Even before the coronavirus spread worldwide, data centers were emerging as a growth sector of choice for investors. And with a pandemic-spurred surge in Internet use and outsourcing services to the cloud, data centers have established their standing as an investment “hot ticket.”

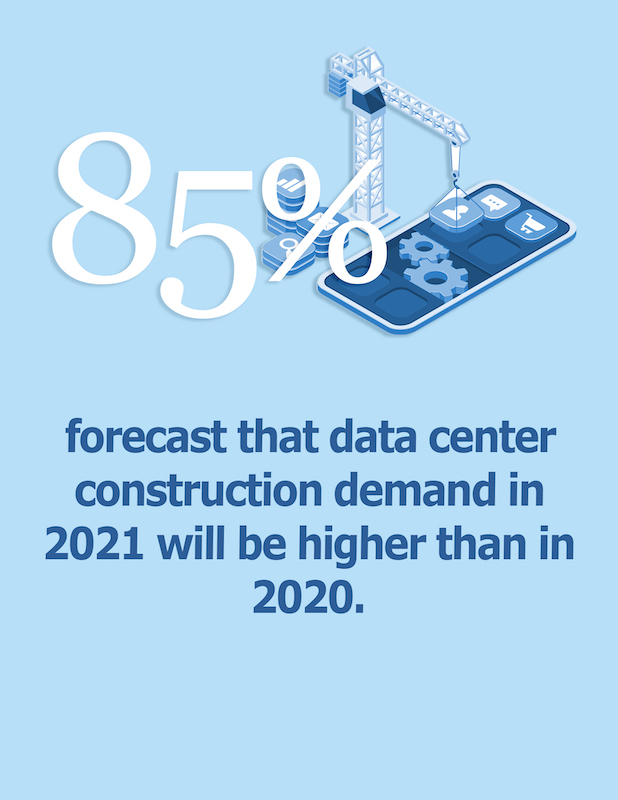

Next year, then, is expected to be big for data center construction demand, based on a poll of 162 data center professionals who participated in Turner & Townsend’s 2020 Data Center Cost Index and Survey.

Indeed, 71% of the survey’s respondents even believe that the data center sector is recession-proof, up from half of the respondents to the 2019 survey. However, industry professionals remain split on whether construction kept pace with demand this year.

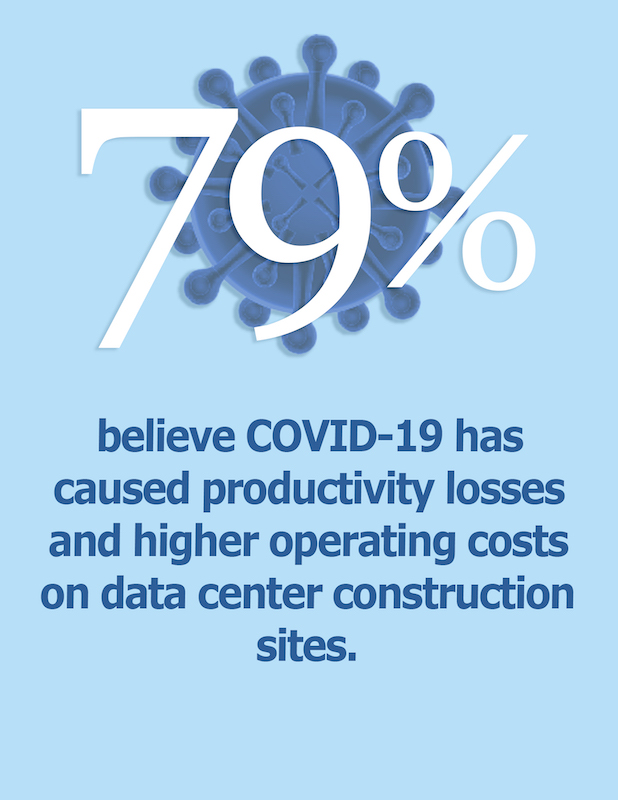

COVID-19 may have sparked demand, but it also snagged project delivery. The virus exposed a fragile global supply chain that, if not addressed, could stymie future growth and create other headaches; 55% of respondents fear a rise in COVID-19 related data center construction claims and litigation.

