In a recent survey, nearly 900 construction firms reported gains in profitability last year, especially among the top 25% whose financial performances significantly outpaced the respondents as a whole.

The Construction Financial Management Association (CFMA), headquartered in Princeton, N.J., emailed its annual questionnaire to about 8,000 member and nonmember construction firms, as well as member CPA firms that represent construction companies. CFMA received data from 869 companies, which submitted detailed financial statements and other required information.

Thirty-seven percent of the respondents were Industrial & Nonresidential contractors, 19% Heavy & Highway contractors, 43% Specialty Trade contractors, and less than 1% classified as “Other.” The typical company reported total annual sales of $39,710,000 for the 2015 fiscal year. Those with sales under $10 million comprised 16% of responding companies, and 8% of respondents reported sales of over $300 million.

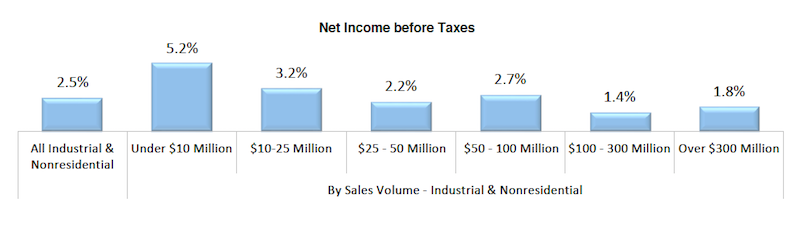

Smaller contracting companies showed stronger earnings last year. Chart: Construction Financial Management Association.

On average, the respondents’ returns on assets and equity rose last year. Returns on Assets was 9%, versus 6.9% in 2014. Returns on equity jumped to 25.3% in 2015, from 19% the previous year.

On the whole, getting paid for services rendered remains a struggle. The respondents’ invoices were in accounts receivable for an average of 55.2 days last year, an increase over the previous two years. As for their accounts payable, the contractors reported a decline to 33.4 days last year, from 35.6 days in 2014.

Gross profits as a percentage of revenue increased to 15%, from 13.1% in 2014. And net income last year stood a 4.4% of sales, versus 3.1% the previous year.

CFMA broke out the financial data by sales volume, and found that companies generating under $10 million in revenue generally had higher profitability ratios than other cohorts. Perhaps coincidentally, the smaller companies had lower debt-to-equity ratios, and significantly lower “underbillings-to-equity” ratios (4.4%, compared to 15.6% for companies with $300 million or more in annual revenue).

Conversely, the largest companies by revenue were more productive, reporting sales per employee of $751,348 ($276,000 more per employee than companies with between $100 million and $300 million in sales, and even higher compared to the other groups), and gross profit per employee of $71,851.

The top-performing contractors—based on a composite ranking of five performance metrics (ROA, ROE, debt to equity, fixed-asset ratios, and gross profit per employee)—were head and shoulders above respondent averages.

The highest achievers reported a 24% Return on Assets and 58.5% Return on Equity, substantively higher on both counts than the survey’s averages noted above.

Best in Class companies also reported less debt (1.2 times debt-to-equity versus 1.8 times for all respondents) and a more stable fixed asset ratio (16.6% versus 25.1% for all respondents). All respondents averaged a 15% gross profit margin, while the Best in Class companies achieved an 18.4% margin. Further, all respondents earned a 4.4% net income before taxes, compared with the highest achievers, which averaged 8.4% margin.

The CFMA survey was compiled and analyzed by Industry Insights and the organization’s Financial Survey & Benchmarker Committee. It did not provide explanations about why some contractors performed better than others.

Related Stories

| Aug 11, 2010

Suffolk Construction Company acquires William A. Berry & Son

Suffolk Construction Company, New England’s largest construction company announced today that they have acquired William A. Berry & Son (Berry), the second largest construction company in the region. The two companies, both with deep New England roots and successful track-records, combined will have more than 1,200 employees and projected revenues of $2 billion.

| Aug 11, 2010

University of Florida aiming for nation’s first LEED Platinum parking garage

If all goes as planned, the University of Florida’s new $20 million Southwest Parking Garage Complex in Gainesville will soon become the first parking facility in the country to earn LEED Platinum status. Designed by the Boca Raton office of PGAL to meet criteria for the highest LEED certification category, the garage complex includes a six-level, 313,000-sf parking garage (927 spaces) and an attached, 10,000-sf, two-story transportation and parking services office building.

| Aug 11, 2010

Draft NIST report on Cowboys practice facility collapse released for public comment

A fabric-covered, steel frame practice facility owned by the National Football League’s Dallas Cowboys collapsed under wind loads significantly less than those required under applicable design standards, according to a report released today for public comment by the Commerce Department's National Institute of Standards and Technology (NIST).

| Aug 11, 2010

USGBC honors Brad Pitt's Make It Right New Orleans as the ‘largest and greenest single-family community in the world’

U.S. Green Building Council President, CEO and Founding Chair Rick Fedrizzi today declared that the neighborhood being built by Make It Right New Orleans, the post-Katrina housing initiative launched by actor Brad Pitt, is the “largest and greenest community of single-family homes in the world” at the annual Clinton Global Initiative meeting in New York.

| Aug 11, 2010

AIA report estimates up to 270,000 construction industry jobs could be created if the American Clean Energy Security Act is passed

With the encouragement of Senate majority leader Harry Reid (D-NV), the American Institute of Architects (AIA) conducted a study to determine how many jobs in the design and construction industry could be created if the American Clean Energy Security Act (H.R. 2454; also known as the Waxman-Markey Bill) is enacted.