The market outlook is brighter for U.S. architecture, engineering, and construction companies, with a majority of AEC firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s fourth annual Market Forecast Survey.

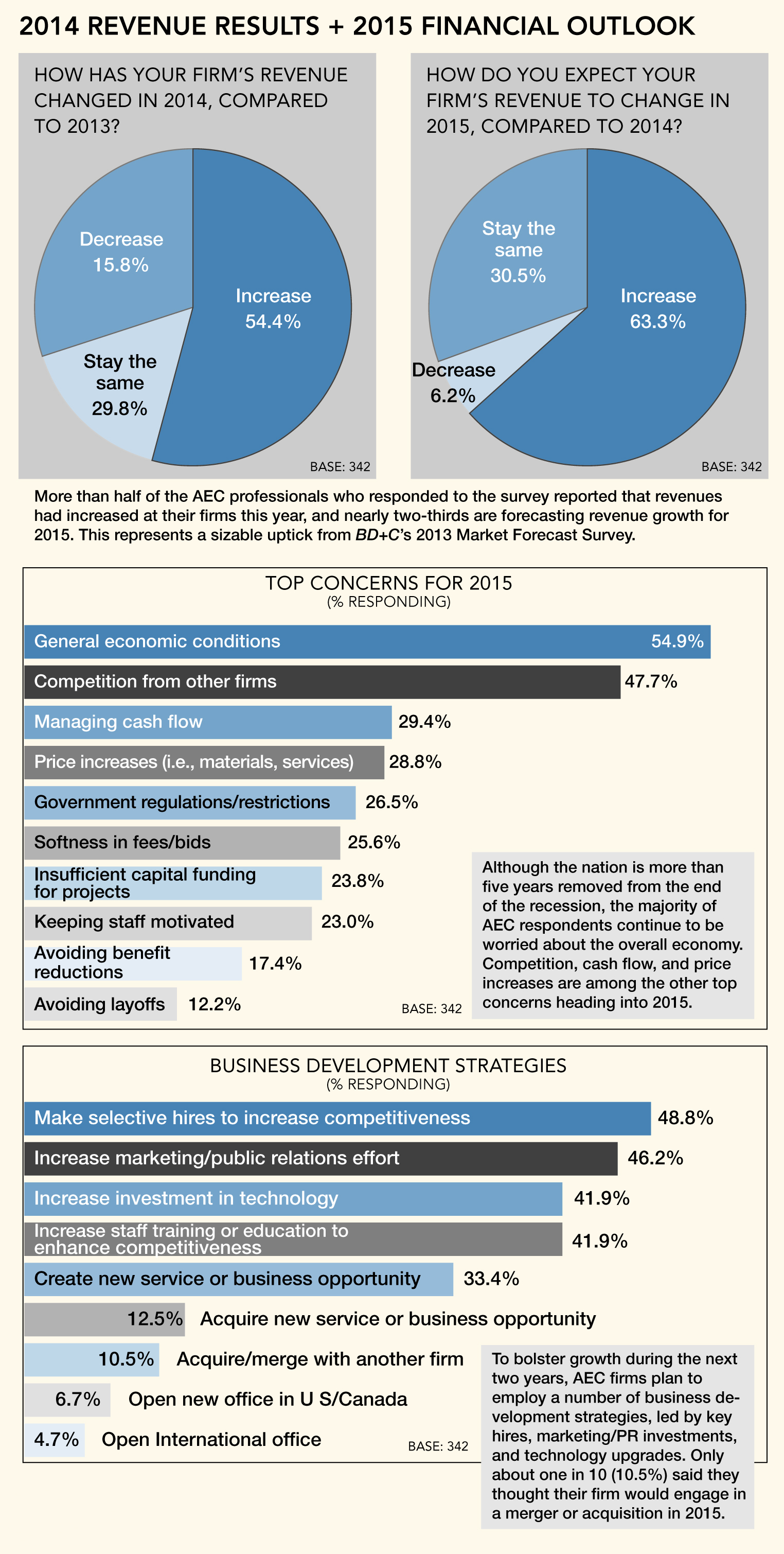

More than half (54.4%) of the 342 AEC professionals who responded to the survey reported that revenues had increased at their firms this year, and nearly two-thirds (63.4%) are forecasting revenue growth for 2015. This represents a sizable uptick from BD+C’s 2013 market forecast survey, in which 46.1% of respondents reported higher revenue for the year and 56.8% predicted growth for 2014.

