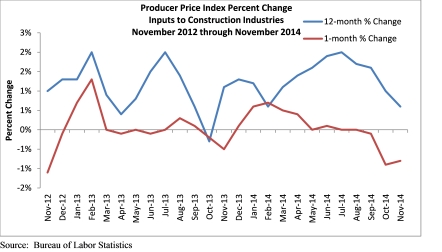

Construction input prices dipped 1.4% during the final month of 2014 and are down nearly 1% on a year-over-year basis, according to the Jan. 15 producer price index release from the U.S. Department of Labor.

Inputs to nonresidential construction fell even further, down 1.7% for the month and 1.9% year over year. December's report marks the sharpest decline in input prices since late 2008 during the global financial crisis and the fifth consecutive month construction materials prices have failed to rise.

"Without question, financial markets have been unnerved by the recent declines in oil, copper and other commodity prices, although that jitteriness does not necessarily imply a serious economic problem in America," said Associated Builders and Contractors Chief Economist Anirban Basu. "The fact is the U.S. economy has performed handsomely over the past nine months, according to most metrics, and conventional wisdom suggests that it can continue to expand at or above trend rates of growth despite economic weakening in Europe, China and elsewhere. This is further evidenced by the World Bank's recent downgrade of its forecasts for global growth in 2015 and 2016, while it upgraded its outlook for the United States.

"Overall, the view that U.S. domestic demand for construction services and most other services continues to expand is consistent with the fact that some domestically produced and consumed materials actually registered price increases last month," said Basu. "Note that concrete prices are up by 5% on a year-over-year basis while natural gas prices are up by 10%."

The following materials prices increased in December:

• Prices for plumbing fixtures expanded 0.1% in December and are up 3.1% on a year-over-year basis.

• Concrete products prices expanded 0.7% in December and are up 5% on a yearly basis.

• Natural gas prices expanded 19.7% in December and are 10% higher than one year ago.

• Fabricated structural metal product prices grew 0.3% for the month and have expanded 1.5% on a year-over-year basis.

• Seven of the 11 key construction inputs did not experience price increases for the month.

• Iron and steel prices fell 1% in December and are down 3.9% from the same time last year.

• Nonferrous wire and cable prices fell 1.6% on a monthly basis and 1.5% on a yearly basis.

• Prices for prepared asphalt, tar roofing, and siding fell 1% for the month but are up 1.9% on a year-ago basis.

• Steel mill products prices fell 1.3% for the month but are 0.4% higher than one year ago.

• Softwood lumber prices fell 1.3% in December but are 0.3% higher than one year ago.

• Crude petroleum prices fell 18.9% in December and are down 37.1% from the same time last year.

• Crude energy materials prices fell 4.7% in December but are 19.6% lower year-over-year.

Related Stories

| Aug 11, 2010

PCA partners with MIT on concrete research center

MIT today announced the creation of the Concrete Sustainability Hub, a research center established at MIT in collaboration with the Portland Cement Association (PCA) and Ready Mixed Concrete (RMC) Research & Education Foundation.

| Aug 11, 2010

Study explains the financial value of green commercial buildings

Green building may be booming, especially in the Northwest, but the claims made for high-performance buildings have been slow to gain traction in the financial community. Appraisers, lenders, investors and brokers have found it difficult to confirm the value of high-performance green features and related savings. A new study of office buildings identifies how high-performance green features and systems can increase the value of commercial buildings.

| Aug 11, 2010

Architecture Billings Index flat in May, according to AIA

After a slight decline in April, the Architecture Billings Index was up a tenth of a point to 42.9 in May. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. Any score above 50 indicates an increase in billings.

| Aug 11, 2010

Architecture Billings Index drops to lowest level since June

Another stall in the recovery for the construction industry as the Architecture Billings Index (ABI) dropped to its lowest level since June. The American Institute of Architects (AIA) reported the August ABI rating was 41.7, down slightly from 43.1 in July. This score indicates a decline in demand for design services (any score above 50 indicates an increase in billings).

| Aug 11, 2010

RTKL names Lance Josal president and CEO

Lance K. Josal FAIA has been named President and CEO of RTKL Associates Inc., the international planning, design and engineering firm. Josal succeeds RTKL’s current President and CEO, David C. Hudson AIA, who is retiring from the firm. The changes will take effect on 1 September 2009.

| Aug 11, 2010

Balfour Beatty agrees to acquire Parsons Brinckerhoff for $626 million

Balfour Beatty, the international engineering, construction, investment and services group, has agreed to acquire Parsons Brinckerhoff for $626 million. Balfour Beatty executives believe the merger will be a major step forward in accomplishing a number of Balfour Beatty’s objectives, including establishing a global professional services business of scale, creating a leading position in U.S. civil infrastructure, particularly in the transportation sector, and enhancing its global reach.

| Aug 11, 2010

Construction unemployment rises to 17.1% as another 64,000 construction workers are laid off in September

The national unemployment rate for the construction industry rose to 17.1 percent as another 64,000 construction workers lost their jobs in September, according to an analysis of new employment data released today. With 80 percent of layoffs occurring in nonresidential construction, Ken Simonson, chief economist for the Associated General Contractors of America, said the decline in nonresidential construction has eclipsed housing’s problems.

| Aug 11, 2010

Billings at U.S. architecture firms exceeds $40 billion annually

In the three-year period leading up to the current recession, gross billings at U.S. architecture firms increased nearly $16 billion from 2005 and totaled $44.3 billion in 2008. This equates to 54 percent growth over the three-year period with annual growth of about 16 percent. These findings are from the American Institute of Architects (AIA) Business of Architecture: AIA Survey Report on Firm Characteristics.