As ecommerce assumes a more dominant role in retailing, logistics and distribution centers in support of ecommerce warehousing and delivery are springing up across the country.

For example, Verst Logistics in June opened a nearly 400,000-sf ecommerce fulfillment center in Hebron, Ky., near the Greater Cincinnati Northern Kentucky International Airport. This DC will allow Verst to distribute products to about 85% of the continental U.S. within 48 hours, says Dean Hoerlin, Verst’s Vice President of Fulfillment and Distribution.

Capital Development Partners and Greenfield Partners broke ground last month on a 2.3-million-sf, $125 million logistics center located on 197 acres in Pooler, Ga., 10 miles from the Port of Savannah. The first of two buildings is set to open next April, and the two buildings will have transload capacities and be able to store more than 2,000 containers.

Also last month, construction began on the 401,577-sf Oakdale Logistics Center on 24 acres in the Dallas suburb of Grand Prairie, Texas, marking the third such development in the Dallas-Fort Worth metroplex between CT (a real estate investment firm) and the developer Port Logistics Realty.

“The primary focus of CT’s growth strategy is to develop, own and manage a portfolio of logistics projects in high demand Tier 1 markets nationwide,” says James Watson, managing partner with CT, which recently announced the development of 1.34 million sf of large-scale distribution buildings in greater Chicago.

CT also is developing logistics centers in northern California, Atlanta, and New Jersey, and its current property holdings could support the addition of 15 million sf of industrial buildings over the next five to seven years.

The Commerce Department estimates that last year consumers spent $453.5 billion for online purchases, a 16% increase over 2016. Some market watchers see ecommerce rising to nearly 14% of total retail sales by 2021, from around 10% this year.

These expanding online purchasing activities among consumers are propelling industrial construction, and presenting fertile opportunities for AEC firms in this sector.

This week, Prologis, which specializes in logistics real estate, announced its selection of Graycor Construction as GC for its I-17 Logistics Center-Phase 1, a Class A development on 25 infill acres in Phoenix that will consist of four buildings totaling 558,712 sf. This development will replace 20 outmoded buildings that were recently demolished. Completion of Phase 1 is scheduled for first quarter of 2019.

A rendering of the Prologis I-17 Logistics Center-Phase I, a 558,712-sf complex that will open in Phoenix in the fall of next year. Image: Prologis

Clayco provided construction services for the $300 million 856,000-sf Amazon Fulfillment Center in Kansas City, which opened last August and was assembled using tilt-up concrete panels and structural steel. This four-floor Center has 2.3 million sf of usable space, and employs more than 2,000 full-time workers.

Clayco has built other warehouses for Amazon in Indiana, Virginia, and New Jersey, and has an 850,000-sf facility under construction in Chicago.

Last August, Ryan Companies closed on a 25.9-acre site in Carlsbad, Calif., where it is building on spec the Pacific Vista Commercial Center, a three-building, 411,000-sf logistics/distribution center located within the Carlsbad Oaks North Business Park. Ware Malcomb provided design and architectural services. SB&O provided civil engineering and storm water design services.

Chris Wood, President of Ryan Companies’ West Region, tells BD+C that this complex should be completed by October. Ryan has already secured a 10-year lease agreement with the Center’s first tenant, the storage provider PODS, which will lease Building B. Wood says it is likely that the entire complex will be leased by three to five tenants.

Inland Empire can’t get enough warehouse space

Ryan Companies is building into a market where demand for warehouse and logistical space seems insatiable. Wood says that, as of the third quarter of 2017, there were nearly 540 million sf of logistics/warehouse buildings in California’s Riverside and San Bernardino counties. For the past several years, the Inland Empire has been adding between 20 million and 25 million sf annually.

JLL estimated that in the 12 months ended December 2017, 43.5% of leasing activities for facilities larger than 50,000 sf came from ecommerce tenants. JLL also estimated at the time that there were 24 million sf of new warehouse space under construction In the Inland Empire, where the vacancy rate was 3.5% and rents averaged 53 cents per sf.

Pacific Vista Commercial Center, says Wood, is one of the first buildings that are being constructed under Carlsbad’s Climate Action Plan, which dates back to 2015, and whose goal is to reduce greenhouse gases to meet California’s mandated targets.

Among the facility’s innovative features is a 0.915-MW photovoltaic rooftop solar system that is allocated for each building that’s designed with its own substation. The PV array is set up to offset 50% of a tenant’s average utility usage, and the lease puts the system in each tenant’s name for metering purposes and so the tenant can reap the full benefits of the solar array’s energy output.

The Center will also offer 24 electric vehicle charging stations, as mandated by the Action Plan. There are 1.77 total parking stalls for every 1,000 sf of warehouse space in the Center.

Wood says Ryan Companies, which has been building industrial facilities for years, embraced Carlsbad’s green requirements. The Center was pre-certified LEED for core and shell, and Wood says it should achieve a Silver certification at a minimum.

The 26-acre Pacific Vista Commercial Center will include segregated vehicular and trucking access points and lanes that run between the buildings. PODS, the storage supplier, is the Center's first tenant, having agreed to a 10-year lease of Building B (top right). Image: Ryan Companies

Robust tenant amenities

Greenness aside, Wood says the key leasing points of this Class A facility are its functionality, location (near the Pacific Ocean), and its flexibility.

