The pressure to reduce cap-ex and op-ex costs in the data center sector, while meeting an ever-growing demand for IT capacity, is driving owners and operators to employ advanced tools and services for the precise tracking and monitoring of nearly every component within their installations—from energy performance and power reliability to IT systems capacity and space utilization.

With better information, and more of it, data center owners believe they will be able to extend the life and optimize the performance of their buildings and IT infrastructure, enabling them to defer, or even avoid, costly upgrades, renovations, expansions, and new construction projects.

The demand for sophisticated monitoring solutions has spurred a new market segment—data center infrastructure management (DCIM)—that is likely to impact the way data center projects are planned, designed, built, and operated.

“DCIM is a powerful tool, when properly designed and deployed, to help manage the capacity, delivery, consumption, and energy across a data center,” says Jay Chester, PE, Senior Project Manager with SSOE’s Advanced Technology group (www.ssoe.com). “The data captured for analysis models can be structured to help predict performance and allow for ‘what if’ testing of equipment placement and operational scheduling.”

While still in its infancy, the DCIM movement is expected to grow sixfold by 2020, according to a new report by Navigant Research (www.navigantresearch.com). The firm’s Research Director, Eric Woods, predicts annual spending on DCIM-related software and services will balloon to more than $4.5 billion over the next six years, from its current market size of $663 million. Moreover, research firm Gartner predicts that 60% of large data centers (at least 3,000 sf) in North America will adopt some type of DCIM solution by 2017.

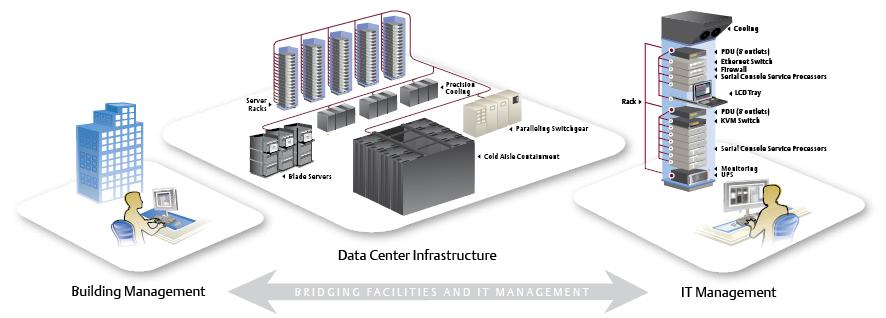

“One of the underlying trends driving the greater adoption and visibility of DCIM solutions is new thinking about the relationship between the building infrastructure for data centers and the IT capacity,” says Woods. “Traditionally, you built the building, put in the basic infrastructure management systems, and largely forgot about it. That is, all the changes occurred at the IT level, in terms of the various evolutions of technology. The two functions—facilities and IT—operated in silos.”

Emerson’s Trellis DCIM platform combines software and hardware into a solution that is managed with a single, Web-enabled, real-time view. It allows data center owners to monitor and measure, in real time, everything from energy and space efficiency to power allocation and server capacity.

Using advanced data collection and monitoring tools, data center providers believe they can bridge the gap between the facilities management function and IT function to offer a holistic, real-time view of their data centers, in an effort to optimize performance, utilization, and longevity.

“What we’re seeing among leading-edge players, as well as in academic research, is moving in the direction of thinking about data centers as a whole unit, sort of like a giant computer,” says Woods. “The data center is a big box that itself is part of the optimized capacity of the computing power in the space.”

DCIM's impact on the Building Team

This more holistic approach to data center planning and operations means that the design table is about to get a little more crowded, as IT managers begin to play a larger role in the planning, design, and preconstruction processes. It also means that Building Teams will be partly responsible for fostering collaboration between their clients’ facilities staff and IT team—two groups with very different priorities and agendas, says Addam Friedl, Senior Vice President, Mission Critical Facilities, with Environmental Systems Design (www.esdesign.com).

“Getting the two sides to sit down at the same table and agree on what the systems are supposed to do, what information needs to be gathered, and how it should be disseminated can be a real challenge, depending on the client,” says Friedl.

A thornier issue, he says, is the mind-boggling amount of data being collected and figuring out how to put it to use. Depending on the scale of the DCIM implementation, data center facilities could be looking at millions of data points that must be collected, organized, and analyzed.

