December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

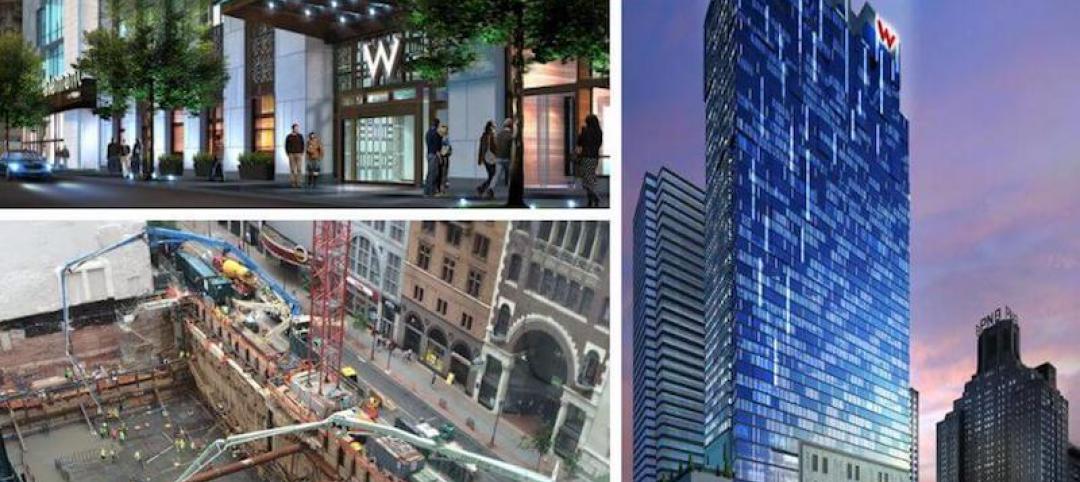

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

| Jun 13, 2017

Accelerate Live! talk: Is the road to the future the path of least resistance? Sasha Reed, Bluebeam (sponsored)

Bluebeam’s Sasha Reed discusses why AEC leaders should give their teams permission to responsibly break things and create ecosystems of people, process, and technology.

| Jun 13, 2017

Accelerate Live! talk: Incubating innovation through R&D and product development, Jonatan Schumacher, Thornton Tomasetti

Thornton Tomasetti’s Jonatan Schumacher presents the firm’s business model for developing, incubating, and delivering cutting-edge tools and solutions for the firm, and the greater AEC market.

| Jun 13, 2017

Accelerate Live! talk: The future of computational design, Ben Juckes, Yazdani Studio of CannonDesign

Yazdani’s Ben Juckes discusses the firm’s tech-centric culture, where scripting has become an every-project occurrence and each designer regularly works with computational tools as part of their basic toolset.

Industry Research | Jun 13, 2017

Gender, racial, and ethnic diversity increases among emerging professionals

For the first time since NCARB began collecting demographics data, gender equity improved along every career stage.

Architects | Jun 7, 2017

Build your very own version of Frank Lloyd Wright’s Guggenheim Museum with this new LEGO set

744 LEGO bricks are used to recreate the famous Wright design, including the 1992 addition.

Multifamily Housing | Jun 7, 2017

Multifamily visionary: The life and work of architect David Baker

For 35 years, architect David Baker has been a spirited voice for affordable housing, in San Francisco and beyond.

Architects | Jun 5, 2017

NCARB launches second alternative path to architect certification

Architects without a professional degree in architecture can now earn NCARB certification through an alternate path.

Architects | Jun 2, 2017

NELSON joins forces with Cope Linder and KA

More growth ahead, as NELSON expects to double its workforce and revenue this year.

Office Buildings | Jun 2, 2017

Strong brew: Heineken HQ spurs innovation through interaction [slideshow]

The open plan concept features a Heineken bar and multiple social zones.

| Jun 2, 2017

Accelerate Live! talk: How maker culture is transforming Sasaki’s design practice

Sasaki’s Pablo Savid-Buteler and Brad Prestbo talk about how the firm’s maker initiatives are changing the way Sasaki goes to market, and how they are helping the firm win new business.

![Strong brew: Heineken HQ spurs innovation through interaction [slideshow] Strong brew: Heineken HQ spurs innovation through interaction [slideshow]](/sites/default/files/styles/list_big/public/OPENER%20Screen%20Shot%202017-06-02%20at%2011.33.34%20AM.png?itok=VNxuazkX)