSA recognized that,” he says, adding that the $100 million in revenue for the two projects was certainly welcome.

Even firms with decades of federal civilian and military experience have to keep constantly attuned to client needs. Reynolds Smith & Hills has been designing and maintaining facilities for NASA for 50 years. Recently, the firm replaced almost 10,000 square feet of windows in the Launch Control Center at the Kennedy Space Center, a highly sensitive project. “NASA is a wonderful client, always looking for innovative solutions, but you have to create a low-risk environment for them,” says RS&H Vice President Richard Hammett, AIA, LEED AP.

Public-private partnerships are “starting to catch on” at the state and local level, says Webcor Builders’ Vetrone. “We’re talking to some of the cities we work for in California which have major public projects with no funding, looking at how P3 could make those a reality,” he says. A recently awarded P3 for a courthouse in Long Beach has attracted a lot of interest from the local AEC community, he says.

Manhattan Construction’s Thompson says privatization seems to be gaining traction with some federal clients. His firm is serving as contracting partner in such a developer leaseback scheme for a VA clinic in Grand Rapids, Mich., with U.S. Federal Properties.

SOME BRIGHT SPOTS ON THE HORIZON

Even with budget cuts, there will still be public-sector jobs for AEC firms. For example, Webcor Builders’ Vetrone reports “a fair amount” of aviation projects in California. “The big work at LAX and Sacramento has been awarded, but SFO still has a fairly aggressive program,” he says.

Manhattan Construction’s Thompson says some state and local government agencies may be rethinking their procurement policies because “service and delivery quality have been affected” by their reliance on super-low bidders. “The trend is back to technical qualifications plus low price, but at least it’s not just low price,” he says.

Vetrone says Webcor Builders is being “pretty selective” as to which government projects it bids on. “We’re looking for clients who want to hire on a best-value basis, whether design-build or CM at risk, where your qualifications, technical competence, and people count as much as your price,” he says.

More commissioning of government and military buildings could also be a godsend for AEC firms. “We’ve done enhanced commissioning for the Air Force, and we’re finding that the buildings have a marked increase in performance,” says RS&H’s Hammett. “If anything was a no-brainer, commissioning would be it.”

Portfolio optimization is becoming much more important to governments at all levels, as they seek to reduce overhead while improving employee productivity. “They’re looking for a trifecta—asset preservation, sustainability, and innovative workplace solutions,” says Becky Greco, Principal, HGA Architects and Engineers. Public-sector clients want to emulate the corporate model of “better, faster, more cost-efficient,” she says.

Lisa Bottom, a Principal at Gensler, agrees. “Government workplaces are moving away from a hierarchical structure and embracing an open plan” based on actual space usage and employee mobility patterns, she says. The goal: flexible offices that will meet current and future needs of the workforce at all levels of government. +

