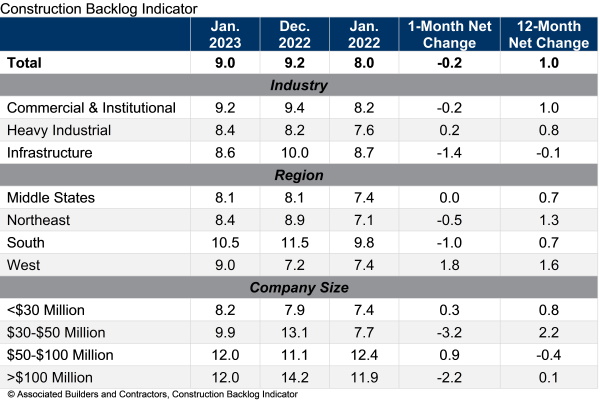

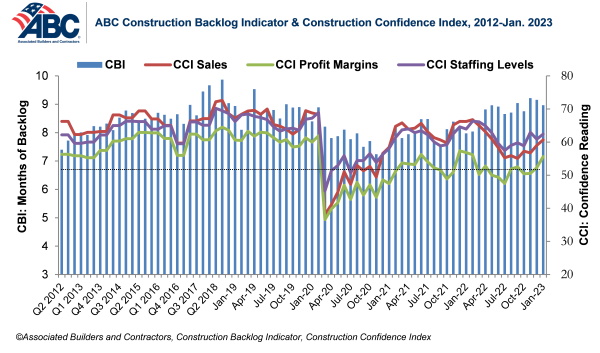

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for January. View the historical Construction Backlog Indicator and Construction Confidence Index data series.

Despite the decline in January, backlog remains elevated by historical standards and is 0.1 months higher than in February 2020, the month before the COVID-19 pandemic began to impact the economy.

ABC’s Construction Confidence Index reading for sales, profit margins and staffing levels increased in January. All three readings remain above the threshold of 50, indicating expectations of growth over the next six months.

“Despite extremely elevated borrowing costs, worker shortages and a generally downcast economic outlook, contractor confidence rebounded in January to a level not seen since the first half of 2022,” said ABC Chief Economist Anirban Basu. “Given the recent employment report, the U.S. economy continues to fend off recession. Some economists have concluded that rather than a hard or soft landing, the U.S. economy is headed for ‘no landing,’ meaning that economic growth will continue despite rising interest rates.

“However, the incredibly strong January jobs report makes it more likely that the Federal Reserve will maintain higher borrowing costs for a longer period,” said Basu. “Eventually, that could cause the economic expansion to unravel, perhaps later this year. That could set the stage for diminished backlog and less confidence for contractors that specialize in privately financed projects as 2024 approaches.”

Related Stories

Museums | Feb 9, 2015

Herzog & de Meuron's M+ museum begins construction in Hong Kong

When completed, M+ will be one of the first buildings in the Foster + Partners-planned West Kowloon Cultural District.

Multifamily Housing | Feb 9, 2015

GSEs and their lenders were active on the multifamily front in 2014

Fannie Mae and Freddie Mac securitized more than $57 billion for 850,000-plus units.

Contractors | Feb 9, 2015

Construction firms reach highest employment total since February 2009

Construction employers added 39,000 jobs in January and 308,000 over the past year, reaching the highest employment total since February 2009.

BIM and Information Technology | Feb 8, 2015

BIM for safety: How to use BIM/VDC tools to prevent injuries on the job site

Gilbane, Southland Industries, Tocci, and Turner are among the firms to incorporate advanced 4D BIM safety assessment and planning on projects.

Museums | Feb 6, 2015

Tacoma Art Museum's new wing features sun screens that operate like railroad box car doors

The 16-foot-tall screens, operated by a hand wheel, roll like box car doors across the façade and interlace with a set of fixed screens.

Cultural Facilities | Feb 6, 2015

Architects look to ‘activate’ vacant block in San Diego with shipping container-based park

A team of alumni from the NewSchool of Architecture and Design in San Diego has taken over a 28,500-sf empty city block in that metro to create what they hope will be a revenue-generating urban park.

Multifamily Housing | Feb 6, 2015

Fannie Mae to offer lower interest rates to LEED-certified multifamily properties

For certified properties, Fannie Mae is now granting a 10 basis point reduction in the interest rate of a multifamily refinance, acquisition, or supplemental mortgage loan.

Codes and Standards | Feb 6, 2015

Obama executive order requires federal construction projects to consider flood damage caused by climate change

To meet the new standard, builders must build two feet above the currently projected elevation for 100-year floods for most projects.

HVAC | Feb 6, 2015

ASHRAE, REHVA publish guide to chilled beam systems

The guide provides tools and advice for designing, commissioning, and operating chilled-beam systems.

Contractors | Feb 6, 2015

Census Bureau: Capital spending by U.S. businesses increased 4.5%

Of the 19 industry sectors covered in the report, only one had a statistically significant year-to-year decrease in capital spending: the utilities sector.