For the second consecutive year, the leading cause of construction contract disputes in North America was errors and/or omissions in contract documents. And while the value of disputes fell by nearly 14% in 2014, the time it took to resolve them lengthened substantially last year.

These are some of the key findings in the “Global Construction Disputes Report 2015,” the fifth such annual report produced by Arcadis, a leading global natural and built asset design and consultancy firm. Its data are based on contract disputes handled by Arcadis’ Construction Claims Consulting teams in North America, Europe, the UK, the Middle East, and Asia.

(Arcadis could not provide statistics on the total value of disputes. But last year it served as a claims consultant on approximately 40 disputes with values up to $100 million last year.)

Globally, the report found an increase in the value and length of disputes, with the most common cause being a failure to properly administer the contract. “This is both a revealing and concerning statistic,” observes Mike Allen, Arcadis’ Global Leader of Contract Solutions. “It raises myriad questions as to how projects and programs are briefed, scoped, [and] structured,” as well as questions about resourcing, training, and contracting environment itself.

The transportation sector accounted for 31% of global contract disputes. And despite the presumed advantages of joint ventures, one in three still ends up in a contract dispute, although that number dips to less than one in five (19.8%) in North America.

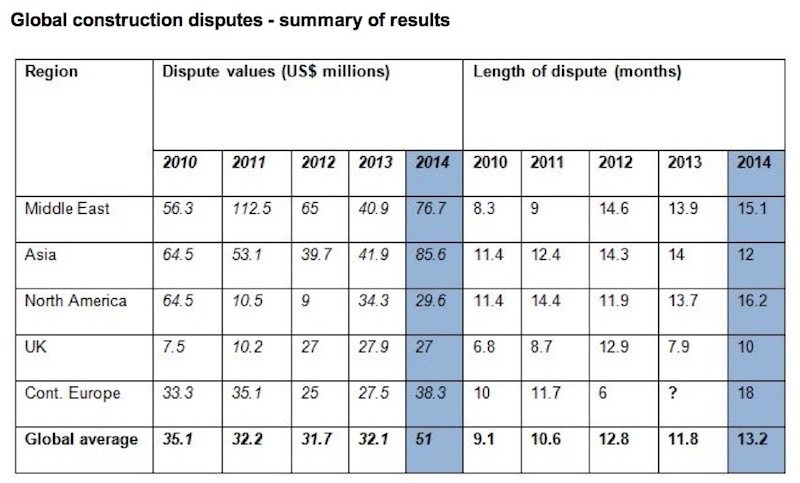

Worldwide, the average value of disputes increased last year to $51 million, from $32.1 million in 2013. The highest average was in Asia, where dispute values more than doubled to $85.6 million. Arcadis attributed the jump primarily to the region’s growth, the complexity of its construction projects, and the rise in joint ventures.

Dispute values in the Middle East rose to $76.7 million, from $40.9 million in 2013. In the UK, dispute values dipped slightly to $27 million.

The average time taken to resolve disputes globally rose to 13.2 months, up from just under 12 months in 2013. All areas of the world saw their resolution processes extend, with the exception of Asia where the average dispute length took two months less than it did the year before.

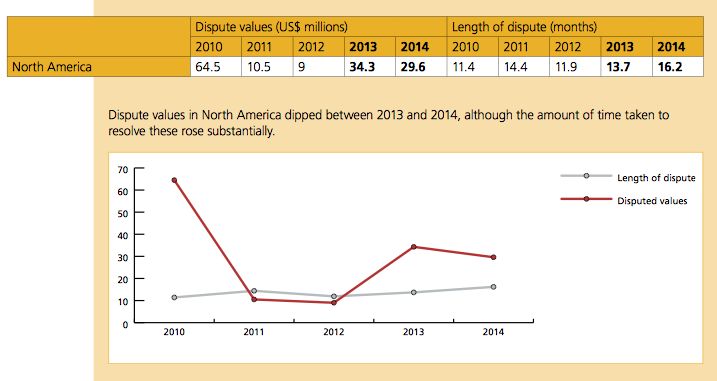

In North America, the length of disputes last year increased by more than 18% to 16.2 months. On the other hand, dispute values dipped by nearly 14% to $29.6 million, and there was evident willingness on behalf of contractual parties “to try and try again to arrive at a settlement” and avoid the inevitably escalating costs associated with formal litigation and negative publicity, said Roy Cooper, Arcadis’ Vice President and Head of Contract Solutions in North America.