TOP 25 GOVERNMENT SECTOR ARCHITECTURE FIRMS

| Rank | Company | 2011 Government Revenue ($) |

| 1 | HOK | 143,334,571 |

| 2 | Heery International | 103,832,000 |

| 3 | SmithGroupJJR | 77,652,837 |

| 4 | IBI Group | 57,347,163 |

| 5 | Perkins+Will | 48,059,661 |

| 6 | HDR Architecture | 46,000,000 |

| 7 | EYP Architecture & Engineering | 40,892,580 |

| 8 | Skidmore, Owings & Merrill | 33,907,000 |

| 9 | HNTB Architecture | 31,338,712 |

| 10 | PageSoutherlandPage | 27,263,377 |

| 11 | NBBJ | 24,958,000 |

| 12 | LEO A DALY | 24,141,694 |

| 13 | Hammel, Green and Abrahamson | 24,028,000 |

| 14 | PGAL | 24,018,100 |

| 15 | Reynolds, Smith and Hills | 18,900,000 |

| 16 | ZGF Architects | 17,653,791 |

| 17 | RTKL Associates | 17,075,180 |

| 18 | DLR Group | 17,000,000 |

| 19 | Gensler | 17,000,000 |

| 20 | Moseley Architects | 13,700,000 |

| 21 | Beyer Blinder Belle Architects & Planners | 12,450,000 |

| 22 | Sasaki Associates | 12,356,441 |

| 23 | Cannon Design | 12,000,000 |

| 24 | KMD Architects | 11,913,372 |

| 25 | Fentress Architects | 11,830,262 |

TOP 25 GOVERNMENT SECTOR ENGINEERING FIRMS

| Rank | Company | 2011 Government Revenue ($) |

| 1 | AECOM Technology Corp. | 2,485,000,000 |

| 2 | Fluor Corp. | 1,127,862,000 |

| 3 | Jacobs | 924,100,000 |

| 4 | URS Corp. | 309,987,000 |

| 5 | STV | 133,396,000 |

| 6 | Stantec | 117,000,000 |

| 7 | Dewberry | 57,006,253 |

| 8 | Atkins North America | 43,330,846 |

| 9 | Parsons Brinckerhoff | 35,515,523 |

| 10 | H&A Architects & Engineers | 31,641,856 |

| 11 | Michael Baker Jr., Inc. | 30,830,000 |

| 12 | Science Applications International Corp. | 15,431,116 |

| 13 | Walter P Moore | 12,531,123 |

| 14 | Coffman Engineers | 12,400,000 |

| 15 | SSOE Group | 12,321,198 |

| 16 | WSP USA | 10,900,000 |

| 17 | Arup | 10,580,870 |

| 18 | TLC Engineering for Architecture | 8,528,328 |

| 19 | Sebesta Blomberg | 8,450,225 |

| 20 | Interface Engineering | 8,103,067 |

| 21 | Walker Parking Consultants | 7,887,763 |

| 22 | Simpson Gumpertz & Heger | 7,800,000 |

| 23 | KPFF Consulting Engineers | 7,000,000 |

| 24 | RMF Engineering | 7,000,000 |

| 25 | Wiss, Janney, Elstner Associates | 6,936,000 |

TOP 25 GOVERNMENT SECTOR CONSTRUCTION FIRMS

| Rank | Company | 2011 Government Revenue ($) |

| 1 | Turner Corporation, The | 2,268,320,925 |

| 2 | Jacobs | 924,100,000 |

| 3 | Clark Group | 850,491,577 |

| 4 | Whiting-Turner Contracting Co., The | 749,080,537 |

| 5 | Gilbane Building Co. | 736,199,000 |

| 6 | Hensel Phelps Construction | 669,080,000 |

| 7 | Walsh Group, The | 552,751,904 |

| 8 | Skanska USA | 550,758,448 |

| 9 | Webcor Builders | 484,567,966 |

| 10 | Tutor Perini | 385,311,000 |

| 11 | Balfour Beatty US | 341,774,742 |

| 12 | URS Corp. | 309,987,000 |

| 13 | Manhattan Construction Group | 274,683,334 |

| 14 | Alberici Corp. | 247,423,509 |

| 15 | PCL Construction Enterprises | 245,007,223 |

| 16 | Mortenson | 233,863,000 |

| 17 | Flintco | 223,200,000 |

| 18 | McCarthy Holdings | 218,000,000 |

| 19 | James G. Davis Construction | 208,000,000 |

| 20 | Yates Companies, The | 187,800,000 |

| 21 | Ryan Companies US | 156,858,437 |

| 22 | DPR Construction | 146,889,203 |

| 23 | JE Dunn Construction | 135,637,557 |

| 24 | Sundt Construction | 100,393,850 |

| 25 | CORE Construction | 94,340,532 |

Related Stories

Sustainability | Jan 9, 2023

Innovative solutions emerge to address New York’s new greenhouse gas law

New York City’s Local Law 97, an ambitious climate plan that includes fines for owners of large buildings that don’t significantly reduce carbon emissions, has spawned innovations to address the law’s provisions.