The Center will include completely segregated vehicular and trucking access points within the open area that runs between the three buildings. It will offer one dock door position for every 4,372 sf of warehouse space, and 32 ft minimum clear heights to maximize interior cubic storage capacity.

The Center’s tenant amenities include six separate outdoor employee areas with views of the surrounding open space and ocean, a centralized food truck location, sand volleyball court, bocce ball court, and a secured bicycle storage area for 35 bikes.

This $67 million project is a joint venture between Ryan Companies and Deutsche Asset Management’s DWS/RREEF Property Trust division. The partners have another joint venture spec project in the works in Poway, Calif., a 530,000-sf logistics center with two buildings that is scheduled to break ground in November.

Related Stories

| Dec 13, 2013

Safe and sound: 10 solutions for fire and life safety

From a dual fire-CO detector to an aspiration-sensing fire alarm, BD+C editors present a roundup of new fire and life safety products and technologies.

| Dec 10, 2013

16 great solutions for architects, engineers, and contractors

From a crowd-funded smart shovel to a why-didn’t-someone-do-this-sooner scheme for managing traffic in public restrooms, these ideas are noteworthy for creative problem-solving. Here are some of the most intriguing innovations the BD+C community has brought to our attention this year.

| Nov 27, 2013

Exclusive survey: Revenues increased at nearly half of AEC firms in 2013

Forty-six percent of the respondents to an exclusive BD+C survey of AEC professionals reported that revenues had increased this year compared to 2012, with another 24.2% saying cash flow had stayed the same.

| Nov 27, 2013

Wonder walls: 13 choices for the building envelope

BD+C editors present a roundup of the latest technologies and applications in exterior wall systems, from a tapered metal wall installation in Oklahoma to a textured precast concrete solution in North Carolina.

| Nov 26, 2013

Construction costs rise for 22nd straight month in November

Construction costs in North America rose for the 22nd consecutive month in November as labor costs continued to increase, amid growing industry concern over the tight availability of skilled workers.

| Nov 25, 2013

Building Teams need to help owners avoid 'operational stray'

"Operational stray" occurs when a building’s MEP systems don’t work the way they should. Even the most well-designed and constructed building can stray from perfection—and that can cost the owner a ton in unnecessary utility costs. But help is on the way.

| Nov 19, 2013

Top 10 green building products for 2014

Assa Abloy's power-over-ethernet access-control locks and Schüco's retrofit façade system are among the products to make BuildingGreen Inc.'s annual Top-10 Green Building Products list.

| Nov 15, 2013

Greenbuild 2013 Report - BD+C Exclusive

The BD+C editorial team brings you this special report on the latest green building trends across nine key market sectors.

| Nov 14, 2013

How increased domestic energy production affects the nation [Infographic]

In light of America's new energy resources and an increased emphasis on energy efficiency, Skanska examined the trends in U.S. energy production and consumption, as well as the benefits we may incur from increased domestic energy production.

| Nov 13, 2013

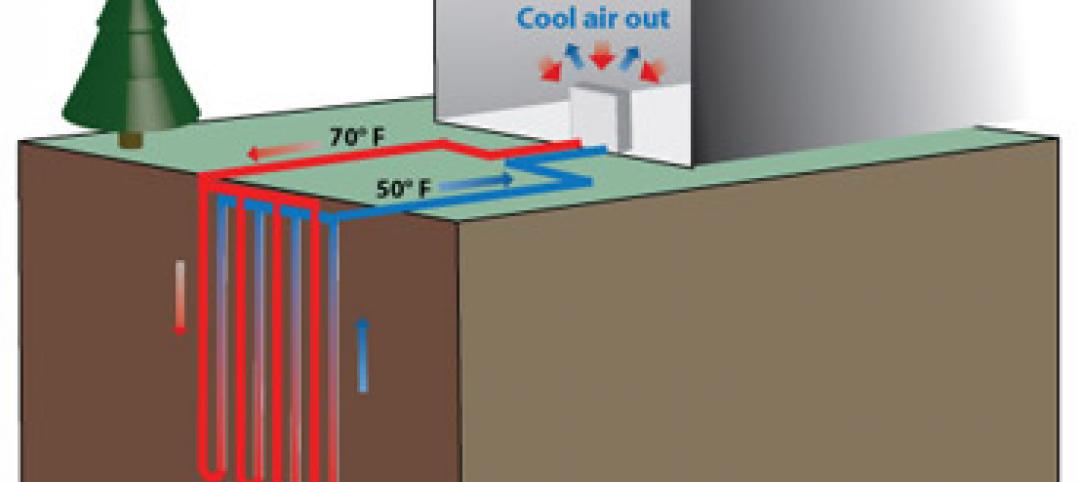

Installed capacity of geothermal heat pumps to grow by 150% by 2020, says study

The worldwide installed capacity of GHP systems will reach 127.4 gigawatts-thermal over the next seven years, growth of nearly 150%, according to a recent report from Navigant Research.