Nearly eight in 10 professionals polled blame the virus for construction productivity losses and higher operating costs, and 57% attributed increases in construction prices to COVID-19. So it probably isn’t surprising that 68% of respondents now see delivering data centers on time to meet new capacity as more important than delivering on budget, or even innovating.

A MISHMASH OF DATA CENTER DELIVERY METHODS

The professionals polled say that it’s imperative to reduce construction schedules for hyperscale data centers to 9-12 months, from the norm of 15-18 months. There’s pressure to reduce the full hyperscale development cycle to 18-24 months, from two-to-three years.

To achieve this accelerated pace, however, developers and AEC firms need to have confidence in their procurement sources and delivery models. Turner & Townsend has found that owner-operators have their own unique attributes for delivering their capital projects. The survey found that 70% of respondents agree that more data centers are using alternative procurement and contracting methods.

The data center sector currently relies on a small pool of skilled workers. Image: Turner & Townsend

This growth sector also must tackle its shortages in skilled labor. Right now, the sector relies on a relatively small pool of specialized talent, so training of local workers is “fundamental” to delivering data center construction demand next year, according to 84% of the survey’s respondents. “Greater localization will be vital to building future resilience [into] the market,” the Turner & Townsend report states.

EUROPE’S SECONDARY MARKETS COULD BENEFIT FROM DEMAND INCREASE

Fixing these shortcomings is essential at a time when data center construction demand should continue to grow in 2021, forecasts 85% of the survey’s respondents. Europe is expected to be the No. 1 investment market for U.S.-based cloud and data center operators. Turner & Townsend also expects secondary markets—such as Berlin, Warsaw, Milan, Madrid, and Vienna—to benefit from this construction demand spurt.

The report notes that Istanbul and Athens are also attracting greater attention “since both cities act as important strategic gateways into Africa, Asia and the Middle East.”

“Hotbeds” of activity are likely to be found, too, in India, Indonesia, Mexico, and Brazil. Industry watchers are keeping an eye on places like Auckland, NZ, where Microsoft recently was granted approval for a $100 million data center.

Europe continues to be a magnet for data center investors. Image: Turner & Townsend

This year, data centers with an aggregate capacity of 395 megawatts (MW) were under construction in North America, where there’s been a 30% surge in Internet usage. North Virginia alone is the world’s largest data center hub, with over 270 MW under construction. Several data center companies filed for permits in North Virginia this year, notably Amazon, which submitted plans for a 1.75-million-sf development in Chantilly, Va. Google is expanding the footprint at its 375-acre campus in Midlothian, Va.

Dallas is North America’s second-largest data center market, abetted by low land costs and robust fiber infrastructure. Equinix, QTS, Digital Realty, and Compass Datacenters were among the developers that are delivering added capacity in Dallas this year. Facebook announced on December 8 that it is adding 170,000 sf to its 2.5-million-sf data center campus in Fort Worth.

PHOENIX IS RISING FOR DATA CENTER DEMAND

Despite its high costs and perennial risk of natural disasters Silicon Valley ranks third for construction demand, primarily due to its proximity to hyperscale cloud providers.

The top 10 data center markets in North America include Phoenix (with over 32 MW under construction), the New York metro area (with Digital Realty building a 600,000-sf data center in Totowa, N.J.), and Greater Toronto in Canada, whose Waterloo Technology Corridor is the second-largest tech cluster in North America.

Turner & Townsend notes that growth in North Virginia is expected to continue next year at a greater pace than the rest of the U.S. Dallas, for example, needs to absorb“a signifcant amount of vacant inventory” to catch up with its pre-2019 demand levels. In contrast, vacancy rates in Silicon Valley have been in the single digits, leading to steady leasing and strong competition.

Phoenix is suddenly the place to be for data center owner-operators, with several projects in the works for 2021 that include Stack Infrastructure’s planned 1-million-sf facility there. CyrusOne is planning a 2.6-million-sf data center, and RagingWire Data Centers has a 1.5-million-sf facility on the drawing board.

Data center professionals also think the virus led to higher construction prices. Image: Turner & Townsend

ZURICH AND TOKYO HIGHEST-COST CONSTRUCTION MARKETS

The report from Turner & Townsend, a professional services company that specializes in project and program management, also analyzes construction costs in 40 countries. It found that data centers are most expensive to build in Zurich, Switzerland, where construction averages US$11.40 per watt of capacity. Zurich, though, remains the “epicenter” of European expansion for global providers, and is set to host a new region for Amazon Web Services in 2022.