Fire and Life Safety | Jan 9, 2023

Why lithium-ion batteries pose fire safety concerns for buildings

Lithium-ion batteries have become the dominant technology in phones, laptops, scooters, electric bikes, electric vehicles, and large-scale battery energy storage facilities. Here’s what you need to know about the fire safety concerns they pose for building owners and occupants.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Performing Arts Centers | Dec 23, 2022

Diller Scofidio + Renfro's renovation of Dallas theater to be ‘faithful reinterpretation’ of Frank Lloyd Wright design

Diller Scofidio + Renfro recently presented plans to restore the Kalita Humphreys Theater at the Dallas Theater Center (DTC) in Dallas. Originally designed by Frank Lloyd Wright, this theater is the only freestanding theater in Wright’s body of work.

University Buildings | Dec 22, 2022

Loyola Marymount University completes a new home for its acclaimed School of Film and Television

California’s Loyola Marymount University (LMU) has completed two new buildings for arts and media education at its Westchester campus. Designed by Skidmore, Owings & Merrill (SOM), the Howard B. Fitzpatrick Pavilion is the new home of the undergraduate School of Film and Television, which is consistently ranked among the nation’s top 10 film schools. Also designed by SOM, the open-air Drollinger Family Stage is an outdoor lecture and performance space.

Adaptive Reuse | Dec 21, 2022

University of Pittsburgh reinvents century-old Model-T building as a life sciences research facility

After opening earlier this year, The Assembly recently achieved LEED Gold certification, aligning with the school’s and community’s larger sustainability efforts.

Multifamily Housing | Dec 20, 2022

Brooks + Scarpa-designed apartment provides affordable housing to young people aging out of support facilities

In Venice, Calif., the recently completed Rose Apartments provides affordable housing to young people who age out of youth facilities and often end up living on the street. Designed by Brooks + Scarpa, the four-story, 35-unit mixed-use apartment building will house transitional aged youths.

Coatings | Dec 20, 2022

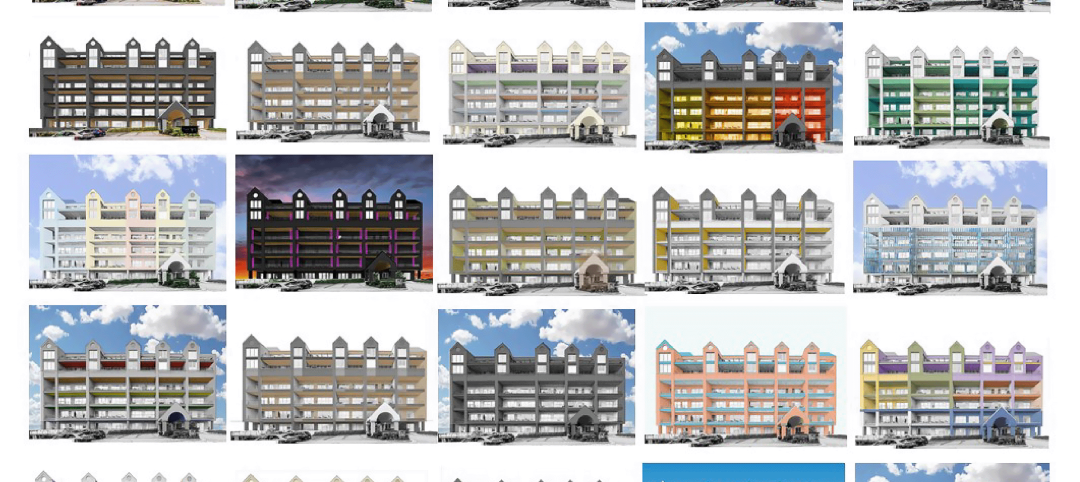

The Pier Condominiums — What's old is new again!

When word was out that the condominium association was planning to carry out a refresh of the Pier Condominiums on Fort Norfolk, Hanbury jumped at the chance to remake what had become a tired, faded project.

Cladding and Facade Systems | Dec 20, 2022

Acoustic design considerations at the building envelope

Acentech's Ben Markham identifies the primary concerns with acoustic performance at the building envelope and offers proven solutions for mitigating acoustic issues.