December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

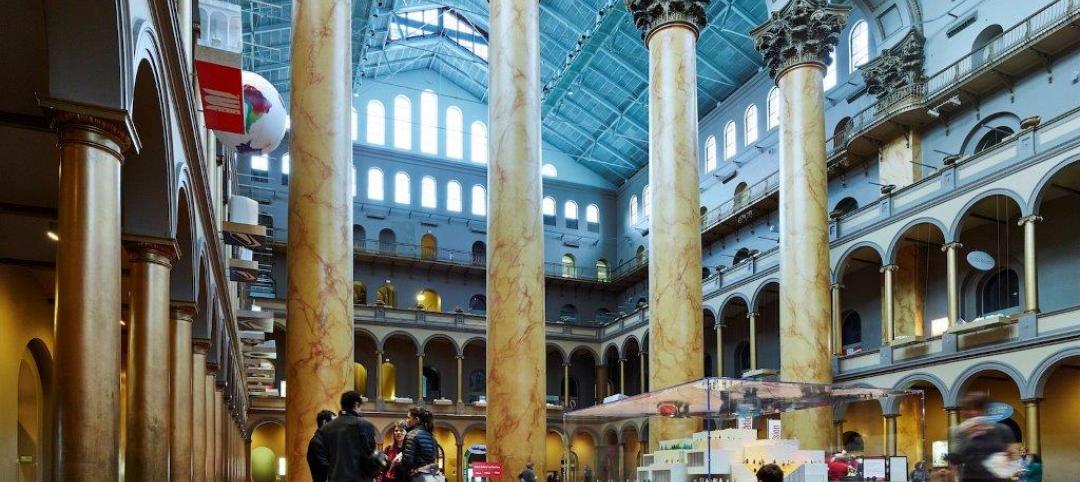

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

Multifamily Housing | Jan 31, 2015

20% down?!! Survey exposes how thin renters’ wallets are

A survey of more than 25,000 adults found the renters to be more burdened by debt than homeowners and severely short of emergency savings.

Multifamily Housing | Jan 31, 2015

Production builders are still shying away from rental housing

Toll Brothers, Lennar, and Trumark are among a small group of production builders to engage in construction for rental customers.

Architects | Jan 30, 2015

Exhibit captures 60 of Bjarke Ingels' projects — from hottest to coldest places on Earth

The Hot to Cold exhibit encompasses 60 of BIG’s recent projects captured by Iwan Baan´s masterful photography.

BIM and Information Technology | Jan 29, 2015

Lego X by Gravity elevates the toy to a digital modeling kit

With the Lego X system, users can transfer the forms they’ve created with legos into real-time digital files.

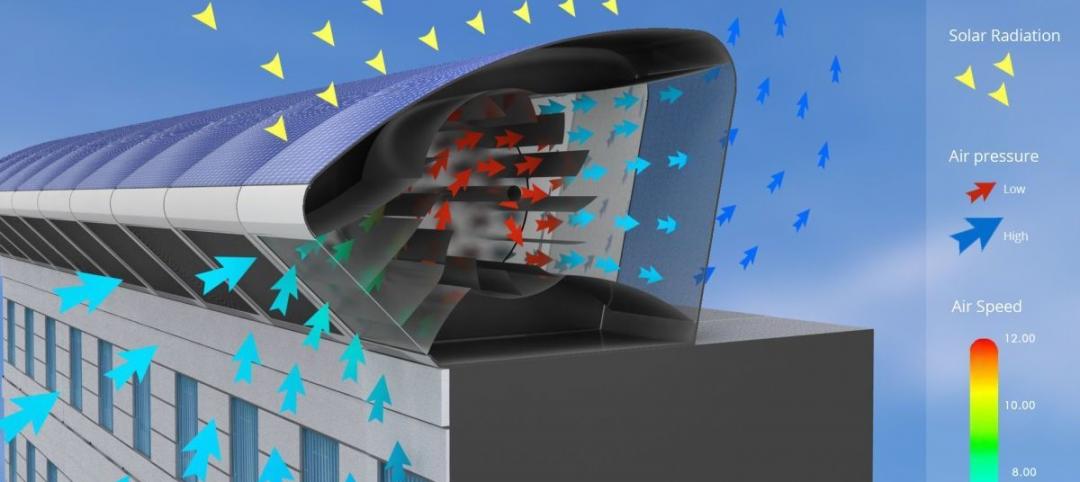

Energy Efficiency | Jan 28, 2015

An urban wind and solar energy system that may actually work

The system was designed to take advantage of a building's air flow and generate energy even if its in the middle of a city.

Multifamily Housing | Jan 27, 2015

Multifamily construction, focused on rentals, expected to slow in the coming years

New-home purchases, which recovered strongly in 2014, indicate that homeownership might finally be making a comeback.

Office Buildings | Jan 27, 2015

London plans to build Foggo Associates' 'can of ham' building

The much delayed high-rise development at London’s 60-70 St. Mary Axe resembles a can of ham, and the project's architects are embracing the playful sobriquet.

Multifamily Housing | Jan 22, 2015

Sales of apartment buildings hit record high in 2014

Investors bet big time on demand for rental properties over homeownership in 2014, when sales of apartment buildings hit a record $110.1 billion, or nearly 15% higher than the previous year.

| Jan 22, 2015

Architecture Billings Index rebounds at end of 2014

The American Institute of Architects reported the December ABI score was 52.2, up from a mark of 50.9 in November. This score reflects an increase in design activity.

| Jan 21, 2015

From technician to rainmaker: Making the leap in your career

Many AEC firms focus on training for the hard skills of the profession, not so much for business prowess, writes BD+C's David Barista.