In a recent survey, nearly 900 construction firms reported gains in profitability last year, especially among the top 25% whose financial performances significantly outpaced the respondents as a whole.

The Construction Financial Management Association (CFMA), headquartered in Princeton, N.J., emailed its annual questionnaire to about 8,000 member and nonmember construction firms, as well as member CPA firms that represent construction companies. CFMA received data from 869 companies, which submitted detailed financial statements and other required information.

Thirty-seven percent of the respondents were Industrial & Nonresidential contractors, 19% Heavy & Highway contractors, 43% Specialty Trade contractors, and less than 1% classified as “Other.” The typical company reported total annual sales of $39,710,000 for the 2015 fiscal year. Those with sales under $10 million comprised 16% of responding companies, and 8% of respondents reported sales of over $300 million.

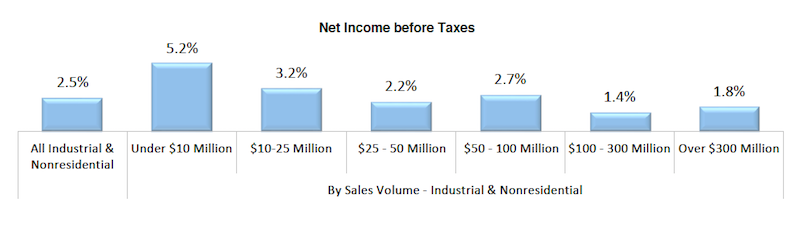

Smaller contracting companies showed stronger earnings last year. Chart: Construction Financial Management Association.

On average, the respondents’ returns on assets and equity rose last year. Returns on Assets was 9%, versus 6.9% in 2014. Returns on equity jumped to 25.3% in 2015, from 19% the previous year.

On the whole, getting paid for services rendered remains a struggle. The respondents’ invoices were in accounts receivable for an average of 55.2 days last year, an increase over the previous two years. As for their accounts payable, the contractors reported a decline to 33.4 days last year, from 35.6 days in 2014.

Gross profits as a percentage of revenue increased to 15%, from 13.1% in 2014. And net income last year stood a 4.4% of sales, versus 3.1% the previous year.

CFMA broke out the financial data by sales volume, and found that companies generating under $10 million in revenue generally had higher profitability ratios than other cohorts. Perhaps coincidentally, the smaller companies had lower debt-to-equity ratios, and significantly lower “underbillings-to-equity” ratios (4.4%, compared to 15.6% for companies with $300 million or more in annual revenue).

Conversely, the largest companies by revenue were more productive, reporting sales per employee of $751,348 ($276,000 more per employee than companies with between $100 million and $300 million in sales, and even higher compared to the other groups), and gross profit per employee of $71,851.

The top-performing contractors—based on a composite ranking of five performance metrics (ROA, ROE, debt to equity, fixed-asset ratios, and gross profit per employee)—were head and shoulders above respondent averages.

The highest achievers reported a 24% Return on Assets and 58.5% Return on Equity, substantively higher on both counts than the survey’s averages noted above.

Best in Class companies also reported less debt (1.2 times debt-to-equity versus 1.8 times for all respondents) and a more stable fixed asset ratio (16.6% versus 25.1% for all respondents). All respondents averaged a 15% gross profit margin, while the Best in Class companies achieved an 18.4% margin. Further, all respondents earned a 4.4% net income before taxes, compared with the highest achievers, which averaged 8.4% margin.

The CFMA survey was compiled and analyzed by Industry Insights and the organization’s Financial Survey & Benchmarker Committee. It did not provide explanations about why some contractors performed better than others.

Related Stories

3D Printing | Sep 13, 2024

Swiss researchers develop robotic additive manufacturing method that uses earth-based materials—and not cement

Researchers at ETH Zurich, a university in Switzerland, have developed a new robotic additive manufacturing method to help make the construction industry more sustainable. Unlike concrete 3D printing, the process does not require cement.

Adaptive Reuse | Sep 12, 2024

White paper on office-to-residential conversions released by IAPMO

IAPMO has published a new white paper titled “Adaptive Reuse: Converting Offices to Multi-Residential Family,” a comprehensive analysis of addressing housing shortages through the conversion of office spaces into residential units.

Mixed-Use | Sep 10, 2024

Centennial Yards, a $5 billion mixed-use development in downtown Atlanta, tops out its first residential tower

Centennial Yards Company has topped out The Mitchell, the first residential tower of Centennial Yards, a $5 billion mixed-use development in downtown Atlanta. Construction of the apartment building is expected to be complete by the middle of next year, with first move-ins slated for summer 2025.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Office Buildings | Sep 6, 2024

Fact sheet outlines benefits, challenges of thermal energy storage for commercial buildings

A U.S. Dept. of Energy document discusses the benefits and challenges of thermal energy storage for commercial buildings. The document explains how the various types of thermal energy storage technologies work, where their installation is most beneficial, and some practical considerations around installations.

Office Buildings | Sep 5, 2024

Office space downsizing trend appears to be past peak

The office downsizing trend may be past its peak, according to a CBRE survey of 225 companies with offices in the U.S., Canada, and Latin America. Just 37% of companies plan to shrink their office space this year compared to 57% last year, the survey found.

Codes and Standards | Sep 3, 2024

Atlanta aims to crack down on blighted properties with new tax

A new Atlanta law is intended to crack down on absentee landlords including commercial property owners and clean up neglected properties. The “Blight Tax” allows city officials to put levies on blighted property owners up to 25 times higher than current millage rates.

Resiliency | Sep 3, 2024

Phius introduces retrofit standard for more resilient buildings

Phius recently released, REVIVE 2024, a retrofit standard for more resilient buildings. The standard focuses on resilience against grid outages by ensuring structures remain habitable for at least a week during extreme weather events.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Adaptive Reuse | Aug 29, 2024

More than 1.2 billion sf of office space have strong potential for residential conversion

More than 1.2 billion sf of U.S. office space—14.8% of the nation’s total—have strong potential for conversion to residential use, according to real estate software and services firm Yardi. Yardi’s new Conversion Feasibility Index scores office buildings on their suitability for multifamily conversion.