A new report on office fit-out costs in North America sets out to establish a range of benchmarks for three different office styles, and to suggest what businesses favor which style.

JLL’s project and development services group, which produced the report, used data from more than 2,800 JLL-managed project budgets for over 100 clients from 17 industries in 59 markets throughout the U.S. and Canada.

The goal, says JLL, is to “elevate the conversation” around the real costs of building out various real estate designs. This year’s report includes office layout and space quality components to allow for evaluations of different office layouts, project complexities, and materials. It also provides high, medium, and low allowances for furniture, fixtures, and equipment (FFE); as well as for the installation of audio-visual and security equipment.

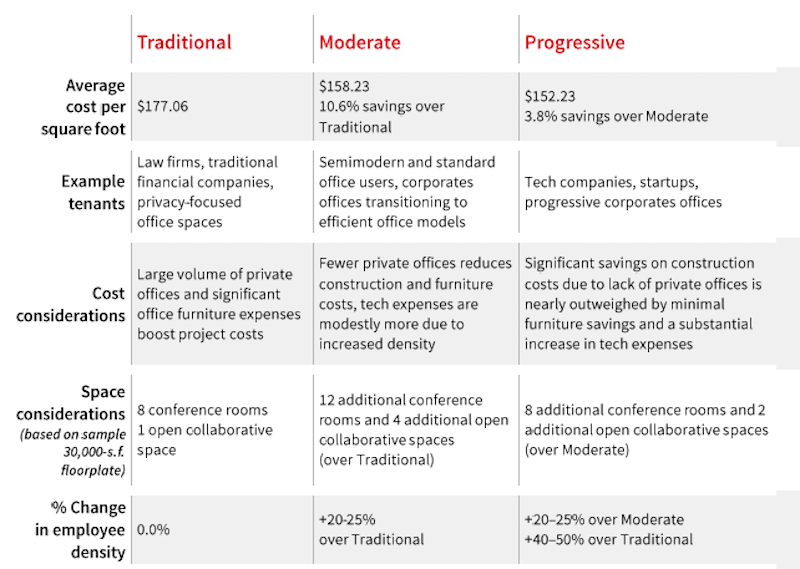

The result is an Office Fit Out Matrix, which shows how a handful of dynamics affect fit-out costs. Depending on the market and style, the costs range from $120.18 per sf to $216.07 per sf (see chart).

JLL breaks down these costs by region and metro market. The Northeast and Northwest consistently have higher fit-out costs. The medium costs in New York City are 28.5% above the U.S. average. In San Francisco, a fit-out would cost 22.6% more than the U.S. average. Conversely, the medium fit-out costs in West Palm Beach, Fla., are 15.9% below the national average; in Austin, Texas, 15.3% below.

This office fit-out matrix is based on data from over 2,800 project budgets in North America that JLL managed. Image: JLL

JLL's matrix compares the medium costs for fitting out three different office styles. Image: JLL

Three office styles examined

JLL divides its office fit-out costs along three styles:

• A Traditional office is still the most expensive to fit out. This style has the highest percentage of private office spaces, and typically between 20% and 50% fewer employees than the other two styles. Its FFE costs are the highest among the three styles, too. And tenant factors are “relatively small,” says JLL, because there is less common area. These offices are still favored by law firms, financial services companies, and businesses that focus on privacy with their offices.

JLL observes that some Traditional office styles are introducing lower-partition bench desks.

• A less-expensive fit-out, a Moderate office style features “agile” floorplans, with 10% dedicated to enclosed offices, and the rest of the space open with 6x6-foot workstations and minimal benching and guest space. Moderate offices—which are 20-25% less dense than Progressive office styles—include a healthy mix of conference rooms, and a few multipurpose and collaborative spaces. The hard fit-out costs for the Moderate style are average, but cost efficiencies can be captured by adding more bench-style desks.

• The Progressive office style is distinguished by an open floorplan, 100% of its desk space outfitted as bench-style furniture with zero enclosed spaces. This style’s focus is on activity-based working. Its employee density is 20-50% higher than a Traditional office, and it has double the amount of collaborative and conference spaces. (A standard plan would include 20 conference rooms and seven open collaborative/multi-use spaces.)