Asked to rate their firms’ overall financial health, almost three-quarters (72.6%) responded either “good” (50.4%) or “very good” (22.2%), compared to just 55.5% in last year’s survey. Only 8.8% indicated that their firm is in a weakened state financially.

Firms are looking to sustain growth during the next two years through a variety of business development strategies, including strategic hires (48.8% rated it as a top tactic for growth), strengthened marketing/public relations efforts (46.2%), more staff training and education (41.9%), technology upgrades (41.9%), and launching a new service or business opportunity (33.4%).

Top concerns heading into 2015: general economic conditions (54.9% ranked it as a top concern), competition from other firms (47.7%), managing cash flow (29.4%), price increases in materials/services (28.8%), government regulations/restrictions (26.5%), and insufficient capital funding for projects (23.8%).

Healthcare keeps chugging, multifamily moves up

Survey respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale, from “excellent” to “very weak.” (Note: Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• For the second consecutive year, the healthcare sector ranked as one of the most active building sectors, with nearly two-thirds of respondents (63.6%) in the good/excellent category, compared to 62.5% in 2013 and 58.8% the previous year.

• Multifamily saw a nice bump in activity over last year, thanks primarily to the nation’s continued rental housing boom. More than six in 10 respondents (62.3%) gave the sector a good or excellent rating, up from 56.1% in the 2013 survey.

• As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted living facilities is expected to spike. This trend is reflected in the survey results, with 59.2% of respondents indicating good/excellent prospects for this sector in 2015—down a bit from the 2013 survey (66.0%), but up strongly from the previous year (50.5%).

• The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies rush to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2%) had either good or excellent prospects for the sector in 2015, up from 56.0% in 2013 and 45.2% the year before.

• The industrial/warehouse and office building sectors saw the largest year-over-year jump in activity among the respondent firms. Nearly half (43.3%) ranked the industrial sector in the good/excellent category, up from 33.0% last year, while 35.4% said they were upbeat about the office sector, versus 26.9% the previous year.

• Other sectors with sizable YoY percentage growth: retail (up 6.5 points, to 37.9%), multifamily (up 6.2 points, to 62.3%), K-12 schools (up 5.9 points, to 36.8%), and office interiors/fitouts (up 5.6 points, to 57.7%). The senior/assisted living sector was the only market to see a significant YoY percentage decline, but it still ranked as one of the industry’s most active sectors, according to the survey.

Uptick in BIM/VDC adoption

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools among BD+C readers, this segment saw modest growth in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up slightly from 77.3% in the 2013 survey. The number of BIM power users increased, as well: 17.3% indicated that their firm uses BIM on more than 75% of projects, up from 12.2% last year.

The respondent breakdown by profession: architect/designer (45.3%), contractor (19.0%), engineer (16.7%), owner/developer (7.0%), consultant (4.1%), facility manager (3.8%), other (4.1%).

Related Stories

Architects | Feb 28, 2022

JLL continues expansion in Southwest with acquisition of San Diego’s Gilliland Construction Management

JLL announced that it has completed the acquisition of Gilliland Construction Management, a leader in project and construction management services for life sciences, lab, retail, hospitality, industrial, multifamily, and office properties.

Codes and Standards | Feb 24, 2022

Most owners adapting digital workflows on projects

Owners are more deeply engaged with digital workflows than other project team members, according to a new report released by Trimble and Dodge Data & Analytics.

