For the second consecutive year, the leading cause of construction contract disputes in North America was errors and/or omissions in contract documents. And while the value of disputes fell by nearly 14% in 2014, the time it took to resolve them lengthened substantially last year.

These are some of the key findings in the “Global Construction Disputes Report 2015,” the fifth such annual report produced by Arcadis, a leading global natural and built asset design and consultancy firm. Its data are based on contract disputes handled by Arcadis’ Construction Claims Consulting teams in North America, Europe, the UK, the Middle East, and Asia.

(Arcadis could not provide statistics on the total value of disputes. But last year it served as a claims consultant on approximately 40 disputes with values up to $100 million last year.)

Globally, the report found an increase in the value and length of disputes, with the most common cause being a failure to properly administer the contract. “This is both a revealing and concerning statistic,” observes Mike Allen, Arcadis’ Global Leader of Contract Solutions. “It raises myriad questions as to how projects and programs are briefed, scoped, [and] structured,” as well as questions about resourcing, training, and contracting environment itself.

The transportation sector accounted for 31% of global contract disputes. And despite the presumed advantages of joint ventures, one in three still ends up in a contract dispute, although that number dips to less than one in five (19.8%) in North America.

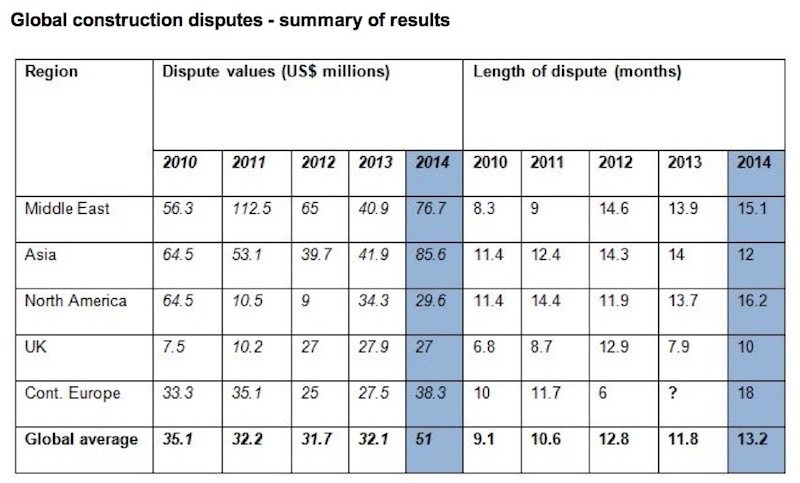

Worldwide, the average value of disputes increased last year to $51 million, from $32.1 million in 2013. The highest average was in Asia, where dispute values more than doubled to $85.6 million. Arcadis attributed the jump primarily to the region’s growth, the complexity of its construction projects, and the rise in joint ventures.

Dispute values in the Middle East rose to $76.7 million, from $40.9 million in 2013. In the UK, dispute values dipped slightly to $27 million.

The average time taken to resolve disputes globally rose to 13.2 months, up from just under 12 months in 2013. All areas of the world saw their resolution processes extend, with the exception of Asia where the average dispute length took two months less than it did the year before.

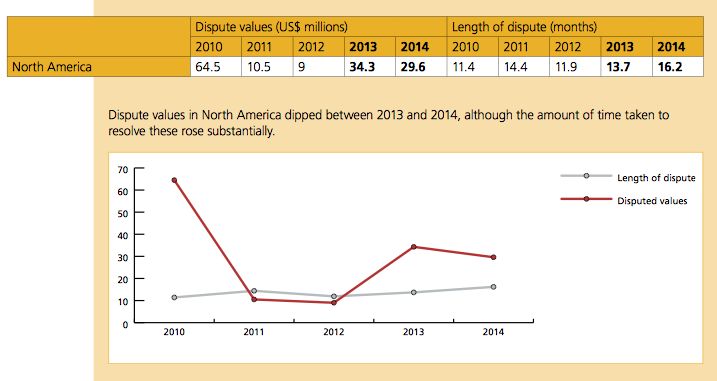

In North America, the length of disputes last year increased by more than 18% to 16.2 months. On the other hand, dispute values dipped by nearly 14% to $29.6 million, and there was evident willingness on behalf of contractual parties “to try and try again to arrive at a settlement” and avoid the inevitably escalating costs associated with formal litigation and negative publicity, said Roy Cooper, Arcadis’ Vice President and Head of Contract Solutions in North America.

