Earlier this week the Small Business Administration and U.S. Treasury Department released a list of recipients from the government’s Paycheck Protection Program (PPP), which so far has allocated $521 billion of the $670 billion approved by Congress under the CARES Act to nearly 659,000 borrowers. The Trump Administration claims that this program has supported 51 million jobs, roughly 84% of whom work for small businesses.

At presstime, SBA hadn't released exactly how much each entity was approved to borrow. And some recipients—like retail and fast-food chains, millionaire rock bands, and a business venture led by NFL quarterback Tom Brady, who earned $23 million last year—have raised questions about the program’s purpose and vetting process.

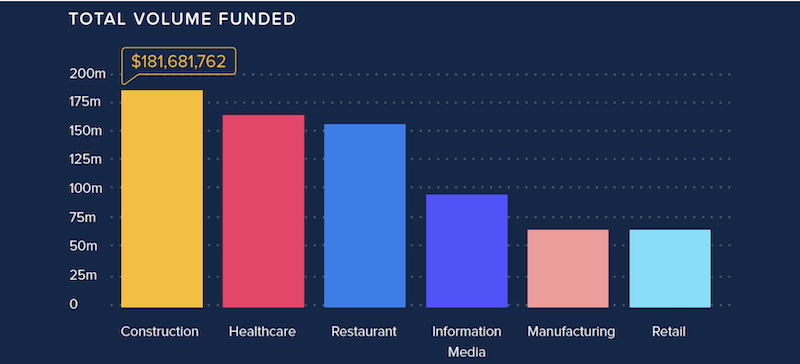

But according to Lendio, a small business marketplace, construction led all industries in total volume among the 100,000 PPP loans totaling $8 billion that Lendio facilitated in partnership with 300 lenders between April 3 and June 30.

FIRST LOAN ROUND LEFT SMALL BUSINESSES STRANDED

The PPP program allowed businesses in many sectors to keep their workers employed even if they were shut down by the coronavirus.

Lendio and its partners tapped into the $350 billion in relief lending that Congress approved in early May, which went primarily to small businesses and small proprietorships.

When Congress approved the first round of PPP loans, its intention was to provide a life raft to businesses forced to close because of the coronavirus pandemic. Borrowers could receive up to 2.5 times their companies’ monthly payrolls, much of which would be forgiven if they keep their workers employed.

However, small businesses struggled to access the first round of PPP loans, totaling $349 billion, which lasted only two weeks and was gobbled up by relatively few businesses. For the second round, Congress earmarked $30 billion specifically for community banks so they wouldn’t have to compete with larger lenders.

The demand was certainly pressing. Lendio points out that prior to participating in the PPP, it had facilitated $2 billion in business loans since its inception in 2011.

The average PPP loan on the Lendio platform is $73,000, versus the national average of $107,000. During the PPP, 30% of the loans that Lendio facilitated went to businesses in urban areas, 28% in the suburbs, and 39% in rural communities. The Pacific and South Atlantic regions of the country accounted for 45% of Lendio’s PPP loans.

LENDIO FACILITATES $182 MILLION IN LOANS TO CONSTRUCTION BORROWERS

About 45% of the PPP loans that Lendio facilitated were to businesses in the Pacific and South Atlantic regions of the U.S.

Of the loans facilitated by Lendio, just under $181.7 million went to businesses in the construction industry, the highest total volume for any sector. Construction was followed by healthcare, restaurants, information media, manufacturing, and retail.

The average loan for construction borrowers was just under $100,000, which ranked fourth by sector, with manufacturing topping this list at $145,568 per loan average.

Lendio estimates that construction borrowers saved 17,500 jobs as a result of the PPP, behind restaurants (31,501 jobs saved), healthcare, and automotive.

ARE MORE LOANS IMMINENT?

Right now, Congress and the White House are debating whether more stimulus is needed, as the coronavirus continues to spread in several areas of the country, with nearly 3.1 confirmed cases of COVID-19 and 133,000 deaths in the U.S., and with hospitalizations rising in 22 states. Some states, cities and towns are reconsidering their plans for reopening their economies.

