Although the construction recovery continues to lag other sectors as well as the overall U.S. economy, the industry is finally seeing a rebound. Commercial real estate giant Jones Lang LaSalle recently released its Summer 2013 Construction Highlights report, which found that there are some sectors (such as energy and high-tech) driving demand for construction, while a few major cities are starting to record increased levels of speculative office building developments. However, with construction demand on the rise in some areas, JLL documents labor shortages and material costs increasing as well.

Local Markets

The recovery theme in the U.S. construction industry can be easily identified as lagging other sectors and the overall U.S. economy. Among many challenges specific to the construction industry, the fact that the overall US.. labor market recovery has been so prolonged is not helping a rebound in construction, which depends on a growing workforce to expand demand across property types. The previous “bright spot” in the construction world – public construction – has taken a backseat in the recovery as the Federal government trims budgets and pulls back on pending.

While job numbers year-over-year are improved, construction employment was hard hit in the month of April, showing a net loss of 6,000 jobs, very much a function of pullback in non-residential sectors including public construction. With the long-awaited rebound in the housing market now permeating the single-family realm, however, job gains and increases in construction-put-in place for residential construction have materialized, and should fuel stronger growth. President Obama’s persistent efforts to increase infrastructure construction funding and MAP-21 investment, already accounted for in budgets, could also ultimately help shore up weaker areas of the construction industry during the next 12 months.

Market Highlights

· Seattle: Technology drives construction, with just over 1 MSF delivered in 2012, much of it pre-leased to Amazon. The spec development pipeline is picking up.

· Portland: Owner-user office development comprises the major projects under construction. Several speculative projects are proposed, but adaptive reuse is the preferred strategy.

· San Francisco: Office and multi-family construction is booming as developers work to meet demand from the growing economy, driven by the technology industry.

· Los Angeles: The first skyscraper to be added to the CBD in over 20 years is underway. Upon completion, the Wilshire Grand will feature retail, office and hospitality components.

· Orange County: Vacancy remains high and rents are still too low to justify any spec development at this time. However, four sizable build-to-suit projects are currently underway.

· Boston: Four build-to-suit projects are underway totaling 2.5 MSF in Boston. Cambridge has 2.5 MSF of new construction (38% lab space, 62% office).

· New York: Construction to begin on more than 5.0 MSF of office space during the next five years, with potentially 25 MSF delivered over next two decades.

· Philadelphia: Liberty Property Trust will break ground on a build-to-suit project for Vanguard. The six-story, 205,000 SF facility will be built to meet LEED standards.

· Washington DC: Nearly 6.2 MSF of office construction is underway. Over one-third of the under construction inventory has garnered preleases.

· Atlanta: Demand for interior build outs up in the last six to nine months; upward pressure on construction costs. Pricing has bottomed and expected to rise due to housing market improvements.

· Minneapolis: Construction activity is on the rise, but so are costs. Construction prices increased 3.2% since last year. Recent negotiations with labor unions will result in average annual increases in labor costs of 2-2.5% through 2016.

· Chicago: No office construction is underway, but River Point is in development stages and broke ground in Q4 2012. Multifamily in the Loop and River North is expanding aggressively, with about 1,000 units under construction.

· Dallas: Availability of the trades is becoming an issue as new construction activity accelerates. This will likely lead to higher labor costs and the need for higher contingencies in project proformas.

· Houston: Houston’s booming energy market continues to drive new office construction. Houston’s CBD market is expecting 4 MSF of new office deliveries in the next 36 to 48 months.

Related Stories

University Buildings | Dec 5, 2023

The University of Cincinnati builds its largest classroom building to serve its largest college

The University of Cincinnati’s recently completed Clifton Court Hall unifies the school’s social science programs into a multidisciplinary research and education facility. The 185,400-sf structure is the university’s largest classroom building, serving its largest college, the College of Arts and Sciences.

MFPRO+ News | Dec 5, 2023

DOE's Zero Energy Ready Home Multifamily Version 2 released

The U.S. Department of Energy has released Zero Energy Ready Home Multifamily Version 2. The latest version of the certification program increases energy efficiency and performance levels, adds electric readiness, and makes compliance pathways and the certification process more consistent with the ENERGY STAR Multifamily New Construction (ESMFNC) program.

Architects | Dec 5, 2023

Populous celebrates its 40th anniversary with a photo exhibit of its works

The firm partnered with Getty Images to assemble more than 60 images, many capturing fan ardor.

Office Buildings | Dec 1, 2023

Amazon office building doubles as emergency housing for Seattle families

The unusual location for services of this kind serves over 300 people per day. Mary's Place spreads across eight of the office's floors—all designed by Graphite—testing the status quo for its experimental approach to homelessness support.

Mixed-Use | Nov 29, 2023

Mixed-use community benefits from city amenities and ‘micro units’

Salt Lake City, Utah, is home to a new mixed-use residential community that benefits from transit-oriented zoning and cleverly designed multifamily units.

Giants 400 | Nov 28, 2023

Top 100 Laboratory Design Firms for 2023

HDR, Flad Architects, DGA, Elkus Manfredi Architects, and Gensler top BD+C's ranking of the nation's largest laboratory architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Engineers | Nov 27, 2023

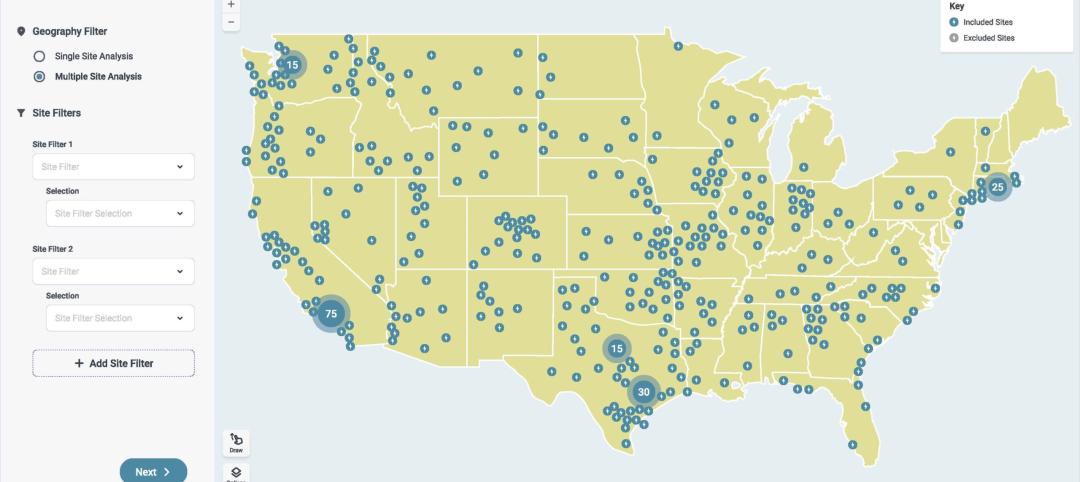

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Resiliency | Nov 27, 2023

All levels of government need to act to cope with climate-driven flooding and sea level rise

The latest National Climate Assessment highlights the need for local, state, and federal governments to adopt policies to mitigate the effects of climate-driven flooding and sea level rise, according to a policy expert with the National Resources Defense Council.

Data Centers | Nov 22, 2023

How is artificial intelligence impacting data center design?

As AI is reshaping how we interact with machines and the world around us, the design of data centers needs to adapt to this fast-changing landscape. So, Page pairs expert thinking with high-performing solutions to meet the needs of rapidly advancing technologies.