December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

Resiliency | Sep 30, 2022

Designing buildings for wildfire defensibility

Wold Architects and Engineers' Senior Planner Ryan Downs, AIA, talks about how to make structures and communities more fire-resistant.

| Sep 30, 2022

Manley Spangler Smith Architects partners with PBK in strategic merger

Manley Spangler Smith Architects (MSSA), a Georgia-based, full-service architectural firm specializing in educational and municipal facilities, announced today a significant development aimed at increasing its capabilities, expertise, and suite of services.

| Sep 30, 2022

Lab-grown bricks offer potential low-carbon building material

A team of students at the University of Waterloo in Canada have developed a process to grow bricks using bacteria.

| Sep 29, 2022

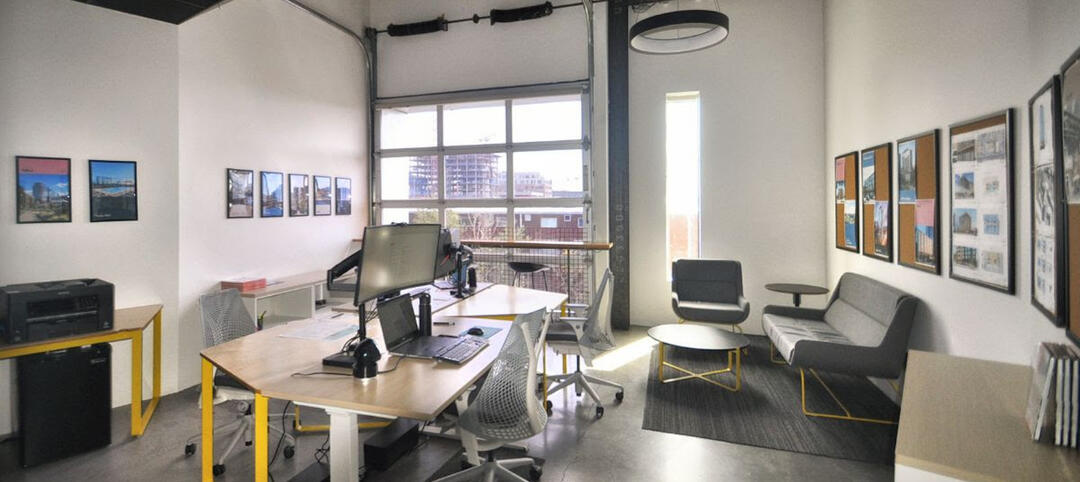

FitzGerald establishes Denver office

The new location bolsters FitzGerald’s nationwide reach and capitalizes on local expertise and boots-on-the-ground to serve new and existing clients seeking to do business in Denver and the Front Range, as well as the Southwest United States, California, and Texas.

| Sep 28, 2022

New digital platform to foster construction supply chains free of forced labor

Design for Freedom by Grace Farms and the U.S. Coalition on Sustainability formed a partnership to advance shared goals regarding sustainable and ethical building material supply chains that are free of forced labor.

| Sep 27, 2022

New Buildings Institute released the Existing Building Decarbonization Code

New Buildings Institute (NBI) has released the Existing Building Decarbonization Code.

| Sep 23, 2022

High projected demand for new housing prompts debate on best climate-friendly materials

The number of people living in cities could increase to 80% of the total population by 2100. That could require more new construction between now and 2050 than all the construction done since the start of the industrial revolution.

| Sep 23, 2022

Central offices making a comeback after pandemic

In the early stages of the Covid pandemic, commercial real estate industry experts predicted that businesses would increasingly move toward a hub-and-spoke office model.

| Sep 22, 2022

Gainesville, Fla., ordinance requires Home Energy Score during rental inspections

The city of Gainesville, Florida was recently recognized by the U.S. Dept. of Energy for an adopted ordinance that requires rental housing to receive a Home Energy Score during rental inspections.

| Sep 21, 2022

New California law creates incentive for installing outdoor dining safety barriers

A new California law provides an incentive for commercial property owners to install barriers to protect outdoor diners.