Get ready for a surge in prefabrication activity by contractors.

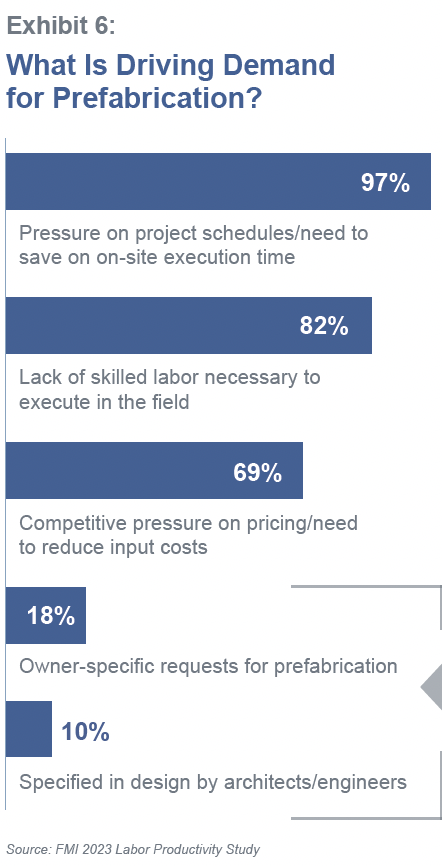

FMI, the consulting and investment banking firm, recently polled contractors about how much time they were spending, in craft labor hours, on prefabrication for construction projects. More than 250 contractors participated in the survey, and the average response to that question was 18%. More revealing, however, was the participants’ anticipation that craft hours dedicated to prefab would essentially double, to 34%, within the next five years.

