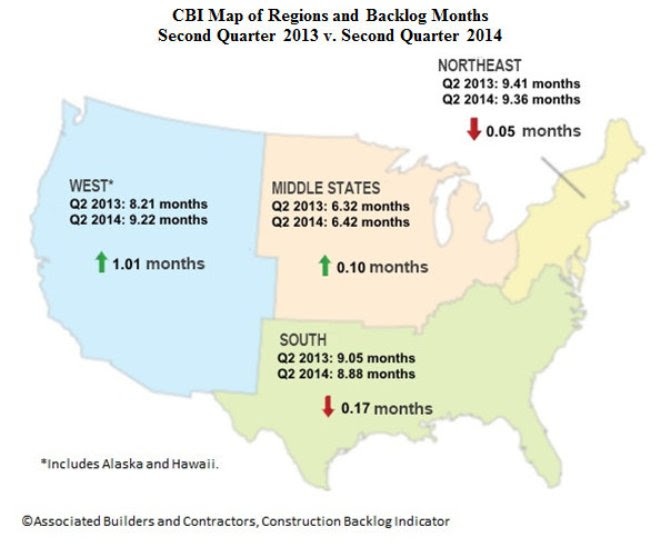

Regional Highlights

- Backlog in the South has fallen just below 9 months, down from 9.14 months in the first quarter and from 9.05 months a year ago.

- The Northeast's backlog now stands at 9.36 months, which is still slightly below where it was this time last year (9.41 months), but an improvement from 8.34 months in the first quarter.

- Backlog in the Middle States is now at 6.42 months compared to 6.32 months a year ago and 6.16 months in the first quarter of 2014.

- The West's backlog stands at 9.22 months, up significantly from 8.21 months on a year-over-year basis and 8.09 months from last quarter.

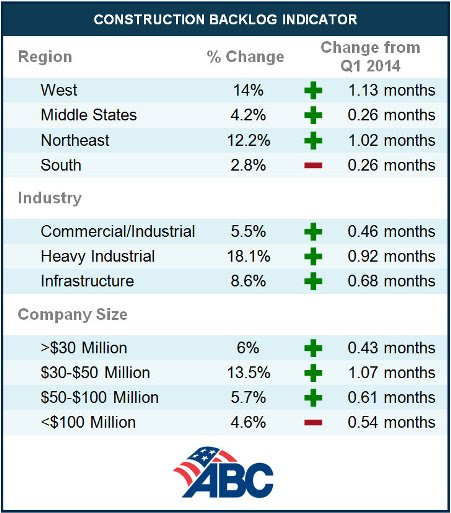

Industry Highlights

- The commercial and institutional segment is just shy of its longest backlog recorded in CBI history at 8.90 months, up from 8.66 months one year ago and 8.44 months in the first quarter.

- Backlog in the heavy industrial segment gained nearly a full month from the first quarter and now stands at 6 months, up from 5.08 months in the first quarter and 5.8 months from the second quarter of 2013.

- Backlog in the infrastructure segment improved to 8.61 months from 7.93 months in the first quarter but is down from 8.96 on a year-over-year basis.

Highlights by Company Size

- The smallest firms, those with revenue less than $30 million, saw their backlog increase to 7.59 months, up from 7.16 months in the first quarter and 6.96 from the second quarter of 2013.

- Backlog from firms with $30-$50 million in revenue increased to 8.97 months, a significant increase from 7.58 months year over year and from 7.9 months from last quarter.

- Firms with revenue between $50-$100 million now have the longest backlog at 11.3 months, up from 10.69 months in the first quarter but down from 11.57 months a year ago.

- The largest firms, those with revenue over $100 million, saw their backlog decrease to 11.16 months from 11.7 months last quarter and 12.25 months a year ago.

Related Stories

Architects | Jan 29, 2018

14 marketing resolutions AEC firms should make in 2018

As we close out the first month of the New Year, AEC firms have made (and are still making) plans for where and how to spend their marketing time and budgets in 2018.

AEC Tech | Jan 29, 2018

thyssenkrupp tests self-driving robot for ‘last mile’ delivery of elevator parts

“With driverless delivery robots, we could fill a gap and get spare parts from our warehouses to the jobsite faster,” said thyssenkrupp SVP Ivo Siebers.

Contractors | Jan 26, 2018

6 regional construction trends for 2018

2018 should be a good year for construction but there are at least 4 things that can influence costs.

K-12 Schools | Jan 25, 2018

Cost estimating for K-12 school projects: An invaluable tool for budget management

Clients want to be able to track costs at every stage of a project, and cost estimates (current and life cycle) are valuable planning and design tools, writes LS3P's Ginny Magrath, AIA.

AEC Tech | Jan 25, 2018

Four high-tech solutions to mitigate theft on the jobsite

Geo-fencing and drone surveillance are among the tech solutions for protecting jobsites from asset loss.

Multifamily Housing | Jan 24, 2018

Apartment rent rates jump 2.5% in 2017, led by small and mid-sized markets

The average price for one-bedroom units increased the most.

Hotel Facilities | Jan 24, 2018

U.S. hotel markets with the largest construction pipelines

Dallas, Houston, and New York lead the way, with more than 460 hotel projects in the works.

Architects | Jan 24, 2018

Strong finish for architecture billings in 2017

The Architecture Billings Index concluded the year in positive terrain, with the December reading capping off three straight months of growth in design billings.

Architects | Jan 10, 2018

7 steps to ending a low growth cycle

Here are the top 10 marketing techniques as rated by high-growth firms and how they compare to their no-growth counterparts.