December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

| Jul 30, 2013

Better planning and delivery sought for VA healthcare facilities

Making Veterans Administration healthcare projects “better planned, better delivered” is the new goal of the VA’s Office of Construction and Facilities Management.

| Jul 30, 2013

Healthcare designers get an earful about controlling medical costs

At the current pace, in 2020 the U.S. will spend $4.2 trillion a year on healthcare; unchecked, waste would hit $1.2 trillion. Yet “waste” is keeping a lot of poorly performing hospitals in business, said healthcare facility experts at the recent American College of Healthcare Architects/AIA Academy of Architecture for Health Summer Leadership Summit in Chicago.

| Jul 30, 2013

Top Healthcare Sector Architecture Firms [2013 Giants 300 Report]

HDR, HKS, Cannon top Building Design+Construction's 2013 ranking of the largest healthcare architecture and architecture/engineering firms in the U.S.

| Jul 26, 2013

HDR acquires Sharon Greene + Associates

HDR Engineering, Inc. has acquired the business and assets of Sharon Greene + Associates, a firm specializing in transportation economics and financial analysis with offices in California and Denver.

| Jul 26, 2013

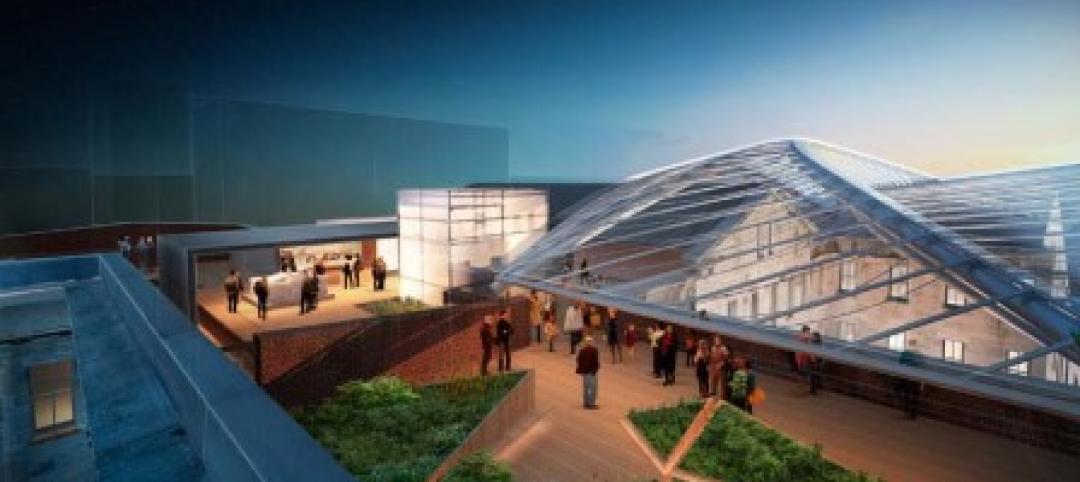

How biomimicry inspired the design of the San Francisco Museum at the Mint

When the city was founded in the 19th century, the San Francisco Bay’s edge and marshland area were just a few hundred feet from where the historic Old Mint building sits today. HOK's design team suggested a design idea that incorporates lessons from the local biome while creating new ways to collect and store water.

| Jul 25, 2013

3 office design strategies for creating happy, productive workers

Office spaces that promote focus, balance, and choice are the ones that will improve employee experience, enhance performance, and drive innovation, according to Gensler's 2013 U.S. Workplace Survey.

| Jul 25, 2013

How can I help you?: The evolution of call center design

Call centers typically bring to mind an image of crowded rows of stressed-out employees who are usually receiving calls from people with a problem or placing calls to people that aren’t thrilled to hear from them. But the nature of the business is changing; telemarketing isn’t what it used to be.

| Jul 25, 2013

First look: Studio Gang's residential/dining commons for University of Chicago

The University of Chicago will build a $148 million residence hall and dining commons designed by Studio Gang Architects, tentatively slated for completion in 2016.

| Jul 25, 2013

Resilience: the hallmark of a successful practice

The key to a firm’s future success has less to do with avoiding trouble than bouncing back from it.

| Jul 25, 2013

ACEEE presents the 2013 Champions of Energy Efficiency in Industry Awards

The American Council for an Energy-Efficient Economy (ACEEE) presented four Champion of Energy Efficiency Awards last night at its Summer Study on Energy Efficiency in Industry.