A new report on office fit-out costs in North America sets out to establish a range of benchmarks for three different office styles, and to suggest what businesses favor which style.

JLL’s project and development services group, which produced the report, used data from more than 2,800 JLL-managed project budgets for over 100 clients from 17 industries in 59 markets throughout the U.S. and Canada.

The goal, says JLL, is to “elevate the conversation” around the real costs of building out various real estate designs. This year’s report includes office layout and space quality components to allow for evaluations of different office layouts, project complexities, and materials. It also provides high, medium, and low allowances for furniture, fixtures, and equipment (FFE); as well as for the installation of audio-visual and security equipment.

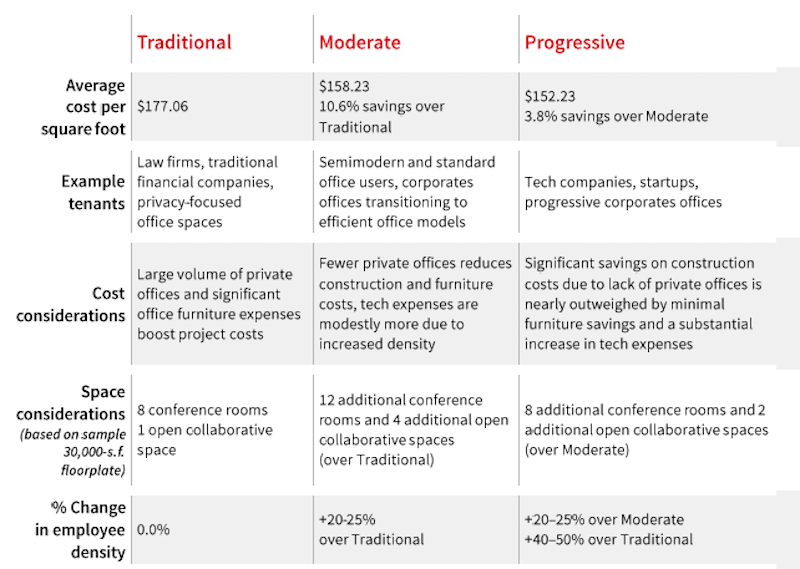

The result is an Office Fit Out Matrix, which shows how a handful of dynamics affect fit-out costs. Depending on the market and style, the costs range from $120.18 per sf to $216.07 per sf (see chart).

JLL breaks down these costs by region and metro market. The Northeast and Northwest consistently have higher fit-out costs. The medium costs in New York City are 28.5% above the U.S. average. In San Francisco, a fit-out would cost 22.6% more than the U.S. average. Conversely, the medium fit-out costs in West Palm Beach, Fla., are 15.9% below the national average; in Austin, Texas, 15.3% below.

This office fit-out matrix is based on data from over 2,800 project budgets in North America that JLL managed. Image: JLL

JLL's matrix compares the medium costs for fitting out three different office styles. Image: JLL

Three office styles examined

JLL divides its office fit-out costs along three styles:

• A Traditional office is still the most expensive to fit out. This style has the highest percentage of private office spaces, and typically between 20% and 50% fewer employees than the other two styles. Its FFE costs are the highest among the three styles, too. And tenant factors are “relatively small,” says JLL, because there is less common area. These offices are still favored by law firms, financial services companies, and businesses that focus on privacy with their offices.

JLL observes that some Traditional office styles are introducing lower-partition bench desks.

• A less-expensive fit-out, a Moderate office style features “agile” floorplans, with 10% dedicated to enclosed offices, and the rest of the space open with 6x6-foot workstations and minimal benching and guest space. Moderate offices—which are 20-25% less dense than Progressive office styles—include a healthy mix of conference rooms, and a few multipurpose and collaborative spaces. The hard fit-out costs for the Moderate style are average, but cost efficiencies can be captured by adding more bench-style desks.