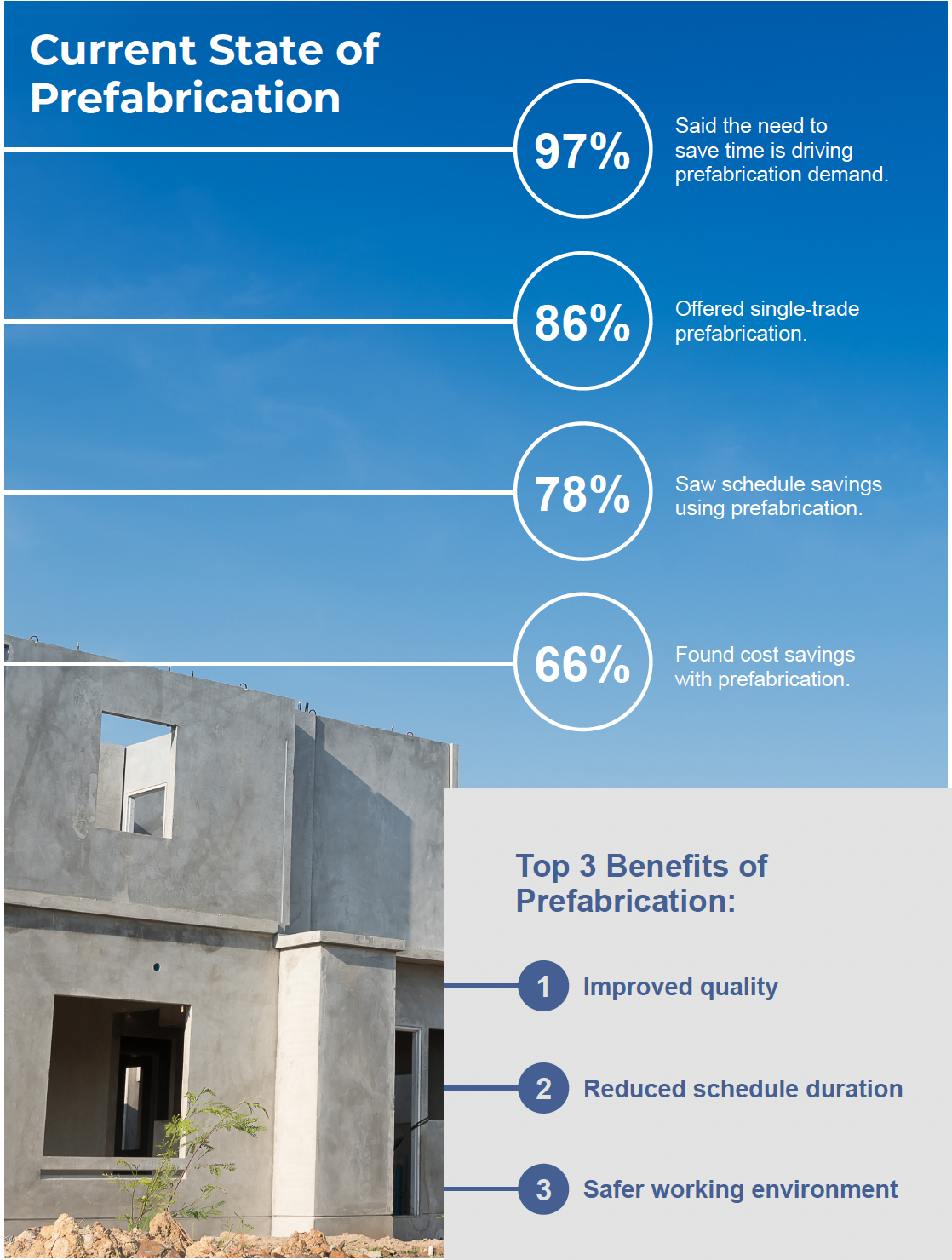

The study—a sequel to FMI’s 2023 Labor Productivity Study—reiterates how the industry’s receptivity to prefab solutions corresponds with its ongoing labor shortages and compressed project schedules. (Contractors experienced approximately $30 billion to $40 billion in lost profits due to labor inefficiencies in 2022.) In its latest study, contractors told FMI that “improved quality” was prefab’s greatest perceived benefit. “Reducing the risk and variability” is how one contractor put it. Other benefits cited include reductions in construction schedules and improved worker safety.

(Nearly three fifths of the respondents to FMI’s study are MEP contractors, with another 15% being framing and drywall contractors.)

Contractors that consider prefabrication must determine how to do it at scale, profitably, and in a way that increases company earnings. Successful prefab practices, says FMI, require long-term strategic thinking and planning across an organization, along with the development of a comprehensive operational blueprint.

Which prefab model is right for pros?

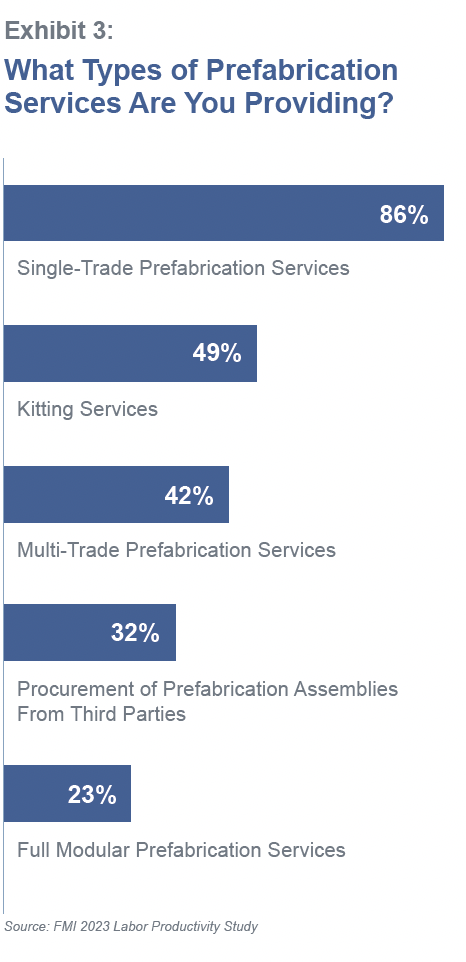

It’s not like prefabrication is an alien concept for contractors. FMI’s study found that 86% of respondents currently offer single-trade prefab services. Three quarters of the concrete contractors surveyed said they are prefabricating on their jobsites; 57% of self-performing general contractors polled are prefabbing on-site, too.

