Earlier today, Bloomberg News reported that Gropyus AG, a Vienna, Austria-based startup that helps streamline housing construction, had raised 100 million Euros (US$109 million) in fresh cash from an investment group led by Vonovia SE, Germany’s largest landlord. Gropyus will use this capital to expand its factory to meet its goal of producing 250,000 sm of timber-based homes by 2024.

Gropyus is one of the top 50 ConTech startups of 2023, as chosen by CEMEX Ventures, the corporate venture capital and open innovation unit of the giant cement, concrete, and aggregates manufacturer CEMEX. That list is part of a recently released report where CEMEX Ventures offers its review of ConTech investments last year and its forecast for this year.

In 2022, global venture capital funding declined by 35 percent, to $445 billion, according to a market analysis by Crunchbase. However, the size of the investment in 2021 may have been an anomaly, as last year’s number exceeded investment totals in the years 2013-2020.

Investment in construction technology (ConTech) specifically hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. Indeed, since 2018 the flow of capital is why ConTech continues to be a vibrant source for innovation.

“The construction sector has entered into an era of change, where new emergent business models are driving its revolution,” writes CEMEX Ventures in its report. Startups “are just some of the new players helped the industry become more sustainable, productive, efficient, and innovative, and are transforming the way we have traditionally seen construction.”

As of January 2023, CEMEX Ventures had 23 startups in its investment portfolio. It also recently launched its exclusive accelerator program, CEMEX Ventures Leaplab, which is currently working with five startups in six different geographies under an intensive 14-week period.

ConTech investors seek productive solutions

The top 50 ConTech investments list classifies each startup according to four categories: Green Construction (13 startups), Enhanced Productivity (13), Construction Supply Chain (12), and Future of Construction (12).

The startups related to enhanced productivity accounted for 53.1 percent of the total deals’ dollar amount, followed by new construction methods and solutions such as prefabrication and robotics, which accounted for 20.6% of the total deals. Green construction (the leading category in 2021) made up 14.9% of the deals last year, and startups in the construction supply chain category 11.4%.

Sorted by geographic region, 113 of the startups in 2022 were in North America (97 in the U.S.), 72 in Europe (of which 20 were in the United Kingdom), 29 in Asia Pacific (10 in Australia), nine in the Middle East, four in Latin America and one in Africa.

