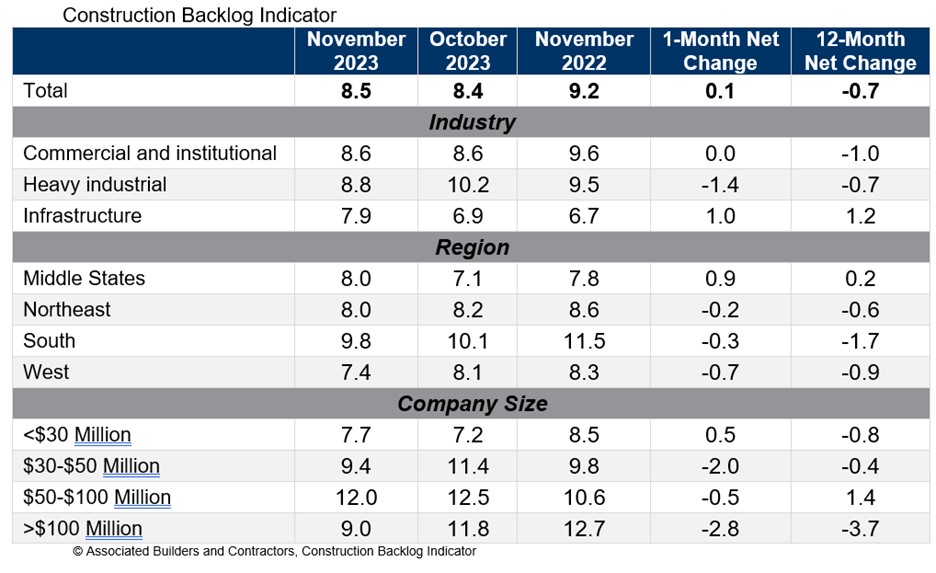

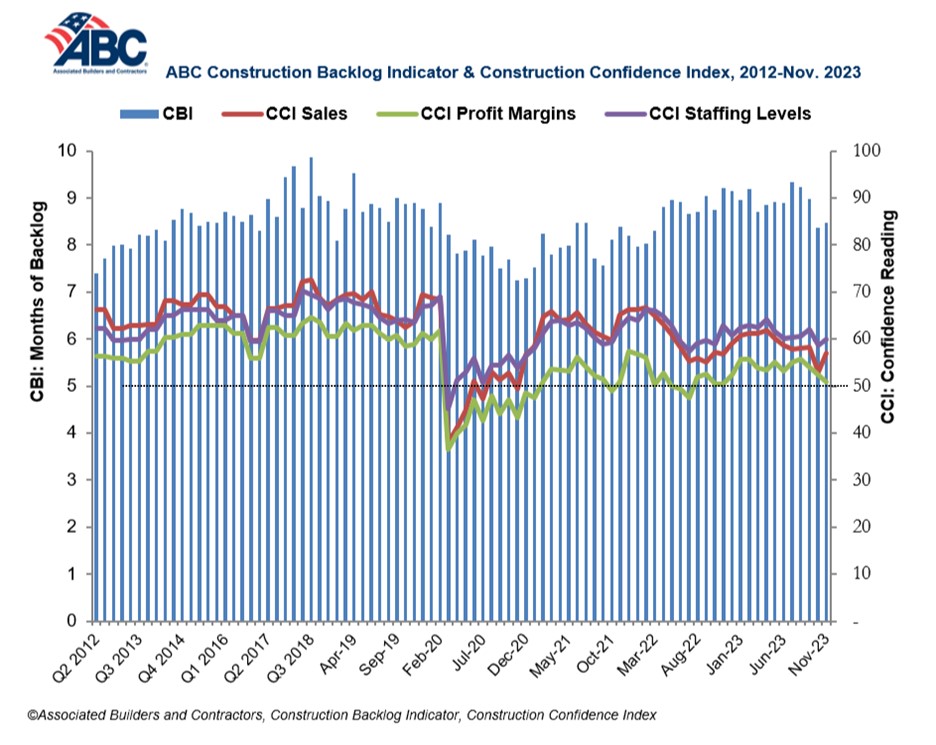

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for November. View the full Construction Backlog Indicator and Construction Confidence Index data series.

Despite the monthly increase, backlog is currently 0.8 months lower than at July’s cyclical peak. The sharpest declines over that span occurred among contractors with more than $100 million in annual revenues, who collectively reported fewer than 10 months of backlog in November for the first time since the second quarter of 2018.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in November, while the reading for profit margins fell. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“A growing number of contractors are reporting declines in backlog,” said ABC Chief Economist Anirban Basu. “The interest rate hikes implemented by the Federal Reserve appear to be making more of a mark on the economy. Not only has the cost of capital risen over the past 20+ months, but credit conditions are also tightening, rendering project financing even more challenging.

“The good news is that certain interest rates have begun to fall in anticipation of Federal Reserve rate cuts next year, perhaps as early as the first quarter,” said Basu. “Still, 2024 is poised to be weaker from a construction demand perspective for many firms, especially those that depend heavily on private developers. Those operating in public construction and/or industrial segments should meet with less resistance on average.”

Related Stories

Contractors | Oct 29, 2021

A grim Market Outlook foresees more shortages that impede construction

Consigli’s new report, though, does offer glimmers of relief on the supply-chain front, and strategies for risk management.

Sustainability | Oct 28, 2021

Reducing embodied carbon in construction, with sustainability leader Sarah King

Sustainability leader Sarah King explains how developers and contractors can use the new EC3 software tool to reduce embodied carbon in their buildings.

Cladding and Facade Systems | Oct 26, 2021

14 projects recognized by DOE for high-performance building envelope design

The inaugural class of DOE’s Better Buildings Building Envelope Campaign includes a medical office building that uses hybrid vacuum-insulated glass and a net-zero concrete-and-timber community center.

Giants 400 | Oct 22, 2021

2021 Retail Giants: Top architecture, engineering, and construction firms in the U.S. retail building sector

Gensler, CallisonRTKL, Kimley-Horn, and Whiting-Turner top BD+C's rankings of the nation's largest retail sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Giants 400 | Oct 22, 2021

2021 Industrial Sector Giants: Top architecture, engineering, and construction firms in the U.S. industrial buildings sector

Ware Malcomb, Clayco, Jacobs, and Stantec top BD+C's rankings of the nation's largest industrial buildings sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Giants 400 | Oct 22, 2021

2021 Airport Sector Giants: Top architecture, engineering, and construction firms in the U.S. airport facilities sector

AECOM, Hensel Phelps, PGAL, and Gensler top BD+C's rankings of the nation's largest airport sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Giants 400 | Oct 22, 2021

2021 Sports Facilities Giants: Top architecture, engineering, and construction firms in the U.S. sports and recreation facility sector

AECOM, Populous, Kimley-Horn, and HOK top BD+C's rankings of the nation's largest sports and recreation facility sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Multifamily Housing | Oct 21, 2021

Chicago’s historic Lathrop public housing complex gets new life as mixed-income community

A revitalized New Deal–era public housing community in Chicago brings the Garden City movement of yesteryear into the 21st century.

Sponsored | BD+C University Course | Oct 15, 2021

7 game-changing trends in structural engineering

Here are seven key areas where innovation in structural engineering is driving evolution.

| Oct 14, 2021

Inside the KCI Airport Terminal Workforce Enhancement Program

The construction and development team for Kansas City International airport's new terminal discuss their Strategic Partnership Program to encourage participation by local minority- and women-owned enterprises, and their Work Training Program to train and hire local KC residents for trade jobs on the KCI Terminal project.