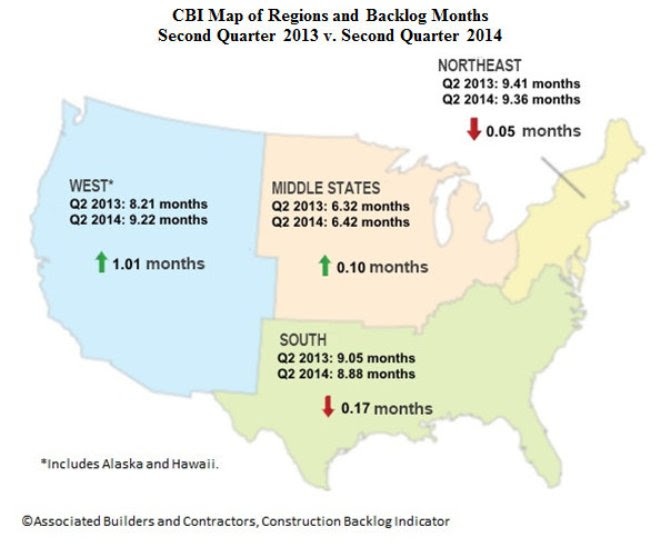

Regional Highlights

- Backlog in the South has fallen just below 9 months, down from 9.14 months in the first quarter and from 9.05 months a year ago.

- The Northeast's backlog now stands at 9.36 months, which is still slightly below where it was this time last year (9.41 months), but an improvement from 8.34 months in the first quarter.

- Backlog in the Middle States is now at 6.42 months compared to 6.32 months a year ago and 6.16 months in the first quarter of 2014.

- The West's backlog stands at 9.22 months, up significantly from 8.21 months on a year-over-year basis and 8.09 months from last quarter.

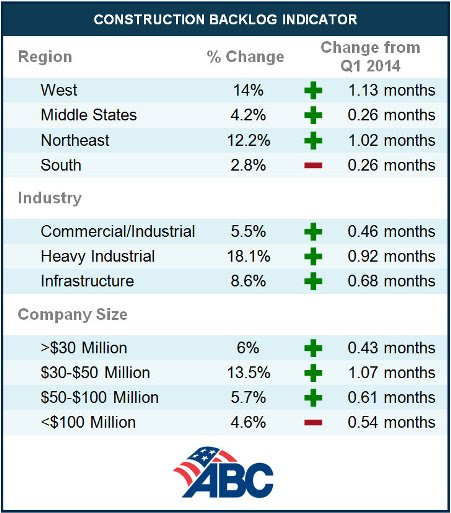

Industry Highlights

- The commercial and institutional segment is just shy of its longest backlog recorded in CBI history at 8.90 months, up from 8.66 months one year ago and 8.44 months in the first quarter.

- Backlog in the heavy industrial segment gained nearly a full month from the first quarter and now stands at 6 months, up from 5.08 months in the first quarter and 5.8 months from the second quarter of 2013.

- Backlog in the infrastructure segment improved to 8.61 months from 7.93 months in the first quarter but is down from 8.96 on a year-over-year basis.

Highlights by Company Size

- The smallest firms, those with revenue less than $30 million, saw their backlog increase to 7.59 months, up from 7.16 months in the first quarter and 6.96 from the second quarter of 2013.

- Backlog from firms with $30-$50 million in revenue increased to 8.97 months, a significant increase from 7.58 months year over year and from 7.9 months from last quarter.

- Firms with revenue between $50-$100 million now have the longest backlog at 11.3 months, up from 10.69 months in the first quarter but down from 11.57 months a year ago.

- The largest firms, those with revenue over $100 million, saw their backlog decrease to 11.16 months from 11.7 months last quarter and 12.25 months a year ago.

Related Stories

| Sep 21, 2010

New BOMA-Kingsley Report Shows Compression in Utilities and Total Operating Expenses

A new report from the Building Owners and Managers Association (BOMA) International and Kingsley Associates shows that property professionals are trimming building operating expenses to stay competitive in today’s challenging marketplace. The report, which analyzes data from BOMA International’s 2010 Experience Exchange Report® (EER), revealed a $0.09 (1.1 percent) decrease in total operating expenses for U.S. private-sector buildings during 2009.

| Sep 21, 2010

Forecast: Existing buildings to earn 50% of green building certifications

A new report from Pike Research forecasts that by 2020, nearly half the green building certifications will be for existing buildings—accounting for 25 billion sf. The study, “Green Building Certification Programs,” analyzed current market and regulatory conditions related to green building certification programs, and found that green building remain robust during the recession and that certifications for existing buildings are an increasing area of focus.

| Sep 21, 2010

Middough Inc. Celebrates its 60th Anniversary

Middough Inc., a top ranking U.S. architectural, engineering and management services company, announces the celebration of its 60th anniversary, says President and CEO, Ronald R. Ledin, PE.

| Sep 16, 2010

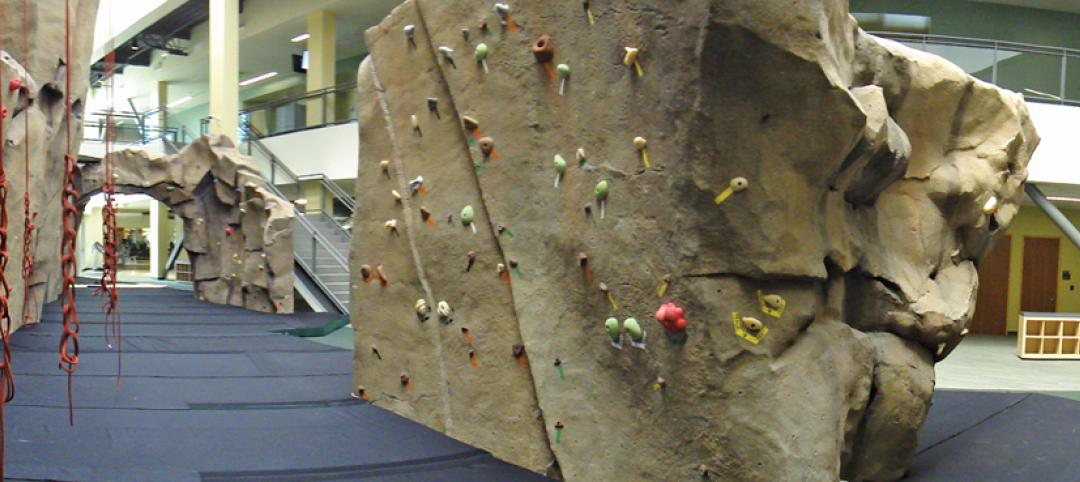

Green recreation/wellness center targets physical, environmental health

The 151,000-sf recreation and wellness center at California State University’s Sacramento campus, called the WELL (for “wellness, education, leisure, lifestyle”), has a fitness center, café, indoor track, gymnasium, racquetball courts, educational and counseling space, the largest rock climbing wall in the CSU system.

| Sep 13, 2010

Community college police, parking structure targets LEED Platinum

The San Diego Community College District's $1.555 billion construction program continues with groundbreaking for a 6,000-sf police substation and an 828-space, four-story parking structure at San Diego Miramar College.