Construction employment continued to show strength across much of the United States through November 2017, when there were 191,000 more workers in the construction industry than during the same month a year earlier, and the construction unemployment rate fell by 0.7% to 5%, the lowest it’s been on record for the month of November, according to estimates released yesterday by Associated Builders and Contractors, a national trade group representing more than 21,000 members.

However, the industry still struggles with labor shortages that could be inhibiting investment and new construction.

During the first nine months of 2017, month-by-month employment growth was “minimal,” due primarily to “historically low unemployment” that limited the new construction talent pool, according to JLL’s Construction Outlook for the third quarter of 2017, which the market research and consulting firm released late last month.

During the third quarter of 2017, construction-related spending inched up by only 1.9% from the same period in 2016. “While topline spending is still increasing, consecutive quarters are demonstrating smaller and smaller gains over past years—underlining the trajectory towards a mature and stable industry,” JLL writes. Percentage growth of year-over-year spending decreased for nine out of the preceding 11 months, but was still above zero, “pointing to a tapering growth curve.”

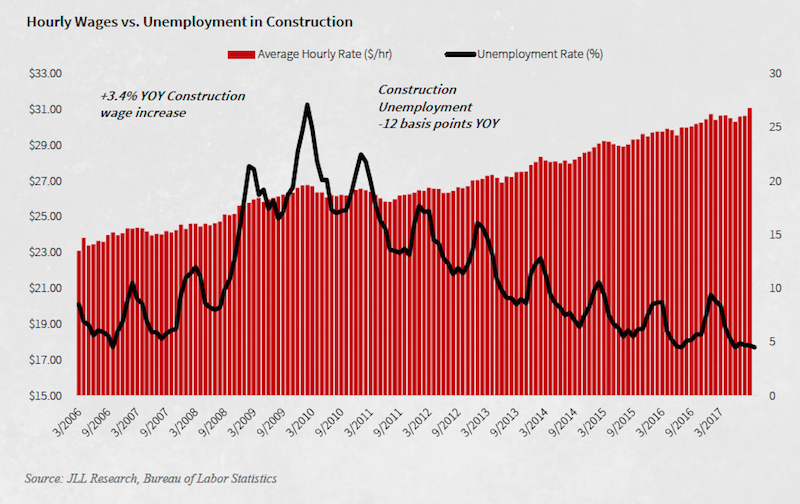

With qualified construction workers being harder to find, labor costs were volatile through the first nine months of last year. Image: JLL Research

Citing Census Bureau estimates, Associated Builders and Contractors posted that nonresidential construction spending declined in November by 1.3%, to $719.2 billion, compared to the same month a year earlier. Private nonres spending was down by 3.1%, while public-sector nonres spending grew by 1.7%. The gainers included commercial, educational, lodging, transportation, healthcare, and public safety. Manufacturing construction took the biggest hit, down 15.6%.

Commercial real estate has proven over the past several years that it can perform well regardless of how the economy in general is growing. “Right now we see little in fundamentals to cause concern about real estate as an asset class,” JLL writes.

Public construction, infrastructure and public works projects picked up steam during the third quarter of 2017, while single-family home construction grew at nearly double-digit annualized growth, which is expected to continue in 2018. Multifamily starts, on the other hand, dipped.

While the groundbreaking of large scale private commercial projects began to scale back due to stretched-out timelines, commercial renovation and fit-out work strengthened, and should prevail through the next several quarters and beyond into 2019, JLL predicts.

The cost of building slowed in the third quarter, up by just 3% from third quarter 2016. But it still grew faster than construction spending primarily because of increasing labor costs. (Wages grew by nearly 3.4%, on an annualized basis, in the third quarter of 2017.) Indeed, JLL expects labor shortages to persist through 2018, at least, and for construction costs to be up another 3% this year. JLL expects wage growth to accelerate, potentially hitting 5% or higher during peak building seasons.

The severe weather events that hit certain areas of the country had a surprisingly minor impact on the availability of most building materials. Nevertheless, materials costs rose by 3% in the third quarter compared to the same period a year ago, and those costs “are beginning to outpace current demand,” says JLL. Impending tariffs on Canadian lumber imports could jack up lumber prices for U.S. purchasers by 20% this year.

Manpower shortages, and the prospect that labor and products will cost more, could finally push the construction industry to embrace technology to a greater degree than it has done so to this point. JLL sees BIM, artificial intelligence and big data, and prefab and offsite construction as the three technologies that show the most promise this year.

Related Stories

Giants 400 | Feb 8, 2024

Top 90 Design-Build Construction Firms for 2023

Hensel Phelps, Ryan Companies US, Gray Construction, Haskell, and Burns & McDonnell top BD+C's ranking of the nation's largest design-build construction firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 20 Public Library Construction Firms for 2023

Gilbane Building Company, Skanska USA, Manhattan Construction, McCownGordon Construction, and C.W. Driver Companies top BD+C's ranking of the nation's largest public library general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 30 Public Library Engineering Firms for 2023

KPFF Consulting Engineers, Tetra Tech High Performance Buildings Group, Thornton Tomasetti, WSP, and Dewberry top BD+C's ranking of the nation's largest public library engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 35 Performing Arts Center and Concert Venue Construction Firms for 2023

The Whiting-Turner Contracting Company, Holder Construction, McCarthy Holdings, Clark Group, and Gilbane Building Company top BD+C's ranking of the nation's largest performing arts center and concert venue general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Feb 8, 2024

Top 40 Museum Construction Firms for 2023

Turner Construction, Clark Group, Bancroft Construction, STO Building Group, and Alberici-Flintco top BD+C's ranking of the nation's largest museum and gallery general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Giants 400 | Feb 6, 2024

Top 40 Religious Facility Construction Firms for 2023

Crossland Construction, Haskell, Big-D Construction, Whiting-Turner, and JE Dunn Construction top BD+C's ranking of the nation's largest religious facility general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 40 Entertainment Center, Cineplex, and Theme Park Construction Firms for 2023

ARCO Construction, Turner Construction, Whiting-Turner, PCL Construction Enterprises, and Balfour Beatty US top BD+C's ranking of the nation's largest entertainment center, cineplex, and theme park general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Feb 5, 2024

Top 60 Shopping Mall, Big Box Store, and Strip Center Construction Firms for 2023

Whiting-Turner, Schimenti Construction, VCC, Ryan Companies US, and STO Building Group top BD+C's ranking of the nation's largest shopping mall, big box store, and strip center general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Laboratories | Feb 5, 2024

DOE selects design-build team for laboratory focused on clean energy innovation

JE Dunn Construction and SmithGroup will construct the 127,000-sf Energy Materials and Processing at Scale (EMAPS) clean energy laboratory in Colorado to create a direct path from lab-scale innovations to pilot-scale production.