• The Progressive office style is distinguished by an open floorplan, 100% of its desk space outfitted as bench-style furniture with zero enclosed spaces. This style’s focus is on activity-based working. Its employee density is 20-50% higher than a Traditional office, and it has double the amount of collaborative and conference spaces. (A standard plan would include 20 conference rooms and seven open collaborative/multi-use spaces.)

JLL points out that Progressive fit-outs generally have higher technology costs, but save money on FFE spending.

Landlords allowing for more upgrades

Last year, nearly 69 million sf of new office space were delivered to the market, but only 47.4% was preleased. JLL’s report observes that landlords are spending more to compete for tenants that are consistently gravitating toward high-quality spaces and assets. Consequently, landlords are offering better tenant improvement packages.

JLL cites several reasons for this trend, including the steady climb in construction costs, which increased on average by 15% last year. Landlords also offer better tenant improvement packages to offset the impact of higher rents.

The national average for tenant improvement allowances was $44 per sf, ranging from $105/sf in Washington D.C. to $28/sf in Nashville.

The report provides detailed snapshots of several markets, such as Austin, one of the country’s dynamic office markets, with robust growth supply. There are 3.1 million sf of new office space in Austin’s pipeline, 36% of which is preleased. The average tenant improvement allowance there last year was $45/sf.

There’s 7 million sf of new office space in the pipeline in San Francisco, where the office vacancy rate is 9.1%, and 68.8% of new space is preleased. The average tenant improvement allowance in San Francisco last year was $60/sf.

Related Stories

Government Buildings | Aug 7, 2023

Nearly $1 billion earmarked for energy efficiency upgrades to federal buildings

The U.S. General Services Administration (GSA) recently announced plans to use $975 million in Inflation Reduction Act funding for energy efficiency and clean energy upgrades to federal buildings across the country. The investment will impact about 40 million sf, or about 20% of GSA’s federal buildings portfolio.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Office Buildings | Aug 1, 2023

Creating a nurturing environment: The value of a mother’s room in the workplace

Since becoming an architect, Rebecca Martin of Design Collaborative has drawn a mother’s room into numerous projects. But it wasn't until she became a mom that she fully appreciated their importance in the workspace.

Adaptive Reuse | Jul 27, 2023

Number of U.S. adaptive reuse projects jumps to 122,000 from 77,000

The number of adaptive reuse projects in the pipeline grew to a record 122,000 in 2023 from 77,000 registered last year, according to RentCafe’s annual Adaptive Reuse Report. Of the 122,000 apartments currently undergoing conversion, 45,000 are the result of office repurposing, representing 37% of the total, followed by hotels (23% of future projects).

High-rise Construction | Jul 26, 2023

A 33-story Singapore tower aims to reimagine work with restorative, outdoor spaces

Architecture firm NBBJ has unveiled design details for Keppel South Central, a commercial tower in Singapore. The project, which is slated for completion in late 2024, will transform the original Keppel Towers into a 33-story, energy-efficient building that aims to reimagine work by providing restorative spaces and connections to the outdoors.

Multifamily Housing | Jul 25, 2023

San Francisco seeks proposals for adaptive reuse of underutilized downtown office buildings

The City of San Francisco released a Request For Interest to identify office building conversions that city officials could help expedite with zoning changes, regulatory measures, and financial incentives.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Office Buildings | Jul 24, 2023

A twist on office conversions maximizes leasable space

A recent NELSON Worldwide project is made more suitable for multiple workplace tenants.

Biophilic Design | Jul 20, 2023

Transform your work environment with biophilic design

Lauren Elliott, Director of Interior Design, Design Collaborative, shares various ways biophilic design elements can be incorporated into the office space.

Office Buildings | Jul 20, 2023

The co-worker as the new office amenity

Incentivizing, rather than mandating the return to the office, is the key to bringing back happy employees that want to work from the office. Spaces that are designed and curated for human-centric experiences will attract employees back into the workplace, and in turn, make office buildings thrive once again. Perkins&Will’s Wyatt Frantom offers a macro to micro view of the office market and the impact of employees on the future of work.