The construction industry, whose workforce was decimated during the last recession, is slowly getting back on its feet. However, in certain markets—especially those where oil drilling and production have been prospering—construction workers can still be scarce.

Based on a survey of nearly 1,100 member firms in October, the Associated General Contractors of America (www.agc.org) reported that 83% of respondents were having difficulty finding craft workers, and 61% said other professional positions were hard to fill.

That being said, it appears employment pressures are easing. AGC’S analysis of data from the U.S. Bureau of Labor Statistics finds that construction employers added 12,000 jobs in October, dropping the industry’s unemployment rate to 6.4%, its lowest level since October 2006.

In fact, construction employment in October, at 6,095,000, was the highest it’s been since May 2009, with 231,000 jobs added over the last 12 months, a 3.9% gain.

Residential construction is driving the market’s employment, as 130,600 residential and specialty trade contractor jobs have been added over the past year, representing a 6% increase over the same period in the previous year. Jobs for nonresidential and specialty trades, and heavy and civil engineering, rose by 2.7%, or 99,800, over the past 12 months.

Ken Simonson, AGC’s chief economist, notes that all construction employees worked an average of 39.2 hours per week in October, tying the highest mark since the association has been tracking this data since March 2006. And wages have been rising at their fastest rate—2.6% in the past year—since early 2010.

Still, AGC sees uncertainty in the future construction employment picture, and is calling on government officials to enact measures that would make it easier for school districts, local associations and private companies to establish career and technical education programs.

The Association’s concerns about where the industry is going to find its next generation of labor stem, in part, from its research which shows that its members in the South are most likely to struggle with labor shortages, particularly places like Louisiana where pipeline, refinery, and petrochemical construction jobs have boomed.

That boom has been a double-edged sword, in that the oil industry is grappling to find qualified labor. A recent article posted on the website Industrial Info Resources quotes John Floren, CEO of Methanex, the world’s largest producer of methanol, who said that projected costs for two projects in Geismar, La., rose by $300 million, largely because of labor costs and productivity issues.

And if, as expected, oil-related projects ramp up, labor shortages in Gulf States could become more acute in 2016 and 2017, according to industry observers quoted by Industrial Info Resources.

Related Stories

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

AEC Tech | Sep 6, 2016

Innovation intervention: How AEC firms are driving growth through R&D programs

AEC firms are taking a page from the tech industry, by infusing a deep commitment to innovation and disruption into their cultural DNA.

Office Buildings | Sep 2, 2016

Eight-story digital installation added as part of ESI Design’s renovation of Denver’s Wells Fargo Center

The crown jewel of a three-year makeover project, the LED columns bring the building’s lobby to life.

| Sep 1, 2016

TRANSIT GIANTS: A ranking of the nation's top transit sector design and construction firms

Skidmore, Owings & Merrill, Perkins+Will, Skanska USA, Webcor Builders, Jacobs, and STV top Building Design+Construction’s annual ranking of the nation’s largest transit sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

INDUSTRIAL GIANTS: A ranking of the nation's top industrial design and construction firms

Stantec, BRPH, Fluor Corp., Walbridge, Jacobs, and AECOM top Building Design+Construction’s annual ranking of the nation’s largest industrial sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

HOTEL SECTOR GIANTS: A ranking of the nation's top hotel sector design and construction firms

Gensler, HKS, Turner Construction Co., The Whiting-Turner Contracting Co., Jacobs, and JBA Consulting Engineers top Building Design+Construction’s annual ranking of the nation’s largest hotel sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

