??Construction growth is looking up, according to the Winter 2013 release of the periodic report Construction Economics, authored by Gilbane Building Company. Construction spending for 2013 will finish the year 5% higher than 2012. All of the growth will be attributed to residential construction. However, the Dodge Momentum Index, a leading indicator, is up more than 20% since January 2013, indicating growth in 2014. ??

The Architecture Billings Index (ABI) dropped below 50 in April, briefly indicating declining workload. Through September, we’ve seen five more months of growth, a good leading indicator for future new construction work. In October we’ve just had another drop, but not below 50, indicating slower gains rather than declines.

??ENR published selling price data for 2013 that shows contractors adding to their margins.

Some economic factors are still negative:

- ??The monthly rate of spending for nonbuilding infrastructure may climb from September through January, but then may decline by 10% through 2014. ??An anticipated decline in spending from February to May 2014 is influenced only mildly by a slight dip in nonresidential buildings and a flattening in residential but is influenced strongly by a steep decline in nonbuilding infrastructure spending.

- ??The construction workforce is still 25% below the peak. It will take a minimum of four more years to return to peak levels.

- ??As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity, and the ability to readily increase construction volume.

Impact of recent events:

- ??FMI’s Third Quarter 2013 Construction Outlook Report mentions a few reasons why spending is not rapidly increasing: the decline in public construction as sequestration continues; lenders are still tight with lending criteria and consumers are still cautious about increasing debt load, and that includes the consumers’share of public debt.

- ??Comments regarding the outlook for economic stimulus have recently caused interest rates to increase rapidly. Lending criteria is still tight and borrowers are cautious about taking on new debt. Rates will continue to rise and borrowing costs will add potential cost to future funding of projects. The cheapest time to build is now behind us.

- ??Construction jobs growth has slowed. Jobs grew by 90,000 in the first half of 2013, but have grown by only 33,000 since June.

The impacts of growth:

- ??Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- ??As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ??ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices up on average about 2% to 2.5% year over year. However, selling price indices are up on average 4%. The difference between these indices is increased margins.

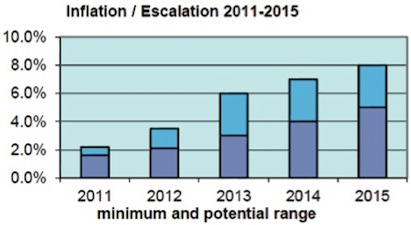

Supported by overall positive growth trends for the year 2013, expect margins and overall escalation to climb more rapidly than we have seen in five years.

Nonresidential buildings construction slowed in the first five months but is expected to increase substantially in the last few months of 2013. We will see a decline in nonbuilding infrastructure extend completely through 2014. Residential work will remain extremely active. Once growth in nonresidential construction picks up, and both residential and nonresidential are active, we will begin to see more significant labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. Even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here for the full report.

About Gilbane

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Author Ed Zarenski, a 40-year construction veteran and a member of the Gilbane team for more than 33 years, is an Estimating Executive who has managed multimillion dollar project budgeting, owner capital plan cost control, value engineering and life cycle cost analysis. He compiles economic information and provides data analysis and opinion for this quarterly report.

Related Stories

| Feb 10, 2011

Zero Energy Buildings: When Do They Pay Off in a Hot and Humid Climate?

There’s lots of talk about zero energy as the next big milestone in green building. Realistically, how close are we to this ambitious goal? At this point, the strategies required to get to zero energy are relatively expensive. Only a few buildings, most of them 6,000 sf or less, mostly located in California and similar moderate climates, have hit the mark. What about larger buildings, commercial buildings, more problematic climates? Given the constraints of current technology and the comfort demands of building users, is zero energy a worthwhile investment for buildings in, for example, a warm, humid climate?

| Feb 9, 2011

Hospital Construction in the Age of Obamacare

The recession has hurt even the usually vibrant healthcare segment. Nearly three out of four hospital systems have put the brakes on capital projects. We asked five capital expenditure insiders for their advice on how Building Teams can still succeed in this highly competitive sector.

| Feb 9, 2011

Businesses make bigger, bolder sustainability commitments

In 2010, U.S. corporations continued to enhance their sustainable business efforts by making bigger, bolder, longer-term sustainability commitments. GreenBiz issued its 4th annual State of Green Business report, a free downloadable report that measures the progress of U.S. business and the economy from an environmental perspective, and highlights key trends in corporate culture in regard to the environment.

| Feb 8, 2011

AIA names 104 members to College of Fellows

The Fellowship program was developed to elevate those architects who have made a significant contribution to architecture and society and who have achieved a standard of excellence in the profession. Election to fellowship not only recognizes the achievements of architects as individuals, but also their significant contribution to architecture and society on a national level.

| Feb 4, 2011

President Obama: 20% improvement in energy efficiency will save $40 billion

President Obama’s Better Buildings Initiative, announced February 3, 2011, aims to achieve a 20% improvement in energy efficiency in commercial buildings by 2020, improvements that will save American businesses $40 billion a year.

| Jan 31, 2011

Cuningham Group Architecture launches Healthcare studio with Lee Brennan

International design firm Cuningham Group Architecture, P.A. (Cuningham Group) has announced the arrival of Lee Brennan, AIA, as Principal and Leader of its new Healthcare studio. Brennan comes to Cuningham Group with over 30 years of professional experience, 22 of those years in healthcare, encompassing all aspects of project delivery, from strategic planning and programming through design and construction. The firm’s new Healthcare studio will enhance Cuningham Group’s expertise in leisure and entertainment, education, mixed-use/housing and workplace environments.

| Jan 31, 2011

HDR Architecture Releases Evidence-based Design Videos

As a follow-up to its book Evidence-based Design for Healthcare Facilities, HDR Architecture, Inc. has released three video case studies that highlight evidence-based design principles in action.

| Jan 31, 2011

CISCA releases White Paper on Acoustics in Healthcare Environments

The Ceilings & Interior Systems Construction Association (CISCA) has released an extensive white paper “Acoustics in Healthcare Environments” for architects, interior designers, and other design professionals who work to improve healthcare settings for all users. This white paper serves as a comprehensive introduction to the acoustical issues commonly confronted on healthcare projects and howbest to address those.

| Jan 28, 2011

Firestone Building Products Unveils FirestoneRoof Mobile Web App

Firestone Building Products Company unveiled FirestoneRoof, a first-of-its-kind free mobile web app. The FirestoneRoof mobile web app enables customers to instantly connect with Firestone commercial roofing experts and is designed to make it easier for building owners, facility managers, roofing consultants and others charged with maintaining commercial roofing systems to get the support they need, when they need it.

| Jan 27, 2011

Perkins Eastman's report on senior housing signals a changing market

Top international design and architecture firm Perkins Eastman is pleased to announce that the Perkins Eastman Research Collaborative recently completed the “Design for Aging Review 10 Insights and Innovations: The State of Senior Housing” study for the American Institute of Architects (AIA). The results of the comprehensive study reflect the changing demands and emerging concepts that are re-shaping today’s senior living industry.