“Unfortunately, the challenges for small business owners do not end when they receive a PPP loan and great economic uncertainty remains,” writes Lendio. It notes that business owners are now navigating the loan forgiveness process, and others continue to seek financial assistance while operating on thin margins. “As demonstrated throughout the program to date, the need for relief funding is unprecedented and will likely continue as small business owners seek to reopen and rebuild in the coming months.”

Related Stories

M/E/P Systems | Oct 30, 2024

After residential success, DOE will test heat pumps for cold climates in commercial sector

All eight manufacturers in the U.S. Department of Energy’s Residential Cold Climate Heat Pump Challenge completed rigorous product field testing to demonstrate energy efficiency and improved performance in cold weather.

MFPRO+ New Projects | Oct 30, 2024

Luxury waterfront tower in Brooklyn features East River and Manhattan skyline views

Leasing recently began for The Dupont, a 41-story luxury rental property along the Brooklyn, N.Y., waterfront. Located within the 22-acre Greenpoint Landing, where it overlooks the newly constructed Newtown Barge Park, the high-rise features East River and Manhattan skyline views along with 20,000 sf of indoor and outdoor communal space.

Resiliency | Oct 29, 2024

Climate change degrades buildings slowly but steadily

While natural disasters such as hurricanes and wildfires can destroy buildings in minutes, other factors exacerbated by climate change degrade buildings more slowly but still cause costly damage.

Hotel Facilities | Oct 29, 2024

Hotel construction pipeline surpasses 6,200 projects at Q3 2024

According to the U.S. Hotel Construction Pipeline Trend Report from Lodging Econometrics, the total hotel pipeline stands at 6,211 projects/722,821 rooms, a new all-time high for projects in the U.S.

Office Buildings | Oct 29, 2024

Editorial call for Office Building project case studies

BD+C editors are looking to feature a roundup of office building projects for 2024, including office-to-residential conversions. Deadline for submission: December 6, 2024.

Healthcare Facilities | Oct 28, 2024

New surgical tower is largest addition to UNC Health campus in Chapel Hill

Construction on UNC Health’s North Carolina Surgical Hospital, the largest addition to the Chapel Hill campus since it was built in 1952, was recently completed. The seven-story, 375,000-sf structure houses 26 operating rooms, four of which are hybrid size to accommodate additional equipment and technology for newly developed procedures.

Contractors | Oct 25, 2024

Construction industry CEOs kick off effort to prevent suicide among workers

A new construction industry CEO Advisory Council dedicated to addressing the issue of suicide in the construction industry recently took shape. The council will guide an industry-wide effort to develop solutions targeting the high rate of suicide among construction workers.

Sports and Recreational Facilities | Oct 24, 2024

Stadium renovation plans unveiled for Boston’s National Women’s Soccer League

A city-owned 75-year-old stadium in Boston’s historic Franklin Park will be renovated for a new National Women’s Soccer League team. The park, designed by Fredrick Law Olmsted in the 1880s, is the home of White Stadium, which was built in 1949 and has since fallen into disrepair.

Laboratories | Oct 23, 2024

From sterile to stimulating: The rise of community-centric life sciences campuses

To distinguish their life sciences campuses, developers are partnering with architectural and design firms to reimagine life sciences facilities as vibrant, welcoming destinations. By emphasizing four key elements—wellness, collaboration, biophilic design, and community integration—they are setting their properties apart.

Adaptive Reuse | Oct 22, 2024

Adaptive reuse project transforms 1840s-era mill building into rental housing

A recently opened multifamily property in Lawrence, Mass., is an adaptive reuse of an 1840s-era mill building. Stone Mill Lofts is one of the first all-electric mixed-income multifamily properties in Massachusetts. The all-electric building meets ambitious modern energy codes and stringent National Park Service historic preservation guidelines.