December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

| Jun 6, 2014

KPF, Kevin Roche unveil design for 51-story Hudson Yards tower in NYC [slideshow]

Related Companies and Oxford Properties Group are teaming to develop Fifty Five Hudson Yards, the latest addition to the commercial office tower collection in the 28-acre Hudson Yards development—the largest private real estate development in the history of the U.S.

| Jun 6, 2014

Shipping container ship terminal completed in Spain

In Seville, Spain, architectural firms Hombre de Piedra and Buró4 have designed and completed a cruise ship terminal out of used shipping containers.

| Jun 5, 2014

International Parking Institute names best new parking structures

Winners include garages that are architectural delights, an airport's canopied parking atrium, and an environmentally friendly garage under America's oldest park.

| Jun 4, 2014

Emerging trends in healthcare development: neighborhood care, mixed-use models on the rise

In urban and even suburban markets, real estate is about the "live, work, play," with close proximity to mass transit and other amenities, like retail stores. Healthcare organizations are following suit.

| Jun 4, 2014

Want to design a Guggenheim? Foundation launches open competition for proposed Helsinki museum

This is the first time the Guggenheim Foundation has sought a design through an open competition. Anonymous submissions for stage one of the competition are due September 10, 2014.

| Jun 4, 2014

Market update: A difficult first quarter for construction spending comes to an end

This year's unusually difficult winter took its toll on construction activity. Nonetheless, first quarter spending for all the major groups was up compared to the same period in 2013.

| Jun 4, 2014

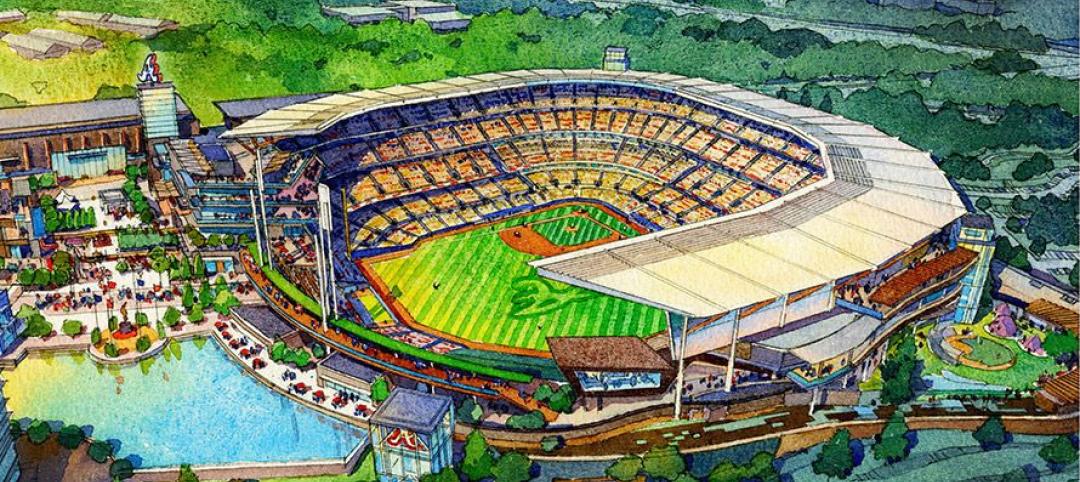

Construction team named for Atlanta Braves ballpark

A joint venture between Barton Malow, Brasfield & Gorrie, Mortenson Construction, and New South Construction will build the Atlanta Braves ballpark, which is scheduled to open in early 2017. Check out the latest renderings of the plan.

| Jun 3, 2014

Must see: World's tallest LEGO tower built in Budapest

The tower, built in front of St. Stephen's Basilica, is topped with a Rubik's cube and was built using thousands of blocks.

| Jun 3, 2014

Great leadership comes down to one thing

While it’s often said that strong leadership is an organization’s competitive advantage, is there a single characteristic that can predict which leaders will be most effective? SPONSORED CONTENT

| Jun 3, 2014

Libeskind's latest skyscraper breaks ground in the Philippines

The Century Spire, Daniel Libeskind's latest project, has just broken ground in Century City, southwest of Manila. It is meant to accommodate apartments and offices.