For the second year running, the most common cause of disputes in North America during 2014 was errors and/or omissions in the contract documents. Differing site conditions came in second, while a failure to understand or comply with contractual obligations on the part of an employer, contractor or subcontractor was the third most commonly cited reason for a dispute.

With North America’s crumbling infrastructure system in need of a significant overhaul, Cooper sees the construction industry moving towards a program of interconnected projects, rather than discrete projects. But big programs can come with bigger risks, so “failure and high visibility disputes are not an option,” he said. “Owners have turned to alternate project delivery, increased project controls and early intervention to mitigate disputes to help manage that risk.”

The three most common methods of Alternate Dispute Resolution in the U.S. were party-to-party negotiation, mediation, and arbitration.

Still, Arcadis predicts that the number of projects going into dispute would to rise this year globally, with projects accepted for lower margins during economic downturns and labor shortages in some markets likely to prove the catalysts for disputes.

Related Stories

M/E/P Systems | Oct 30, 2024

After residential success, DOE will test heat pumps for cold climates in commercial sector

All eight manufacturers in the U.S. Department of Energy’s Residential Cold Climate Heat Pump Challenge completed rigorous product field testing to demonstrate energy efficiency and improved performance in cold weather.

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

Resiliency | Oct 29, 2024

Climate change degrades buildings slowly but steadily

While natural disasters such as hurricanes and wildfires can destroy buildings in minutes, other factors exacerbated by climate change degrade buildings more slowly but still cause costly damage.

Hotel Facilities | Oct 29, 2024

Hotel construction pipeline surpasses 6,200 projects at Q3 2024

According to the U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics, the total hotel pipeline stands at 6,211 projects/722,821 rooms, a new all-time high for projects in the U.S.

Office Buildings | Oct 29, 2024

Editorial call for Office Building project case studies

BD+C editors are looking to feature a roundup of office building projects for 2024, including office-to-residential conversions. Deadline for submission: December 6, 2024.

Healthcare Facilities | Oct 28, 2024

New surgical tower is largest addition to UNC Health campus in Chapel Hill

Construction on UNC Health’s North Carolina Surgical Hospital, the largest addition to the Chapel Hill campus since it was built in 1952, was recently completed. The seven-story, 375,000-sf structure houses 26 operating rooms, four of which are hybrid size to accommodate additional equipment and technology for newly developed procedures.

Contractors | Oct 25, 2024

Construction industry CEOs kick off effort to prevent suicide among workers

A new construction industry CEO Advisory Council dedicated to addressing the issue of suicide in the construction industry recently took shape. The council will guide an industry-wide effort to develop solutions targeting the high rate of suicide among construction workers.

Sports and Recreational Facilities | Oct 24, 2024

Stadium renovation plans unveiled for Boston’s National Women’s Soccer League

A city-owned 75-year-old stadium in Boston’s historic Franklin Park will be renovated for a new National Women’s Soccer League team. The park, designed by Fredrick Law Olmsted in the 1880s, is the home of White Stadium, which was built in 1949 and has since fallen into disrepair.

Laboratories | Oct 23, 2024

From sterile to stimulating: The rise of community-centric life sciences campuses

To distinguish their life sciences campuses, developers are partnering with architectural and design firms to reimagine life sciences facilities as vibrant, welcoming destinations. By emphasizing four key elements—wellness, collaboration, biophilic design, and community integration—they are setting their properties apart.

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.