December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

High-rise Construction | Mar 16, 2015

NBBJ creates 'shadowless' skyscraper concept for proposed UK development

A team of architects from the London branch of NBBJ used computer algorithms to generate a dual-tower design that maximizes sunlight reflections to eliminate the buildings' shadows.

Healthcare Facilities | Mar 16, 2015

Healthcare planning in a post-ACA world: 3 strategies for success

Healthcare providers are seeking direction on how to plan for a value-based world while still very much operating in a volume-based market. CBRE Healthcare's Curtis Skolnick offers helpful strategies.

Resort Design | Mar 16, 2015

Giancarlo Zema Design Group unveils plans for semi-submerged resort in Qatar

The resort will have four semi-submerged hotels that look similar to super-yachts, each including 75 luxury suites with private terraces.

Mixed-Use | Mar 13, 2015

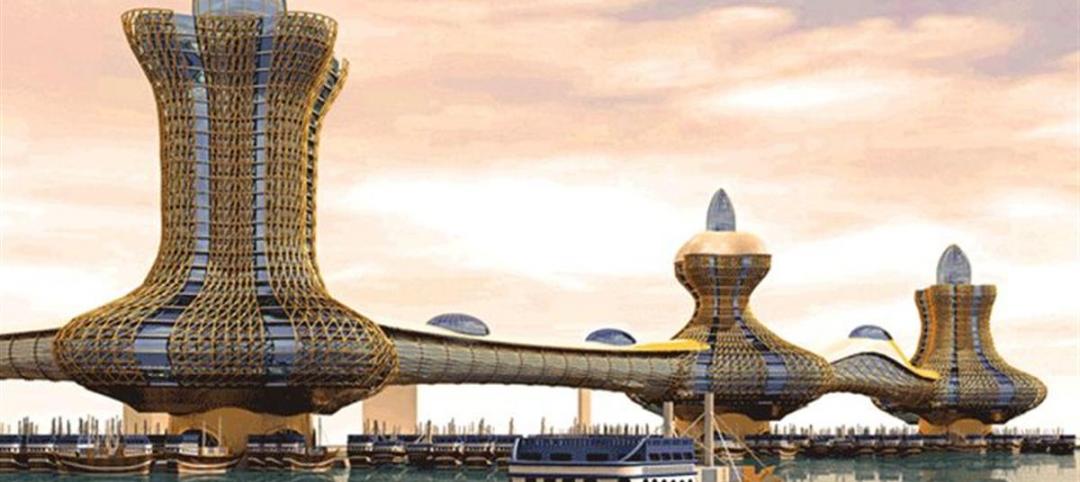

Dubai announces mega waterfront development Aladdin City

Planned on 4,000 acres in the Dubai Creek area, the towers will be covered in gold lattice and connected via air-conditioned bridges.

Contractors | Mar 13, 2015

Construction materials prices rise for first time in six months

The largest monthly gain in petroleum prices in over three years caused construction materials prices to expand 0.4% in February, ending a six-month streak when prices failed to rise, according to the Bureau of Labor Statistics.

High-rise Construction | Mar 12, 2015

Developers confirm Renzo Piano’s contribution in Sydney harbor overhaul

If the entire development is approved, One Sydney Harbour will be Piano’s second project in Australia.

High-rise Construction | Mar 12, 2015

Foster and Partners designs 'The One' in Toronto

Developer Sam Mizrahi worked with Foster and Partners and Core Architects to design Toronto's tallest skyscraper aside from the CN Tower, The One, which will house a luxury shopping mall and condos.

Contractors | Mar 12, 2015

Construction demand exploding in 2015, but costs complicate recovery

Raw materials and labor costs temper expectations for soaring profits.

Codes and Standards | Mar 12, 2015

Energy Trust of Oregon offers financial incentives for net-zero buildings

The organization is offering technical assistance along with financial benefits.

BIM and Information Technology | Mar 11, 2015

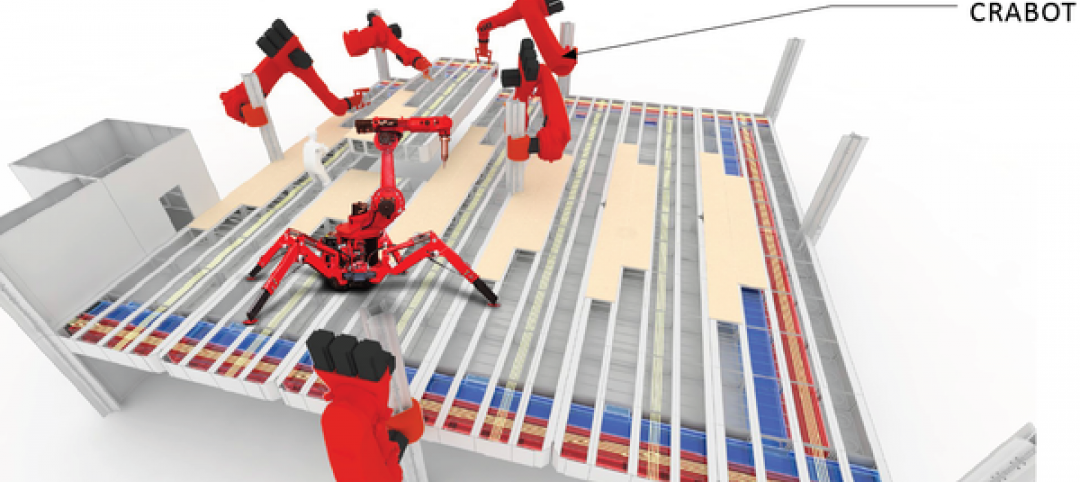

Google plans to use robots, cranes to manipulate modular offices at its new HQ

Its visions of “crabots” accentuate the search-engine giant’s recent fascination with robotics and automation.