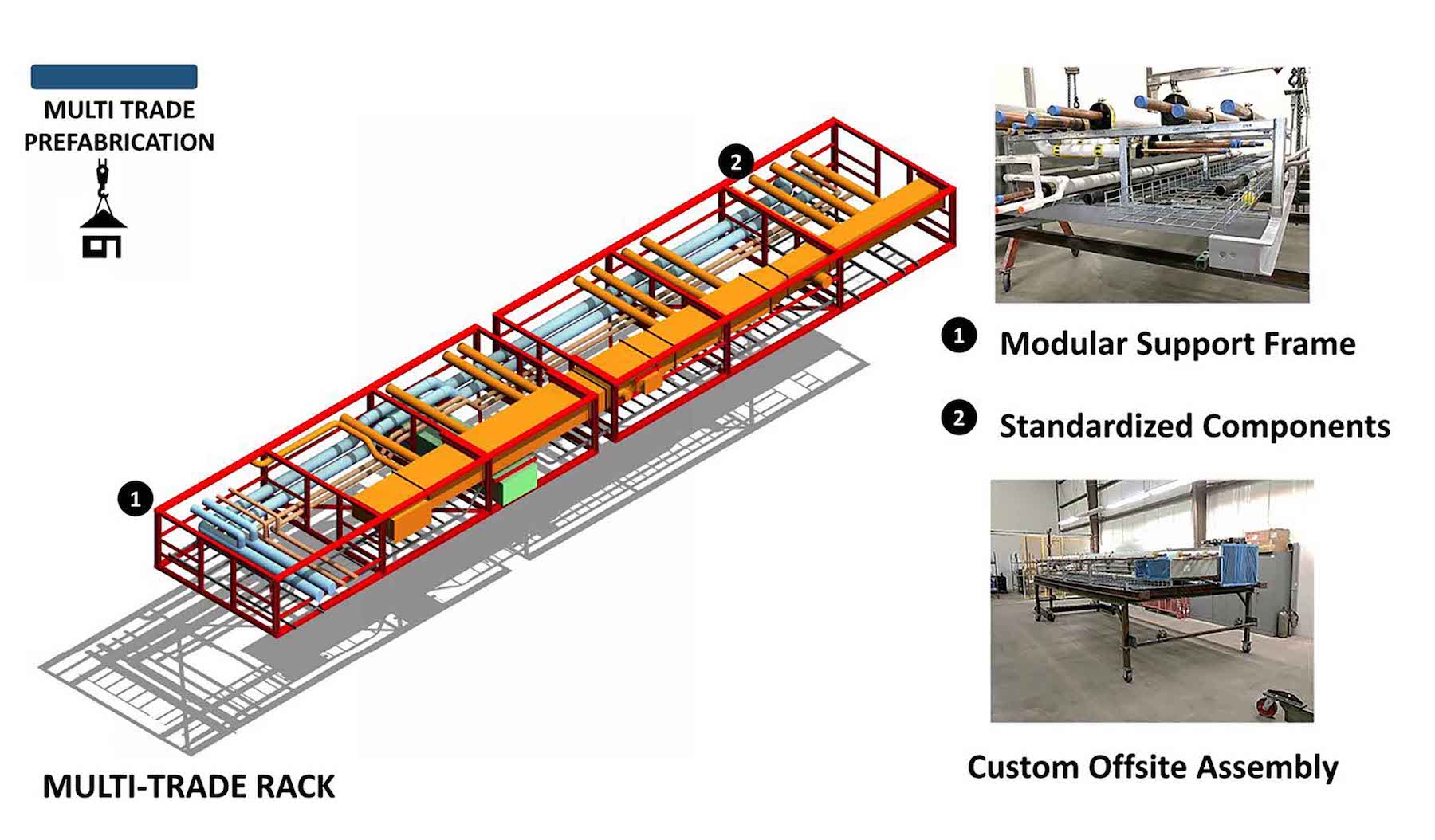

What’s often lacking, however, is a clear vision of what they want their prefab capabilities to become. To make prefab work, says FMI, contractors need to shift their operating models, processes and systems. Contractors also need to decide which prefab models and combinations would work best for their companies; these include kitting services, multi-trade services, procurement, and modular services.

In making these determinations, contractors should be asking themselves:

•Why do we want to do more prefabrication?

•What is the total addressable portion of our work mix (today) that could be prefabricated?

•What investments would need to be made to scale our prefabrication capabilities to capture that opportunity?

•When fully optimized, what does the earnings stream from prefabrication look like?

•What does the return on investment look like for the enterprise?

•Do we have alternative investment options for other initiatives in the business? How do those options stack up against our prefabrication ambitions?

•Will prefab make the company better, more profitable, and resilient?

