In a recent survey, nearly 900 construction firms reported gains in profitability last year, especially among the top 25% whose financial performances significantly outpaced the respondents as a whole.

The Construction Financial Management Association (CFMA), headquartered in Princeton, N.J., emailed its annual questionnaire to about 8,000 member and nonmember construction firms, as well as member CPA firms that represent construction companies. CFMA received data from 869 companies, which submitted detailed financial statements and other required information.

Thirty-seven percent of the respondents were Industrial & Nonresidential contractors, 19% Heavy & Highway contractors, 43% Specialty Trade contractors, and less than 1% classified as “Other.” The typical company reported total annual sales of $39,710,000 for the 2015 fiscal year. Those with sales under $10 million comprised 16% of responding companies, and 8% of respondents reported sales of over $300 million.

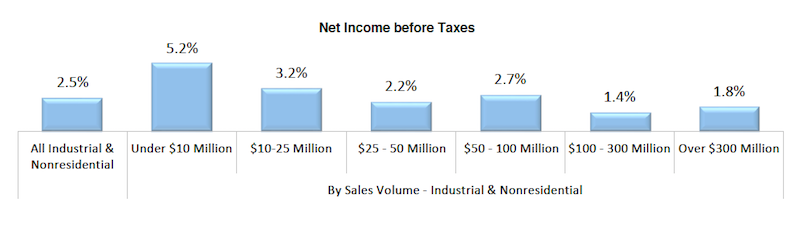

Smaller contracting companies showed stronger earnings last year. Chart: Construction Financial Management Association.

On average, the respondents’ returns on assets and equity rose last year. Returns on Assets was 9%, versus 6.9% in 2014. Returns on equity jumped to 25.3% in 2015, from 19% the previous year.

On the whole, getting paid for services rendered remains a struggle. The respondents’ invoices were in accounts receivable for an average of 55.2 days last year, an increase over the previous two years. As for their accounts payable, the contractors reported a decline to 33.4 days last year, from 35.6 days in 2014.

Gross profits as a percentage of revenue increased to 15%, from 13.1% in 2014. And net income last year stood a 4.4% of sales, versus 3.1% the previous year.

CFMA broke out the financial data by sales volume, and found that companies generating under $10 million in revenue generally had higher profitability ratios than other cohorts. Perhaps coincidentally, the smaller companies had lower debt-to-equity ratios, and significantly lower “underbillings-to-equity” ratios (4.4%, compared to 15.6% for companies with $300 million or more in annual revenue).

Conversely, the largest companies by revenue were more productive, reporting sales per employee of $751,348 ($276,000 more per employee than companies with between $100 million and $300 million in sales, and even higher compared to the other groups), and gross profit per employee of $71,851.

The top-performing contractors—based on a composite ranking of five performance metrics (ROA, ROE, debt to equity, fixed-asset ratios, and gross profit per employee)—were head and shoulders above respondent averages.

The highest achievers reported a 24% Return on Assets and 58.5% Return on Equity, substantively higher on both counts than the survey’s averages noted above.

Best in Class companies also reported less debt (1.2 times debt-to-equity versus 1.8 times for all respondents) and a more stable fixed asset ratio (16.6% versus 25.1% for all respondents). All respondents averaged a 15% gross profit margin, while the Best in Class companies achieved an 18.4% margin. Further, all respondents earned a 4.4% net income before taxes, compared with the highest achievers, which averaged 8.4% margin.

The CFMA survey was compiled and analyzed by Industry Insights and the organization’s Financial Survey & Benchmarker Committee. It did not provide explanations about why some contractors performed better than others.

Related Stories

Contractors | Sep 25, 2023

Balfour Beatty expands its operations in Tampa Bay, Fla.

Balfour Beatty is expanding its leading construction operations into the Tampa Bay area offering specialized and expert services to deliver premier projects along Florida’s Gulf Coast.

Resiliency | Sep 25, 2023

National Institute of Building Sciences, Fannie Mae release roadmap for resilience

The National Institute of Building Sciences and Fannie Mae have released the Resilience Incentivization Roadmap 2.0. The document is intended to guide mitigation investment to prepare for and respond to natural disasters.

Codes and Standards | Sep 25, 2023

Lendlease launches new protocol for Scope 3 carbon reduction

Lendlease unveiled a new protocol to monitor, measure, and disclose Scope 3 carbon emissions and called on built environment industry leaders to tackle this challenge.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Giants 400 | Sep 20, 2023

Top 80 Hospitality Facility Construction Firms for 2023

Suffolk Construction, The Yates Companies, STO Building Group, and PCL Construction Enterprises top BD+C's ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 18, 2023

Top 120 Office Building Construction Firms for 2023

Turner Construction, STO Building Group, AECOM, and DPR Construction top BD+C's ranking of the nation's largest office building sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all office building work, including core and shell projects and workplace/interior fitouts.

Adaptive Reuse | Sep 15, 2023

Salt Lake City’s Frank E. Moss U.S. Courthouse will transform into a modern workplace for federal agencies

In downtown Salt Lake City, the Frank E. Moss U.S. Courthouse is being transformed into a modern workplace for about a dozen federal agencies. By providing offices for agencies previously housed elsewhere, the adaptive reuse project is expected to realize an annual savings for the federal government of up to $6 million in lease costs.

Data Centers | Sep 15, 2023

Power constraints are restricting data center market growth

There is record global demand for new data centers, but availability of power is hampering market growth. That’s one of the key findings from a new CBRE report: Global Data Center Trends 2023.

Engineers | Sep 15, 2023

NIST investigation of Champlain Towers South collapse indicates no sinkhole

Investigators from the National Institute of Standards and Technology (NIST) say they have found no evidence of underground voids on the site of the Champlain Towers South collapse, according to a new NIST report. The team of investigators have studied the site’s subsurface conditions to determine if sinkholes or excessive settling of the pile foundations might have caused the collapse.

Office Buildings | Sep 14, 2023

New York office revamp by Kohn Pedersen Fox features new façade raising occupant comfort, reducing energy use

The modernization of a mid-century Midtown Manhattan office tower features a new façade intended to improve occupant comfort and reduce energy consumption. The building, at 666 Fifth Avenue, was originally designed by Carson & Lundin. First opened in November 1957 when it was considered cutting-edge, the original façade of the 500-foot-tall modernist skyscraper was highly inefficient by today’s energy efficiency standards.