Principia, a provider of business insights to the building materials and business construction industry, tracks $72 billion of residential revenue sold in selected building product categories (roofing, siding, exterior trim, windows, doors, decking, railing, and insulation) through the lumber and building materials (LBM) channel in 2019. Remodeling and repair represented $46 billion (over 64%) of channel revenues, with new construction accounting for $26 billion.

Principia's has issued a bulletin on COVID-19 impact on LBM distribution.

MOST LBM DISTRIBUTORS ARE STILL OPEN FOR BUSINESS

Distributors are open for business, with most states also deeming them essential.

- Most distributors are not experiencing material shortages, except in areas like personal protection equipment and some stuff from China.

- Deliveries from suppliers are proceeding apace. Some distributors have heard from dealers that they would like to push April deliveries to May. If this activity is widespread, distributor inventory levels will start rising, leading to a pullback on orders from suppliers.Focusing on inventories and receivables. Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts at the same time they are watching their own accounts receivables and inventory levels.

- Distributors are staying in touch with their dealer customers and watching their accounts receivables and destocking efforts.

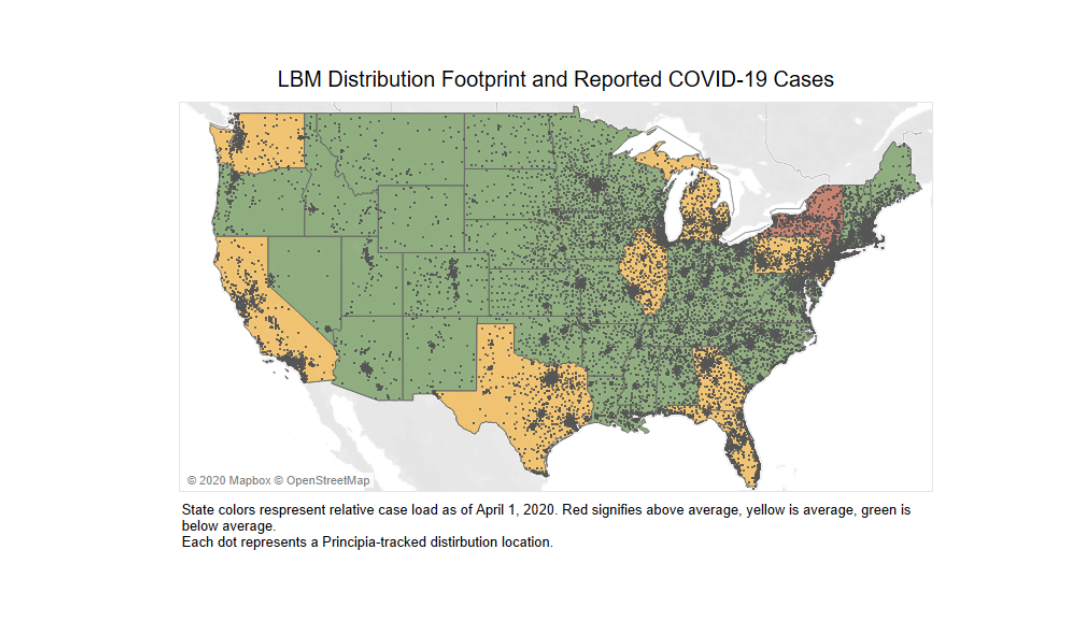

- Areas with higher concentrations of COVID-19 cases are reporting more disruptions. Distributors overexposed to a state where construction has not been exempted are faring less well than their counterparts.

MOST STATES DEEM LBM DEALERS 'ESSENTIAL BUSINESSES'

Most states have deemed building materials dealerships essential, so most dealers are open for business.

Most have made changes to operate safely—reduced store hours, limitation on the number of people entering the building at one time, more reliance on curbside pickup and online orders with store pickup.

Small dealers in states where construction has not been exempted from stay-at-home restrictions are faring worse than those in other states. Dealers are watching inventory levels and are slowing restocking of slow-moving products.

This map correlates COVID-19 intensity with LBM distribution tracked by Principia:

State colors indicate relative COVID-19 case load as of 04-02-01: red, above average; yellow, average; green, below average. Dots represent Principia-tracked locations. Map © 2020 Mapbox © OpenStreetMap Source: Principia