More than half of contractors say their methods of collecting and analyzing data from their jobsites need to get better over the next three years, in part for their companies to use these data to predict employee and project performance.

That’s a key finding in a new 40-page SmartMarket report that Viewpoint and Dodge Data & Analytics have released, entitled

“Improving Performance with Project Data.”

The report is based on an online survey conducted from August 14, 2017, through September 12, 2018. The survey used Dodge’s Contractor Panel and contacts provided by Viewpoint. Of its 187 respondents, 98 were GCs, 47 specialty trade contractors, 28 construction managers, nine design-build firms, and four design-contracting firms. Thirty-seven percent of respondent companies generate revenues between $50 million and $250 million.

The research focused on five key types of data: project progress, manhours, productivity, safety, and equipment management.

Respondents were asked how they gather, store, manage, secure, analyze, and report on each of these types of data. Key trends include a rapid shift away from paper-based forms, reports, and spreadsheets to digital tools and platforms, some that leverage cloud technology; increasing use of apps on mobile phones and digital cameras in the field; the desire for more accurate field data that enables trends analysis across projects; and a focus on data security.

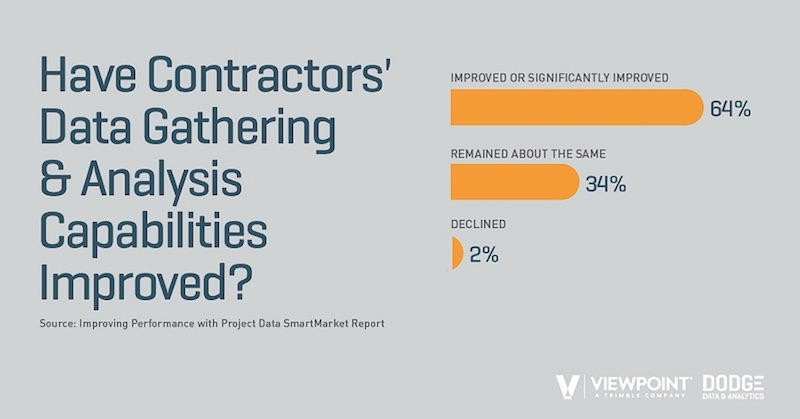

More than three-fifths of the contractors surveyed say they’ve seen improvements in their data gathering and analysis capabilities over the past three years. That’s especially true among larger companies. By far, the most important project data being gathered is performance information such as scheduling and costs, followed by payroll and manhour data.

The top-three benefits from data analysis, say contractors polled, are improving their ability to complete projects at or under budget (53%), greater productivity (47%), and greater profitability (46%).

However, more than half of the respondents (54%) admitted that they need to improve how they gather jobsite information over the next three years. And 45% think their ability to analyze trends across projects must get sharper, too, as well as their ability to gather current data from the field.

Relying on physical records, like paper forms, for data collection is steadily giving way among contractors to custom-designed or commercial software, a trend that is likely to be more prevalent over the next three years. Nearly three-quarters of respondents say they were satisfied with using software as a way to collect data.

Most pros (65% of the ones polled) still store their digital information in on-premise servers. But 37% have turned to third-party cloud providers, such as Amazon, to host their field information. The benefits of using the cloud are manifold, the most prominent being the ability to access data from the field while working in the office or remote locations, and vice versa.

Well over half of the contractors surveyed deploy mobile phone apps and cameras to collect and send data from the field. Expect that wave of data to rise, as drones, sensors, and wearables gain more traction as jobsite tools. However, contractors are also acutely aware of how their use of devices presents security risks. That explains why 86% of contractors say they are using anti-malware software, 78% are using enterprise-grade firewalls, and 56% have imposed policies for managing the use of mobile devices.

a plan to gather data

More than one-fifth of contractors surveyed have had experience with predictive analysis of data and business intelligence. That compares with just 7% for artificial intelligence and 6% for machine learning. The largest group of respondents noted they are aware of and understand the concepts of each of these emerging technologies but have not implemented them in their own organizations—39% for predictive analysis, 47% for artificial intelligence, and 33% for machine learning.

But it is clear that technology is advancing faster than the AEC industry’s ability to assimilate it. The report’s authors offer a multi-step process to structure a company’s data collection, analysis, and reporting.

• Determine what aspects of project delivery would benefit most from better information to guide your data strategy.

• Identify which types of field data will best-enable the proper analysis to generate critical decision-support information. And think about the minimum level of completeness, accuracy, and timeliness required for each type.

• Develop a focused technology and plan for collection and analysis that incorporates the specific data needed and types of analysis required, as well as financial and human capital investments, the time frames for implementation, clear roles of responsibility, and measurable goals for success.

The report includes two case studies—how Leander Construction is using the cloud to enhance productivity; and how W. Soule & Co. is using data to build better—as well as a Q&A with Jit Kee Chin, Suffolk Construction’s Chief Data Officer. Chin laments that what’s keeping AI from becoming a more efficient construction tool is the lack of useful data. Her viewpoint may explain why she sees “great potential” in automated monitoring.

Related Stories

Giants 400 | Nov 20, 2021

Top 100 Design-Build Construction Firms for 2021

Clayco, Hensel Phelps, ARCO Construction Companies, Swinerton, and Ryan Companies US top the rankings of the nation's largest design-build construction firms for buildings construction work, according to BD+C's 2021 Giants 400 Report.

Giants 400 | Nov 19, 2021

2021 Cultural Facilities Giants: Top architecture, engineering, and construction firms in the U.S. cultural facilities sector

Gensler, AECOM, Buro Happold, and Arup top BD+C's rankings of the nation's largest cultural facilities sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Giants 400 | Nov 19, 2021

2021 Convention Center Sector Giants: Top architecture, engineering, and construction firms in the U.S. convention and conference facilities sector

Populous, KPFF, Lendlease, and Turner Construction top BD+C's rankings of the nation's largest convention and conference facilities architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Giants 400 | Nov 18, 2021

2021 Multifamily Sector Giants: Top architecture, engineering, and construction firms in the U.S. multifamily building sector

Clark Group, Humphreys and Partners, and Kimley-Horn head BD+C's rankings of the nation's largest multifamily building sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

2021 Building Team Awards | Nov 17, 2021

Caltech's new neuroscience building unites scientists, engineers to master the human brain

The Tianqiao and Chrissy Chen Institute for Neuroscience at the California Institute of Technology in Pasadena wins a Gold Award in BD+C's 2021 Building Team Awards.

Architects | Nov 9, 2021

Download BD+C’s 2021 Design Innovation Report

AEC and development firms share where new ideas come from, and what makes them click.

Architects | Nov 9, 2021

Download BD+C’s 10 Predictions for the Construction Industry in 2022

Our prognostications focus on how AEC firms will streamline and modernize their projects and operations.

Movers+Shapers | Nov 7, 2021

Passage of $1.2 trillion infrastructure bill expected to spur stronger construction activity

AEC firms see federal investment as historic

Contractors | Nov 4, 2021

Coping with labor and material shortages in construction

Learn how New York-based Denham Wolf Real Estate Services is helping its nonprofit builder clients minimize delays and cost overruns from labor and materials shortages. Ron Innocent, Director of Project Management with Denham Wolf Real Estate Services sits down with BD+C's John Caulfield.

Contractors | Nov 3, 2021

RC Andersen Construction to join the STO Building Group

Merger extends both firms’ capabilities for clients in the industrial/distribution sector.