“My challenge to the client is always: What are you going to do with all this data?” says Friedl. “A large data center with just a basic building management system and power monitoring system will have tens of thousands of data points; a DCIM setup could have millions. A lot of operators don’t use the data to the level they think they want to use it to.”

Furthermore, who’s going to be responsible for crunching the data? Facilities? IT? A third-party DCIM provider? An AEC firm? These are questions that need to be sorted out well before the data center is constructed and occupied. Friedl envisions many data center owners outsourcing the DCIM functions, either to an AEC firm involved in the project or a DCIM solutions provider.

Other advice for Building Teams from our experts includes:

Be prepared to coach clients through the DCIM implementation process. Because the movement is so new, clients will likely lean on the Building Team for guidance on everything from choosing the DCIM components to identifying critical data points to figuring out how best to use the data for performance optimization.

Beef up the infrastructure. “As the DCIM system becomes more robust, you’ll need more cabling, a larger cable tray or raceway, and potentially more monitoring capabilities,” says SSOE’s Chester. A more sophisticated control room will also be required. In addition, he says Building Teams will need to design for I/O (input/output) points for gear and equipment that traditionally have not been monitored by a central system.

Flexibility will become more crucial. The ultimate goal of DCIM is to minimize future capital expenditures, so clients will be looking to Building Teams to create facilities that can be easily and inexpensively expanded or reconfigured to keep up with the fast pace of technology and demand for computing power.

Expect to lose business to DCIM solution providers. Some data center clients may choose to completely outsource the DCIM-related functions to a third-party provider, which would almost certainly impact billings on the project.

Related Stories

Urban Planning | Oct 30, 2024

Bridging the gap: How early architect involvement can revolutionize a city’s capital improvement plans

Capital Improvement Plans (CIPs) typically span three to five years and outline future city projects and their costs. While they set the stage, the design and construction of these projects often extend beyond the CIP window, leading to a disconnect between the initial budget and evolving project scope. This can result in financial shortfalls, forcing cities to cut back on critical project features.

M/E/P Systems | Oct 30, 2024

After residential success, DOE will test heat pumps for cold climates in commercial sector

All eight manufacturers in the U.S. Department of Energy’s Residential Cold Climate Heat Pump Challenge completed rigorous product field testing to demonstrate energy efficiency and improved performance in cold weather.

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

Resiliency | Oct 29, 2024

Climate change degrades buildings slowly but steadily

While natural disasters such as hurricanes and wildfires can destroy buildings in minutes, other factors exacerbated by climate change degrade buildings more slowly but still cause costly damage.

Office Buildings | Oct 29, 2024

Editorial call for Office Building project case studies

BD+C editors are looking to feature a roundup of office building projects for 2024, including office-to-residential conversions. Deadline for submission: December 6, 2024.

Healthcare Facilities | Oct 28, 2024

New surgical tower is largest addition to UNC Health campus in Chapel Hill

Construction on UNC Health’s North Carolina Surgical Hospital, the largest addition to the Chapel Hill campus since it was built in 1952, was recently completed. The seven-story, 375,000-sf structure houses 26 operating rooms, four of which are hybrid size to accommodate additional equipment and technology for newly developed procedures.

Sports and Recreational Facilities | Oct 24, 2024

Stadium renovation plans unveiled for Boston’s National Women’s Soccer League

A city-owned 75-year-old stadium in Boston’s historic Franklin Park will be renovated for a new National Women’s Soccer League team. The park, designed by Fredrick Law Olmsted in the 1880s, is the home of White Stadium, which was built in 1949 and has since fallen into disrepair.

Laboratories | Oct 23, 2024

From sterile to stimulating: The rise of community-centric life sciences campuses

To distinguish their life sciences campuses, developers are partnering with architectural and design firms to reimagine life sciences facilities as vibrant, welcoming destinations. By emphasizing four key elements—wellness, collaboration, biophilic design, and community integration—they are setting their properties apart.

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.

MFPRO+ News | Oct 22, 2024

Project financing tempers robust demand for multifamily housing

AEC Giants with multifamily practices report that the sector has been struggling over the past year, despite the high demand for housing, especially affordable products.