Prefabrication a different kind of business

Prefabrication is a manufacturing endeavor that’s different from building construction. Contractors diving into prefab in a bigger way need to think about whether prefab will be a unique business or separate entity, and how autonomously construction and prefabrication operate? Will prefab services be proprietary or available to other contractors? Will prefab be a profit or cost center? How will manufacturing cost overruns, if there are any, be accounted for?

FMI says that contractors need to establish clear project management lines that encompass how prefabricated products are tracked, stored, and billed for. Tracking labor productivity across prefabrication and field installation is key.

Owners and designers need to buy in more

One of the contractors whom FMI polled mentioned a recent casino and hotel project that required 25% less labor in the field, and cut nearly two months off of its installation time, by using prefabrication methods.

Scheduling is driving prefab demand, says FMI. But expanding that demand depends on acceptance by owners and AEC firms, and right now, that acceptance is middling: only 18% of the contractors polled by FMI said that owner-specific requests drove prefab, and only 10% said that prefab was specified by architects or engineers.

“For the industry to realize substantial gains in prefabrication and productivity, owners and designers need to be a bigger part of the demand equation,” says FMI.

FMI’s study found that the industry still struggles with broad adoption. The biggest challenges to adopting prefab are a project’s design and coordination, stakeholder awareness and education, the mindset and culture of a project’s active players, and the investment in facilities and equipment.

But given current and projected labor force limitations, “it’s clear that prefabrication will need to become part of the solution.” For that to happen, building teams need to demonstrate a bolder vision, strategic planning, commitment to investing, consistent communication, and a proactive engagement by external stakeholders.

Related Stories

| May 18, 2011

Addition provides new school for pre-K and special-needs kids outside Chicago

Perkins+Will, Chicago, designed the Early Learning Center, a $9 million, 37,000-sf addition to Barrington Middle School in Barrington, Ill., to create an easily accessible and safe learning environment for pre-kindergarten and special-needs students.

| May 18, 2011

Raphael Viñoly’s serpentine-shaped building snakes up San Francisco hillside

The hillside location for the Ray and Dagmar Dolby Regeneration Medicine building at the University of California, San Francisco, presented a challenge to the Building Team of Raphael Viñoly, SmithGroup, DPR Construction, and Forell/Elsesser Engineers. The 660-foot-long serpentine-shaped building sits on a structural framework 40 to 70 feet off the ground to accommodate the hillside’s steep 60-degree slope.

| May 18, 2011

New center provides home to medical specialties

Construction has begun on the 150,000-sf Medical Arts Pavilion at the University Medical Center in Princeton, N.J.

| May 18, 2011

Improvements add to Detroit convention center’s appeal

Interior and exterior renovations and updates will make the Detroit Cobo Center more appealing to conventioneers. A new 40,000-sf ballroom will take advantage of the center’s riverfront location, with views of the river and downtown.

| May 18, 2011

One of Delaware’s largest high schools seeks LEED for Schools designation

The $82 million, 280,000-sf Dover (Del.) High School will have capacity for 1,800 students and feature a 900-seat theater, a 2,500-seat gymnasium, and a 5,000-seat football stadium.

| May 18, 2011

Carnegie Hall vaults into the 21st century with a $200 million renovation

Historic Carnegie Hall in New York City is in the midst of a major $200 million renovation that will bring the building up to contemporary standards, increase educational and backstage space, and target LEED Silver.

| May 17, 2011

Sustainability tops the syllabus at net-zero energy school in Texas

Texas-based firm Corgan designed the 152,200-sf Lady Bird Johnson Middle School in Irving, Texas, with the goal of creating the largest net-zero educational facility in the nation, and the first in the state. The facility is expected to use 50% less energy than a standard school.

| May 17, 2011

Gilbane partners with Steel Orca on ultra-green data center

Gilbane, along with Crabtree, Rohrbaugh & Associates, has been selected to partner with Steel Orca to design and build a 300,000-sf data center in Bucks County, Pa., that will be powered entirely through renewable energy sources--gas, solar, fuel cells, wind and geo-thermal. Completion is scheduled for 2013.

| May 17, 2011

Should Washington, D.C., allow taller buildings?

Suggestions are being made that Washington revise its restrictions on building heights. Architect Roger Lewis, who raised the topic in the Washington Post a few weeks ago, argues for a modest relaxation of the height limits, and thinks that concerns about ruining the city’s aesthetics are unfounded.