JLL points out that Progressive fit-outs generally have higher technology costs, but save money on FFE spending.

Landlords allowing for more upgrades

Last year, nearly 69 million sf of new office space were delivered to the market, but only 47.4% was preleased. JLL’s report observes that landlords are spending more to compete for tenants that are consistently gravitating toward high-quality spaces and assets. Consequently, landlords are offering better tenant improvement packages.

JLL cites several reasons for this trend, including the steady climb in construction costs, which increased on average by 15% last year. Landlords also offer better tenant improvement packages to offset the impact of higher rents.

The national average for tenant improvement allowances was $44 per sf, ranging from $105/sf in Washington D.C. to $28/sf in Nashville.

The report provides detailed snapshots of several markets, such as Austin, one of the country’s dynamic office markets, with robust growth supply. There are 3.1 million sf of new office space in Austin’s pipeline, 36% of which is preleased. The average tenant improvement allowance there last year was $45/sf.

There’s 7 million sf of new office space in the pipeline in San Francisco, where the office vacancy rate is 9.1%, and 68.8% of new space is preleased. The average tenant improvement allowance in San Francisco last year was $60/sf.

Related Stories

| Aug 11, 2010

Turner Building Cost Index dips nearly 4% in second quarter 2009

Turner Construction Company announced that the second quarter 2009 Turner Building Cost Index, which measures nonresidential building construction costs in the U.S., has decreased 3.35% from the first quarter 2009 and is 8.92% lower than its peak in the second quarter of 2008. The Turner Building Cost Index number for second quarter 2009 is 837.

| Aug 11, 2010

Turner, Structure Tone top BD+C's ranking of the 50 largest office contractors

A ranking of the Top 50 Office Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

AGC unveils comprehensive plan to revive the construction industry

The Associated General Contractors of America unveiled a new plan today designed to revive the nation’s construction industry. The plan, “Build Now for the Future: A Blueprint for Economic Growth,” is designed to reverse predictions that construction activity will continue to shrink through 2010, crippling broader economic growth.

| Aug 11, 2010

PCL Construction, HITT Contracting among nation's largest commercial building contractors, according to BD+C's Giants 300 report

A ranking of the Top 50 Commercial Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Webcor, Hunt Construction lead the way in mixed-use construction, according to BD+C's Giants 300 report

A ranking of the Top 30 Mixed-Use Contractors based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

NBBJ selected to design Russell Investments’ Seattle headquarters

NBBJ has been hired by Russell Investments as the architectural firm to design the interior space of its new global headquarters at 1301 2nd Avenue, a building also designed by NBBJ.

| Aug 11, 2010

Report: Fraud levels fall for construction industry, but companies still losing $6.4 million on average

The global construction, engineering and infrastructure industry saw a significant decline in fraud activity with companies losing an average of $6.4 million over the last three years, according to the latest edition of the Kroll Annual Global Fraud Report, released today at the Association of Corporate Counsel’s 2009 Annual Meeting in Boston. This new figure represents less than half of last year’s amount of $14.2 million.

| Aug 11, 2010

AAMA developing product-based green certification program for fenestration

The American Architectural Manufacturers Association is working on a product-based green certification program for residential and commercial fenestration, the organization announced today. AAMA will use the results of a recent green building survey to help shape the program. Among the survey's findings: 77% of respondents reported a green certification program for fenestration would benefit the product selection process for their company.

| Aug 11, 2010

City offices to up daylight, reduce water use

Breaking ground this month and scheduled for completion in November, the Palmetto Bay Village Hall in Miami-Dade County, Fla., will become the operating center for the mayor, village commissioners, government departments, the police department, and commission chambers. The two-story facility has been designed by JMWA Architects to win LEED Gold certification.

| Aug 11, 2010

Glass features keep Phoenix high-rise cool

A 26-story, 700,000-sf glass-clad tower has become downtown Phoenix's first office high-rise in eight years. One Central Park East, developed by Mesirow Financial, designed by SmithGroup, and built by Holder Construction Company, contains 495,000 sf of office space spanning 16 floors, plus a nine-level parking lot and ground-floor retail space.