For the second year running, the most common cause of disputes in North America during 2014 was errors and/or omissions in the contract documents. Differing site conditions came in second, while a failure to understand or comply with contractual obligations on the part of an employer, contractor or subcontractor was the third most commonly cited reason for a dispute.

With North America’s crumbling infrastructure system in need of a significant overhaul, Cooper sees the construction industry moving towards a program of interconnected projects, rather than discrete projects. But big programs can come with bigger risks, so “failure and high visibility disputes are not an option,” he said. “Owners have turned to alternate project delivery, increased project controls and early intervention to mitigate disputes to help manage that risk.”

The three most common methods of Alternate Dispute Resolution in the U.S. were party-to-party negotiation, mediation, and arbitration.

Still, Arcadis predicts that the number of projects going into dispute would to rise this year globally, with projects accepted for lower margins during economic downturns and labor shortages in some markets likely to prove the catalysts for disputes.

Related Stories

| Nov 16, 2010

Landscape architecture challenges Andrés Duany’s Congress for New Urbanism

Andrés Duany, founder of the Congress for the New Urbanism, adopted the ideas, vision, and values of the early 20th Century landscape architects/planners John Nolen and Frederick Law Olmsted, Jr., to launch a movement that led to more than 300 new towns, regional plans, and community revitalization project commissions for his firm. However, now that there’s a societal buyer’s remorse about New Urbanism, Duany is coming up against a movement that sees landscape architecture—not architecture—as the design medium more capable of organizing the city and enhancing the urban experience.

| Nov 16, 2010

NFRC approves technical procedures for attachment product ratings

The NFRC Board of Directors has approved technical procedures for the development of U-factor, solar heat gain coefficient (SHGC), and visible transmittance (VT) ratings for co-planar interior and exterior attachment products. The new procedures, approved by unanimous voice vote last week at NFRC’s Fall Membership Meeting in San Francisco, will add co-planar attachments such as blinds and shades to the group’s existing portfolio of windows, doors, skylights, curtain walls, and window film.

| Nov 15, 2010

Gilbane to acquire W.G. Mills, Inc.

Rhode Island-based Gilbane Building Company announced plans to acquire W.G. Mills, Inc., a construction management firm with operations based in Florida. The acquisition will dramatically strengthen Gilbane’s position in Florida’s growing market and complement its already established presence in the southeast.

| Nov 11, 2010

Saint-Gobain to make $80 million investment in SAGE Electrochromics

Saint-Gobain, one of the world’s largest glass and construction material manufacturers, is making a strategic equity investment in SAGE Electrochromics to make electronically tintable “dynamic glass” an affordable, mass-market product, ushering in a new era of energy-saving buildings.

| Nov 11, 2010

Saint-Gobain to make $80 million investment in SAGE Electrochromics

Saint-Gobain, one of the world’s largest glass and construction material manufacturers, is making a strategic equity investment in SAGE Electrochromics to make electronically tintable “dynamic glass” an affordable, mass-market product, ushering in a new era of energy-saving buildings.

| Nov 11, 2010

USGBC certifies more than 1 billion square feet of commercial space

This month, the total footprint of commercial projects certified under the U.S. Green Building Council’s LEED Green Building Rating System surpassed one billion square feet. Another six billion square feet of projects are registered and currently working toward LEED certification around the world. Since 2000, more than 36,000 commercial projects and 38,000 single-family homes have participated in LEED.

| Nov 10, 2010

$700 million plan to restore the National Mall

The National Mall—known as America’s front yard—is being targeted for a massive rehab and restoration that could cost as much as $700 million (it’s estimated that the Mall has $400 million in deferred maintenance alone). A few of the proposed projects: refurbishing the Grant Memorial, replacing the Capitol Reflecting Pool with a smaller pool or fountain, reconstructing the Constitution Gardens lake and constructing a multipurpose visitor center, and replacing the Sylvan Theater near the Washington Monument with a new multipurpose facility.

| Nov 9, 2010

Just how green is that college campus?

The College Sustainability Report Card 2011 evaluated colleges and universities in the U.S. and Canada with the 300 largest endowments—plus 22 others that asked to be included in the GreenReportCard.org study—on nine categories, including climate change, energy use, green building, and investment priorities. More than half (56%) earned a B or better, but 6% got a D. Can you guess which is the greenest of these: UC San Diego, Dickinson College, University of Calgary, and Dartmouth? Hint: The Red Devil has turned green.