In a recent survey, nearly 900 construction firms reported gains in profitability last year, especially among the top 25% whose financial performances significantly outpaced the respondents as a whole.

The Construction Financial Management Association (CFMA), headquartered in Princeton, N.J., emailed its annual questionnaire to about 8,000 member and nonmember construction firms, as well as member CPA firms that represent construction companies. CFMA received data from 869 companies, which submitted detailed financial statements and other required information.

Thirty-seven percent of the respondents were Industrial & Nonresidential contractors, 19% Heavy & Highway contractors, 43% Specialty Trade contractors, and less than 1% classified as “Other.” The typical company reported total annual sales of $39,710,000 for the 2015 fiscal year. Those with sales under $10 million comprised 16% of responding companies, and 8% of respondents reported sales of over $300 million.

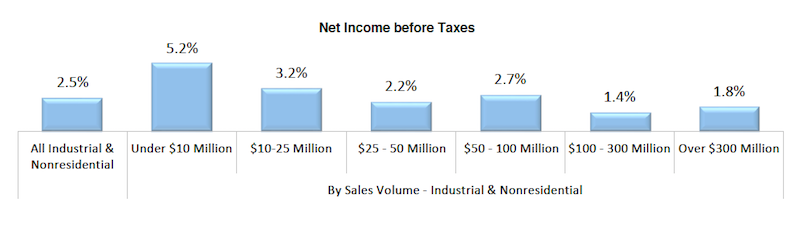

Smaller contracting companies showed stronger earnings last year. Chart: Construction Financial Management Association.

On average, the respondents’ returns on assets and equity rose last year. Returns on Assets was 9%, versus 6.9% in 2014. Returns on equity jumped to 25.3% in 2015, from 19% the previous year.

On the whole, getting paid for services rendered remains a struggle. The respondents’ invoices were in accounts receivable for an average of 55.2 days last year, an increase over the previous two years. As for their accounts payable, the contractors reported a decline to 33.4 days last year, from 35.6 days in 2014.

Gross profits as a percentage of revenue increased to 15%, from 13.1% in 2014. And net income last year stood a 4.4% of sales, versus 3.1% the previous year.

CFMA broke out the financial data by sales volume, and found that companies generating under $10 million in revenue generally had higher profitability ratios than other cohorts. Perhaps coincidentally, the smaller companies had lower debt-to-equity ratios, and significantly lower “underbillings-to-equity” ratios (4.4%, compared to 15.6% for companies with $300 million or more in annual revenue).

Conversely, the largest companies by revenue were more productive, reporting sales per employee of $751,348 ($276,000 more per employee than companies with between $100 million and $300 million in sales, and even higher compared to the other groups), and gross profit per employee of $71,851.

The top-performing contractors—based on a composite ranking of five performance metrics (ROA, ROE, debt to equity, fixed-asset ratios, and gross profit per employee)—were head and shoulders above respondent averages.

The highest achievers reported a 24% Return on Assets and 58.5% Return on Equity, substantively higher on both counts than the survey’s averages noted above.

Best in Class companies also reported less debt (1.2 times debt-to-equity versus 1.8 times for all respondents) and a more stable fixed asset ratio (16.6% versus 25.1% for all respondents). All respondents averaged a 15% gross profit margin, while the Best in Class companies achieved an 18.4% margin. Further, all respondents earned a 4.4% net income before taxes, compared with the highest achievers, which averaged 8.4% margin.

The CFMA survey was compiled and analyzed by Industry Insights and the organization’s Financial Survey & Benchmarker Committee. It did not provide explanations about why some contractors performed better than others.

Related Stories

Geothermal Technology | Jul 29, 2024

Rochester, Minn., plans extensive geothermal network

The city of Rochester, Minn., home of the famed Mayo Clinic, is going big on geothermal networks. The city is constructing Thermal Energy Networks (TENs) that consist of ambient pipe loops connecting multiple buildings and delivering thermal heating and cooling energy via water-source heat pumps.

High-rise Construction | Jul 29, 2024

Safdie Architects’ Shanghai office tower features glass-enclosed corner garden that ascends the 35-story structure

Safdie Architects has announced the completion of LuOne Mixed-Use Complex—a business, retail, and entertainment development in the Luwan district of Shanghai, China. The mixed-use complex consists of an eight-level retail galleria, which opened in 2018, and a 35-story office tower, which recently reached completion.

Casinos | Jul 26, 2024

New luxury resort casino will be regional draw for Shreveport, Louisiana area

Live! Casino & Hotel Louisiana, the first land-based casino in the Shreveport-Bossier market, recently topped off. The $270+ project will serve as a regional destination for world-class gaming, dining, entertainment, and hotel amenities.

Smart Buildings | Jul 25, 2024

A Swiss startup devises an intelligent photovoltaic façade that tracks and moves with the sun

Zurich Soft Robotics says Solskin can reduce building energy consumption by up to 80% while producing up to 40% more electricity than comparable façade systems.

Codes and Standards | Jul 25, 2024

GSA and DOE select technologies to evaluate for commercial building decarbonization

The General Services Administration and the U.S. Department of Energy have selected 17 innovative building technologies to evaluate in real-world settings throughout GSA’s real estate portfolio.

Great Solutions | Jul 23, 2024

41 Great Solutions for architects, engineers, and contractors

AI ChatBots, ambient computing, floating MRIs, low-carbon cement, sunshine on demand, next-generation top-down construction. These and 35 other innovations make up our 2024 Great Solutions Report, which highlights fresh ideas and innovations from leading architecture, engineering, and construction firms.

MFPRO+ News | Jul 22, 2024

Miami luxury condominium tower will have more than 50,000 sf of amenities

Continuum Club & Residences, a new 32-story luxury condominium tower in the coveted North Bay Village of Miami will feature more than 50,000 sf of indoor and outdoor amenities. The program includes a waterfront restaurant, dining terraces with resident privileges, and a private dining room outdoor pavilion.

Healthcare Facilities | Jul 22, 2024

5 healthcare building sector trends for 2024-2025

Interactive patient care systems and trauma-informed design are among two emerging trends in the U.S. healthcare building sector, according to BD+C's 2024 Healthcare Annual Report (free download; short registration required).

Office Buildings | Jul 22, 2024

U.S. commercial foreclosures increased 48% in June from last year

The commercial building sector continues to be under financial pressure as foreclosures nationwide increased 48% in June compared to June 2023, according to ATTOM, a real estate data analysis firm.

Codes and Standards | Jul 22, 2024

Tennessee developers can now hire their own building safety inspectors

A new law in Tennessee allows developers to hire their own building inspectors to check for environmental, safety, and construction violations. The law is intended to streamline the building process, particularly in rapidly growing communities.