Multifamily Housing | Feb 24, 2022

First new, mixed-use high-rise in Detroit’s central business district in nearly 30 years opens

City Club Apartments completed two multifamily projects in 2021 in downtown Detroit including the first new, mixed-use high-rise in Detroit’s central business district in nearly 30 years.

| Feb 24, 2022

Signs of ‘Antiwork’ appear in the architecture industry

Reddit's r/Antiwork forum highlights the mounting pressures everyday workers face in a purely capitalistic society. AEC industry professionals are not immune to these pressures.

Office Buildings | Feb 23, 2022

The Beam on Farmer, Arizona’s first mass timber, multi-story office building tops out

The Beam on Farmer, Arizona’s first mass timber, multi-story office building, topped out on Feb. 10, 2022.

Codes and Standards | Feb 21, 2022

More bad news on sea level rise for U.S. coastal areas

A new government report predicts sea levels in the U.S. of 10 to 12 inches higher by 2050, with some major cities on the East and Gulf coasts experiencing damaging floods even on sunny days.

Wood | Feb 18, 2022

$2 million mass timber design competition: Building to Net-Zero Carbon (entries due March 30!)

To promote construction of tall mass timber buildings in the U.S., the Softwood Lumber Board (SLB) and USDA Forest Service (USDA) have joined forces on a competition to showcase mass timber’s application, commercial viability, and role as a natural climate solution.

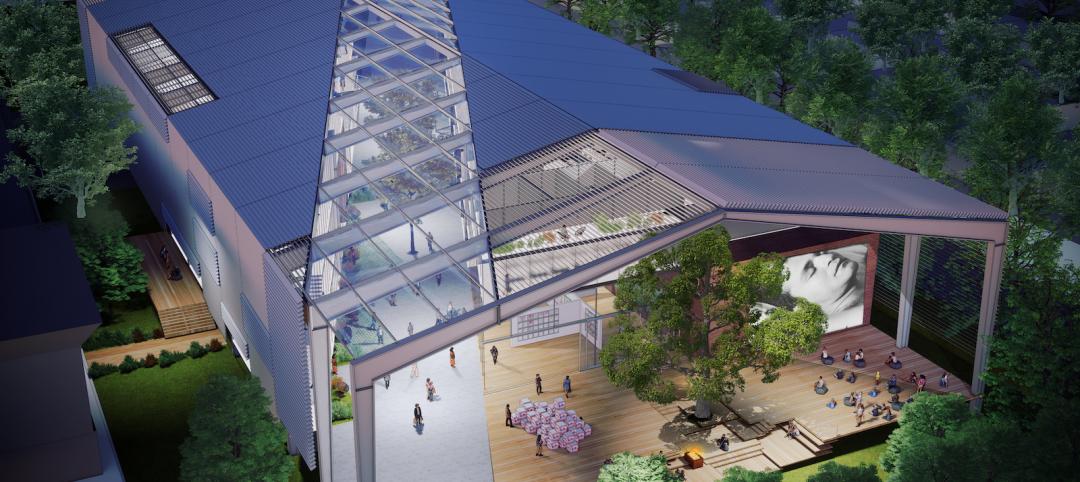

University Buildings | Feb 18, 2022

On-campus performing arts centers and museums can be talent magnets for universities

Cultural facilities are changing the way prospective students and parents view higher education campuses.

University Buildings | Feb 17, 2022

A vacated school in St. Louis is turned into a center where suppliers exchange ideas

In 1871, The Carondelet School, designed by Frederick William Raeder, opened to educate more than 400 children of laborers and manufacturers in St. Louis. The building is getting a second lease on life, as it has undergone a $2 million renovation by goBRANDgo!, a marketing firm for the manufacturing and industrial sectors.

Data Centers | Feb 15, 2022

Data center boom: How two AEC firms plan to meet unprecedented demand for data center facilities

Ramboll's Jim Fox and EYP Mission Critical Facilities' Rick Einhorn discuss the recent joining of their companies at a time of unprecedented data center demand. BD+C's John Caulfield leads the discussion with Fox, Ramboll's Managing Director for the Americas, and Einhorn, EYP Mission Critical Facilities' Managing Director.