More than half of contractors say their methods of collecting and analyzing data from their jobsites need to get better over the next three years, in part for their companies to use these data to predict employee and project performance.

That’s a key finding in a new 40-page SmartMarket report that Viewpoint and Dodge Data & Analytics have released, entitled

“Improving Performance with Project Data.”

The report is based on an online survey conducted from August 14, 2017, through September 12, 2018. The survey used Dodge’s Contractor Panel and contacts provided by Viewpoint. Of its 187 respondents, 98 were GCs, 47 specialty trade contractors, 28 construction managers, nine design-build firms, and four design-contracting firms. Thirty-seven percent of respondent companies generate revenues between $50 million and $250 million.

The research focused on five key types of data: project progress, manhours, productivity, safety, and equipment management.

Respondents were asked how they gather, store, manage, secure, analyze, and report on each of these types of data. Key trends include a rapid shift away from paper-based forms, reports, and spreadsheets to digital tools and platforms, some that leverage cloud technology; increasing use of apps on mobile phones and digital cameras in the field; the desire for more accurate field data that enables trends analysis across projects; and a focus on data security.

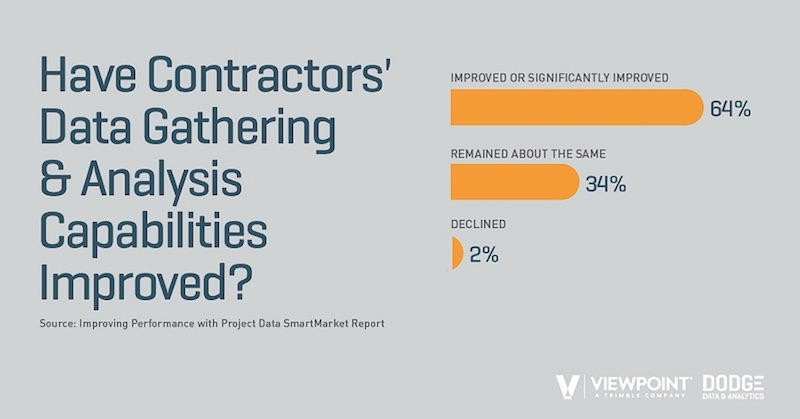

More than three-fifths of the contractors surveyed say they’ve seen improvements in their data gathering and analysis capabilities over the past three years. That’s especially true among larger companies. By far, the most important project data being gathered is performance information such as scheduling and costs, followed by payroll and manhour data.

The top-three benefits from data analysis, say contractors polled, are improving their ability to complete projects at or under budget (53%), greater productivity (47%), and greater profitability (46%).

However, more than half of the respondents (54%) admitted that they need to improve how they gather jobsite information over the next three years. And 45% think their ability to analyze trends across projects must get sharper, too, as well as their ability to gather current data from the field.

Relying on physical records, like paper forms, for data collection is steadily giving way among contractors to custom-designed or commercial software, a trend that is likely to be more prevalent over the next three years. Nearly three-quarters of respondents say they were satisfied with using software as a way to collect data.

Most pros (65% of the ones polled) still store their digital information in on-premise servers. But 37% have turned to third-party cloud providers, such as Amazon, to host their field information. The benefits of using the cloud are manifold, the most prominent being the ability to access data from the field while working in the office or remote locations, and vice versa.

Well over half of the contractors surveyed deploy mobile phone apps and cameras to collect and send data from the field. Expect that wave of data to rise, as drones, sensors, and wearables gain more traction as jobsite tools. However, contractors are also acutely aware of how their use of devices presents security risks. That explains why 86% of contractors say they are using anti-malware software, 78% are using enterprise-grade firewalls, and 56% have imposed policies for managing the use of mobile devices.

a plan to gather data

More than one-fifth of contractors surveyed have had experience with predictive analysis of data and business intelligence. That compares with just 7% for artificial intelligence and 6% for machine learning. The largest group of respondents noted they are aware of and understand the concepts of each of these emerging technologies but have not implemented them in their own organizations—39% for predictive analysis, 47% for artificial intelligence, and 33% for machine learning.

But it is clear that technology is advancing faster than the AEC industry’s ability to assimilate it. The report’s authors offer a multi-step process to structure a company’s data collection, analysis, and reporting.

• Determine what aspects of project delivery would benefit most from better information to guide your data strategy.

• Identify which types of field data will best-enable the proper analysis to generate critical decision-support information. And think about the minimum level of completeness, accuracy, and timeliness required for each type.

• Develop a focused technology and plan for collection and analysis that incorporates the specific data needed and types of analysis required, as well as financial and human capital investments, the time frames for implementation, clear roles of responsibility, and measurable goals for success.

The report includes two case studies—how Leander Construction is using the cloud to enhance productivity; and how W. Soule & Co. is using data to build better—as well as a Q&A with Jit Kee Chin, Suffolk Construction’s Chief Data Officer. Chin laments that what’s keeping AI from becoming a more efficient construction tool is the lack of useful data. Her viewpoint may explain why she sees “great potential” in automated monitoring.

Related Stories

Adaptive Reuse | Nov 1, 2023

Biden Administration reveals plan to spur more office-to-residential conversions

The Biden Administration recently announced plans to encourage more office buildings to be converted to residential use. The plan includes using federal money to lend to developers for conversion projects and selling government property that is suitable for conversions.

Sustainability | Nov 1, 2023

Tool identifies financial incentives for decarbonizing heavy industry, transportation projects

Rocky Mountain Institute (RMI) has released a tool to identify financial incentives to help developers, industrial companies, and investors find financial incentives for heavy industry and transport projects.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Sponsored | MFPRO+ Course | Oct 30, 2023

For the Multifamily Sector, Product Innovations Boost Design and Construction Success

This course covers emerging trends in exterior design and products/systems selection in the low- and mid-rise market-rate and luxury multifamily rental market. Topics include facade design, cladding material trends, fenestration trends/innovations, indoor/outdoor connection, and rooftop spaces.

Giants 400 | Oct 30, 2023

Top 170 K-12 School Architecture Firms for 2023

PBK Architects, Huckabee, DLR Group, VLK Architects, and Stantec top BD+C's ranking of the nation's largest K-12 school building architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 100 K-12 School Construction Firms for 2023

CORE Construction, Gilbane, Balfour Beatty, Skanska USA, and Adolfson & Peterson top BD+C's ranking of the nation's largest K-12 school building contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Oct 30, 2023

Top 80 K-12 School Engineering Firms for 2023

AECOM, CMTA, Jacobs, WSP, and IMEG head BD+C's ranking of the nation's largest K-12 school building engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

MFPRO+ Special Reports | Oct 27, 2023

Download the 2023 Multifamily Annual Report

Welcome to Building Design+Construction and Multifamily Pro+’s first Multifamily Annual Report. This 76-page special report is our first-ever “state of the state” update on the $110 billion multifamily housing construction sector.

Giants 400 | Oct 23, 2023

Top 115 Multifamily Construction Firms for 2023

Clark Group, Suffolk Construction, Summit Contracting Group, Whiting-Turner Contracting, and McShane Companies top the ranking of the nation's largest multifamily housing sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue for all multifamily buildings work, including apartments, condominiums, student housing facilities, and senior living facilities.

Senior Living Design | Oct 19, 2023

Senior living construction poised for steady recovery

Senior housing demand, as measured by the change in occupied units, continued to outpace new supply in the third quarter, according to NIC MAP Vision. It was the ninth consecutive quarter of growth with a net absorption gain. On the supply side, construction starts continued to be limited compared with pre-pandemic levels.