The construction industry, whose workforce was decimated during the last recession, is slowly getting back on its feet. However, in certain markets—especially those where oil drilling and production have been prospering—construction workers can still be scarce.

Based on a survey of nearly 1,100 member firms in October, the Associated General Contractors of America (www.agc.org) reported that 83% of respondents were having difficulty finding craft workers, and 61% said other professional positions were hard to fill.

That being said, it appears employment pressures are easing. AGC’S analysis of data from the U.S. Bureau of Labor Statistics finds that construction employers added 12,000 jobs in October, dropping the industry’s unemployment rate to 6.4%, its lowest level since October 2006.

In fact, construction employment in October, at 6,095,000, was the highest it’s been since May 2009, with 231,000 jobs added over the last 12 months, a 3.9% gain.

Residential construction is driving the market’s employment, as 130,600 residential and specialty trade contractor jobs have been added over the past year, representing a 6% increase over the same period in the previous year. Jobs for nonresidential and specialty trades, and heavy and civil engineering, rose by 2.7%, or 99,800, over the past 12 months.

Ken Simonson, AGC’s chief economist, notes that all construction employees worked an average of 39.2 hours per week in October, tying the highest mark since the association has been tracking this data since March 2006. And wages have been rising at their fastest rate—2.6% in the past year—since early 2010.

Still, AGC sees uncertainty in the future construction employment picture, and is calling on government officials to enact measures that would make it easier for school districts, local associations and private companies to establish career and technical education programs.

The Association’s concerns about where the industry is going to find its next generation of labor stem, in part, from its research which shows that its members in the South are most likely to struggle with labor shortages, particularly places like Louisiana where pipeline, refinery, and petrochemical construction jobs have boomed.

That boom has been a double-edged sword, in that the oil industry is grappling to find qualified labor. A recent article posted on the website Industrial Info Resources quotes John Floren, CEO of Methanex, the world’s largest producer of methanol, who said that projected costs for two projects in Geismar, La., rose by $300 million, largely because of labor costs and productivity issues.

And if, as expected, oil-related projects ramp up, labor shortages in Gulf States could become more acute in 2016 and 2017, according to industry observers quoted by Industrial Info Resources.

Related Stories

Industry Research | Nov 8, 2022

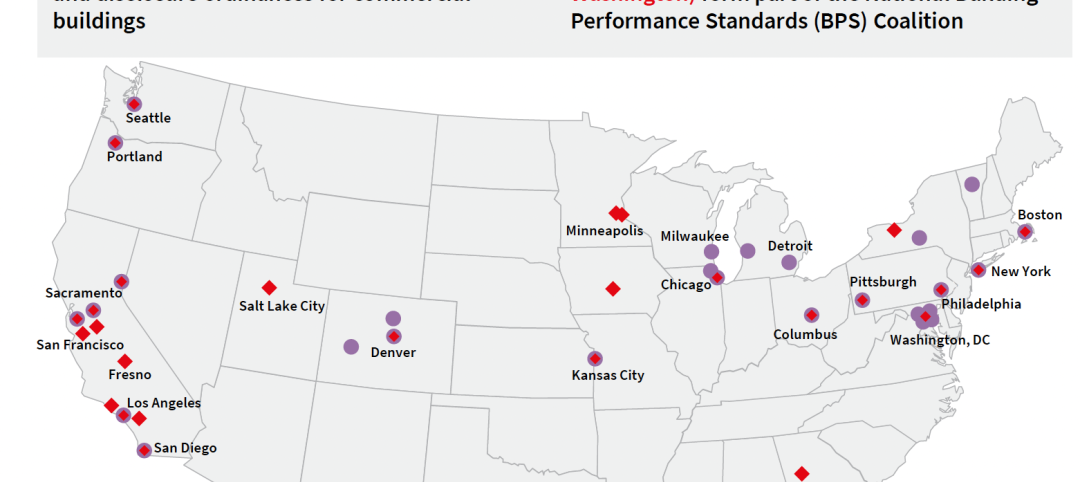

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Hotel Facilities | Nov 8, 2022

6 hotel design trends for 2022-2023

Personalization of the hotel guest experience shapes new construction and renovation, say architects and construction experts in this sector.

Green | Nov 8, 2022

USGBC and IWBI will develop dual certification pathways for LEED and WELL

The U.S. Green Building Council (USGBC) and the International WELL Building Institute (IWBI) will expand their strategic partnership to develop dual certification pathways for LEED and WELL.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Sponsored | Steel Buildings | Nov 7, 2022

Steel structures offer faster path to climate benefits

Faster delivery of buildings isn’t always associated with sustainability benefits or long-term value, but things are changing. An instructive case is in the development of steel structures that not only allow speedier erection times, but also can reduce embodied carbon and create durable, highly resilient building approaches.

Building Team | Nov 7, 2022

U.S. commercial buildings decreased energy use intensity from 2012 to 2018

The recently released 2018 Commercial Buildings Energy Consumption Survey (CBECS) by the U.S. Energy Information Administration found that the total floorspace in commercial buildings has increased but energy consumption has not, compared with the last survey analyzing the landscape in 2012.

Sports and Recreational Facilities | Nov 7, 2022

Gilbane, Turner, Populous tapped to design and build new Buffalo Bills stadium

The joint venture of Gilbane Building Company and Turner Construction Company, in association with 34 Group, has been selected to provide construction management of the planned new NFL stadium for the Buffalo Bills in Orchard Park, N.Y. The project team also includes the project management firm, Legends Project Development, and Populous as the designer.

| Nov 7, 2022

Mixed-use tower in China features world’s highest outdoor pool

Guangxi China Resources Tower, a new 403-meter-tall (1,322 feet) skyscraper in Nanning, China features the world’s highest outdoor pool—at 323 meters (1,060 feet) above grade.

Building Team | Nov 3, 2022

More than half of U.S. contractors say finding skilled workers is big barrier to their growth

More than half of U.S. contractors (55%) say finding enough skilled workers is one of the biggest barriers to growing their business, according to a DEWALT Powering the Future Survey.

Building Materials | Nov 2, 2022

Design for Freedom: Ending slavery and child labor in the global building materials sector

Sharon Prince, Founder and CEO of Grace Farms and Design for Freedom, discusses DFF's report on slavery and enforced child labor in building products and materials.