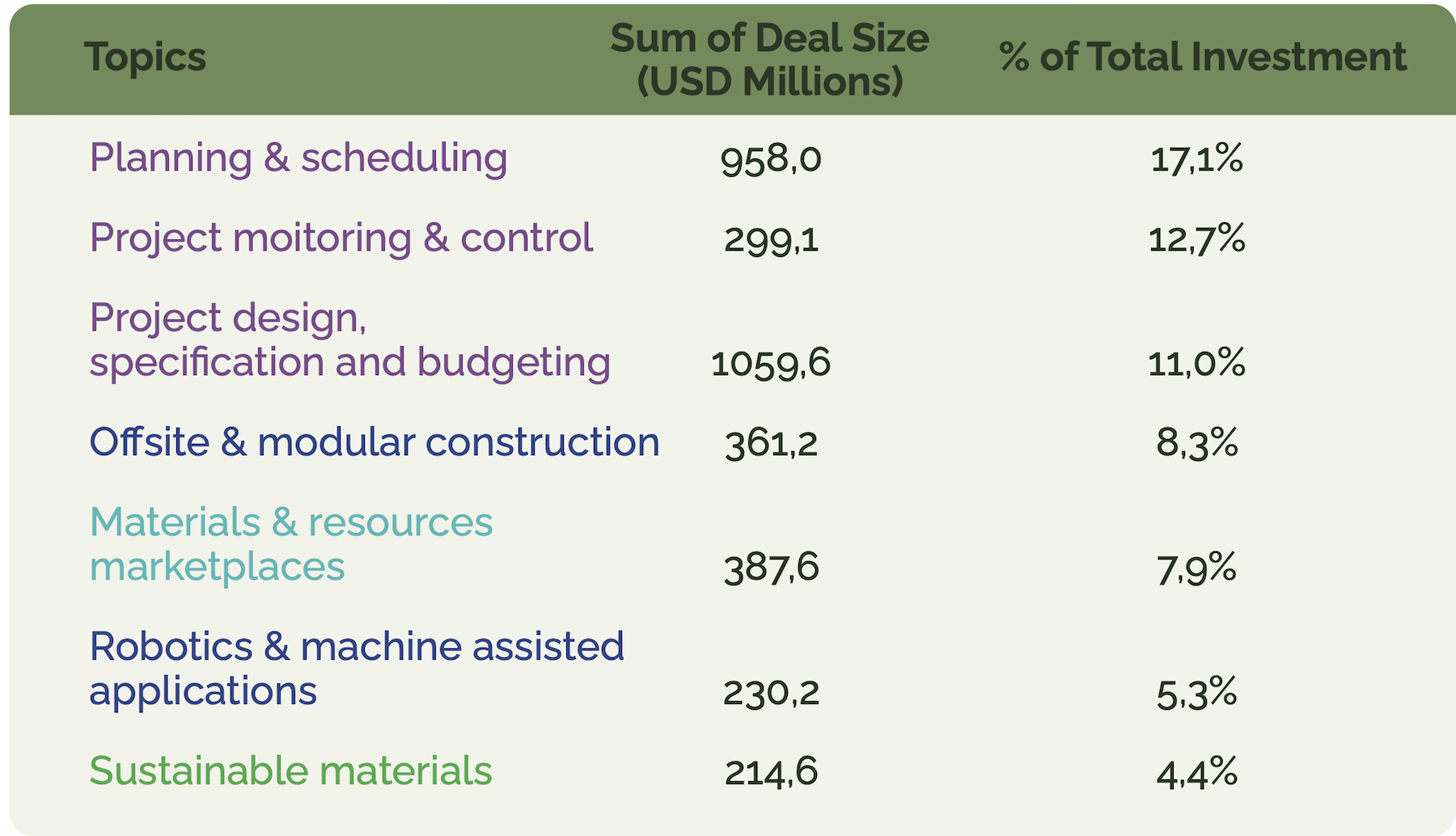

Planning and scheduling led the top seven most common topics related to ConTech investment last year, representing 17.1% of total investment. Project monitoring and control placed second among topics, accounting for 12.7% of last year’s investment dollars.

'Promising year' ahead for building materials, offsite construction firms

CEMEX Ventures observes that, despite a slowdown in the global economy in the later stages of 2022, there were still a high number of Seed and Series A deals, and acquisitions. There were, in fact, 91 Seed investments, nearly two-fifths of the total number of deals, followed by 53 Series A deals.

CEMEX Ventures’ report notes that ConTech investment flatlined last year due to unfavorable economic forces that are likely to continue through 2023. Yet, CEMEX Ventures foresees resilience to economic forces because, it writes, “ConTech is an emerging sector with a less-crowded marketplace [than FinTech or PropTech] brimming with opportunities for ambitious entrepreneurs.”

Enhanced Productivity will continue to receive healthy investor interest, CEMEX Ventures predicts, partly because it requires less upfront capital, and has higher short-term ROI. On the Green Construction front, CEMEX Ventures expects “heightened demand for new processes, products, and services” that negate environmental impacts and to comply with tougher climate targets.

The report sees a “promising year” ahead for startups focused on advanced building materials, industrialized construction methods (especially off-site construction), and robotics and machine-assisted applications.

North America and Europe will remain hotbeds for ConTech investment, and early-stage investment will predominate again this year. “This is especially true for corporate venture capitals that seek to link startup solutions with their core products.”

As a corporate venture capitalist itself, CEMEX Ventures advises prudence and collaboration to entrepreneurs. “We are not out of the current macroeconomic environment yet, so stay ambitious while preparing for the worst.”

The report includes interviews with CEOs from four companies that have been on previous years’ lists: PartRunner (an on-demand delivery service for contractors and supply houses), hyperTunnel (infrastructure solutions), StructShare (cloud-based procurement), and Plinx (construction safety).

Related Stories

Design Innovation Report | Apr 19, 2023

HDR uses artificial intelligence tools to help design a vital health clinic in India

Architects from HDR worked pro bono with iKure, a technology-centric healthcare provider, to build a healthcare clinic in rural India.

Resiliency | Apr 18, 2023

AI-simulated hurricanes could aid in designing more resilient buildings

Researchers at the National Institute of Standards and Technology (NIST) have devised a new method of digitally simulating hurricanes in an effort to create more resilient buildings. A recent study asserts that the simulations can accurately represent the trajectory and wind speeds of a collection of actual storms.

AEC Tech | Mar 14, 2023

Skanska tests robots to keep construction sites clean

What if we could increase consistency and efficiency with housekeeping by automating this process with a robot? Introducing: Spot.

AEC Innovators | Feb 28, 2023

Meet the 'urban miner' who is rethinking how we deconstruct and reuse buildings

New Horizon Urban Mining, a demolition firm in the Netherlands, has hitched its business model to construction materials recycling. It's plan: deconstruct buildings and infrastructure and sell the building products for reuse in new construction. New Horizon and its Founder Michel Baars have been named 2023 AEC Innovators by Building Design+Construction editors.

Multifamily Housing | Feb 3, 2023

HUD unveils report to help multifamily housing developers overcome barriers to offsite construction

The U.S. Department of Housing and Urban Development, in partnership with the National Institute of Building Sciences and MOD X, has released the Offsite Construction for Housing: Research Roadmap, a strategic report that presents the key knowledge gaps and research needs to overcome the barriers and challenges to offsite construction.

AEC Tech | Jan 27, 2023

Key takeaways from Autodesk University 2022

Autodesk laid out its long-term vision to drive digital collaboration through cloud-based solutions and emphasized the importance of connecting people, processes and data.

AEC Tech Innovation | Jan 14, 2023

CES recognizes a Dutch firm’s wearable technology for construction management

The firm’s TokenMe product offers construction managers a real-time crowd- and asset-tracking solution via low-power, location-aware radio and RFID tags and multiple sensors through which data are processed with cloud-based artificial intelligence.

Virtual Reality | Dec 12, 2022

Supplementing workplace connections through digital knowledge networks

Zachary Wassenberg of Burns & McDonnell breaks down three applications for digital knowledge networks: training, libraries, and instructions.

Digital Twin | Nov 21, 2022

An inside look at the airport industry's plan to develop a digital twin guidebook

Zoë Fisher, AIA explores how design strategies are changing the way we deliver and design projects in the post-pandemic world.

Giants 400 | Nov 14, 2022

4 emerging trends from BD+C's 2022 Giants 400 Report

Regenerative design, cognitive health, and jobsite robotics highlight the top trends from the 519 design and construction firms that participated in BD+C's 2022 Giants 400 Report.