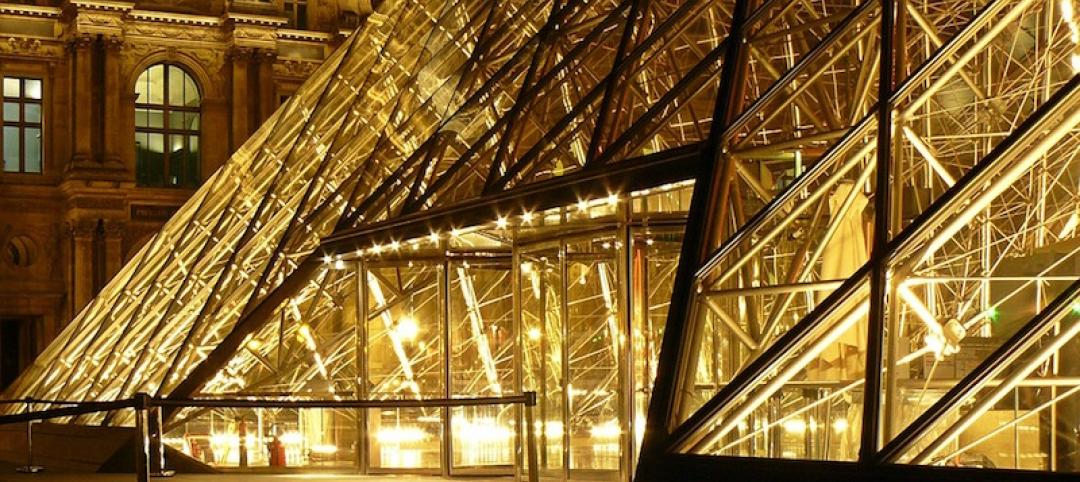

CULTURAL SECTOR GIANTS: A ranking of the nation's top cultural sector design and construction firms

Gensler, Perkins+Will, PCL Construction Enterprises, Turner Construction Co., AECOM, and WSP | Parsons Brinckerhoff top Building Design+Construction’s annual ranking of the nation’s largest cultural sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

COURTHOUSE GIANTS: A ranking of the nation's top courthouse design and construction firms

DLR Group, NBBJ, Hensel Phelps, Sundt Construction, AECOM, and Dewberry top Building Design+Construction’s annual ranking of the nation’s largest courthouse sector AEC firms, as reported in the 2016 Giants 300 Report.

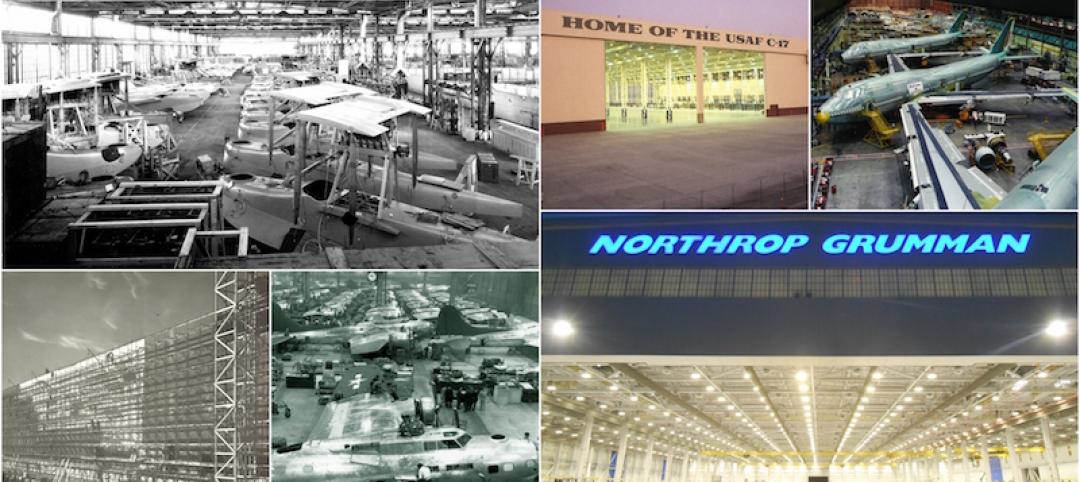

Airports | Aug 31, 2016

Aircraft manufacturing facility innovation from The Austin Company

Austin’s many innovations contributed to the success of our clients by enabling them to operate in more efficient environments, optimize the flexibility of their operations, and meet aggressive schedules.

| Aug 30, 2016

CONVENTION CENTER GIANTS: A ranking of the nation's top convention center sector design and construction firms

Gensler, LMN Architects, AECOM, Turner Construction Co., and WSP | Parsons Brinckerhoff top Building Design+Construction’s annual ranking of the nation’s largest convention center sector AEC firms, as reported in the 2016 Giants 300 Report.