In descending order, the next nine most expensive markets for data center construction are Tokyo ($10/watt), Silicon Valley ($9.80), New Jersey ($9.80), London ($9.10), Sydney, Australia ($9), Stockholm, Sweden ($8.90), and Copenhagen, Denmark ($8.80).

Build costs in other prominent U.S. markets include North Virginia ($8.40), Dallas ($7.70), Phoenix ($7.60), Atlanta ($7.40), and Kansas City ($7.60)

Related Stories

Energy | Mar 20, 2023

Battery energy storage market predictions are trickier than ever

Burns & McDonnell breaks down the state of battery energy storage today, from pricing concerns to alternative solutions.

Giants 400 | Feb 9, 2023

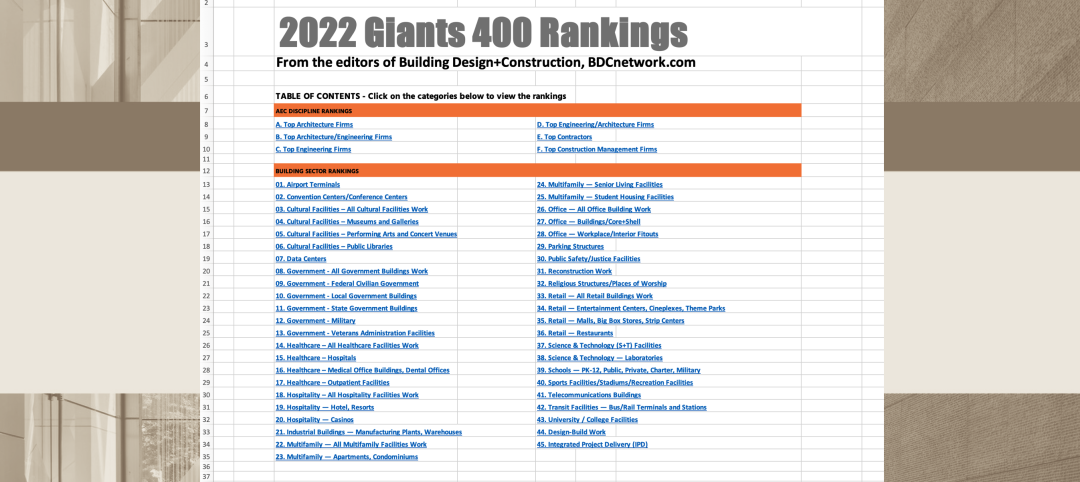

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Data Centers | Feb 6, 2023

Modular electric rooms are the new normal

Southland Industries breaks down the prefabrication benefits of Modular Electric Rooms (MERs).

Sponsored | Resiliency | Dec 14, 2022

Flood protection: What building owners need to know to protect their properties

This course from Walter P Moore examines numerous flood protection approaches and building owner needs before delving into the flood protection process. Determining the flood resilience of a property can provide a good understanding of risk associated costs.

Data Centers | Nov 28, 2022

Data centers are a hot market—don't waste the heat!

SmithGroup's Brian Rener shares a few ways to integrate data centers in mixed-use sites, utilizing waste heat to optimize the energy demands of the buildings.

Giants 400 | Nov 9, 2022

Top 50 Data Center Contractors + CM Firms for 2022

Holder, Turner, DPR, and HITT Contracting head the ranking of the nation's largest data center contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 9, 2022

Top 60 Data Center Engineering + EA Firms for 2022

Jacobs, Burns & McDonnell, WSP, and Alfa Tech top the ranking of the nation's largest data center engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 9, 2022

Top 30 Data Center Architecture + AE Firms for 2022

HDR, Corgan, Sheehan Nagle Hartray Architects, and Gensler top the ranking of the nation's largest data center architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Data Centers | Oct 31, 2022

Data center construction facing record-breaking inflation, delays

Data center construction projects face record-breaking inflation amid delays to materials deliveries and competition for skilled labor, according to research from global professional services company Turner & Townsend.

Data Centers | Oct 25, 2022

Virginia county moves to restrict the growth of new server farms

Loudoun County, Va., home to the largest data center cluster in the world known as Data Center Alley, recently took steps to prohibit the growth of new server farms in certain parts of the county.